WHEN THE HOUSE OF CARDS FELL a concise look at history’s largest trading disasters. Intro Markets make fortunes, and erase them. Some of the largest drawdowns in modern financial history weren’t caused by market moves alone, but by human error, hubris, weak controls, or leverage run amok. Below are the most instructive episodes. 1) Nick Leeson — Barings...

Intro : Over the past two decades retail forex traders have gathered around a handful of trading methods, some taught by personalities, other emerging from various trading online communities. These strategies range from rules-based technical systems to conceptual frameworks and mostly try to explain large institutional behavior. Most of these strategies are the...

magic arts of finance The financial markets are often portrayed as cold, logical, and ruthlessly efficient. But let’s be honest sometimes they feel more like a scene out of a fantasy novel than a spreadsheet. Traders have long whispered about strange patterns, uncanny coincidences, and borderline mystical forces shaping price action. here as some of which i...

📉 The September Effect chart example: average monthly returns of the S&P500 since 1928 Every year, as summer ends and September rolls in, traders brace themselves. Why? Because the “September Effect” is notorious for turning even the steadiest markets into a rollercoaster. Understanding this seasonal quirk can make the difference between a smooth ride and...

The Greatest Financial Minds Who Shaped the Trading Industry In trading, we often obsess over charts, entries, and exits, forgetting that the very foundation of our craft was built by great thinkers who saw beyond their time. These financial minds left behind legacies that continue to guide us every time we analyze a chart, hedge a risk, or speculate on a macro...

Trendlines: The Most Misused Tool in Trading If I had a pip for every time a trader got faked out by a “trendline breakout,” I’d probably have more profits than most retail traders combined. Trendlines are one of the simplest, oldest, and most powerful tools in technical analysis yet they’re also one of the most misused. Most traders rely on what they’ve been...

The History and Origin of Technical Analysis Every chart we study today. Every candlestick, moving average, or RSI indicator is built on centuries of market wisdom. While many believe technical analysis began with Charles Dow in the 1800s, its origins reach much further back, to Amsterdam’s bustling spice markets in the 1600s and Japan’s rice exchanges in the...

Are We Nearing a Macro Turning Point? Markets may look chaotic on the surface, but zoom out far enough and a rhythm begins to emerge. For Bitcoin and the broader crypto market, one of the most compelling patterns traders track is the 1,064-day cycle, a rough cadence of boom and bust that has repeated across multiple market eras. With October 2025 approaching,...

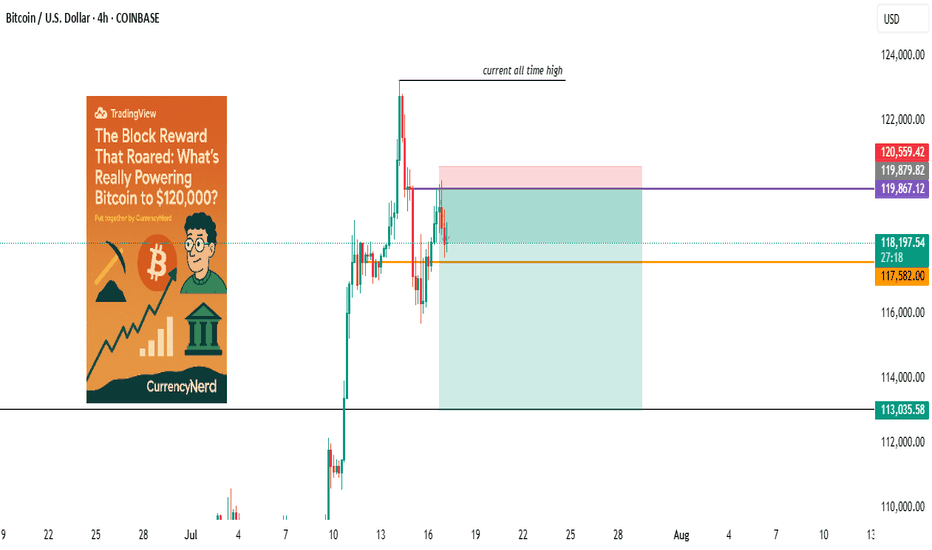

Bitcoin didn’t just wake up and choose violence. It chose velocity. As BTC blasts through the six-figure ceiling and fiddles $120k with laser precision, everyone’s pointing to “the halving” like it’s some magical switch. But let's be real, Bitcoin bull runs don’t run on fairy dust and hope. They run on liquidity, macro dislocations, structural demand shifts, and...

stablecoins were once the rebels of finance—anchored to fiat yet untethered from traditional banking laws, but the tides are turning. Across major economies, lawmakers are drawing up legal frameworks that place stablecoins inside the banking sector rather than outside of it. This shift could be the most pivotal regulatory development since Bitcoin was born. But...

In the world of trading, technical analysis often gets the spotlight—candlesticks, moving averages, and indicators. But beneath every price movement lies a deeper current: macroeconomic forces. These forces shape the environment in which all trades happen. Great traders don’t just react to price—they understand the context behind it. That context is found in...

"Watch what they do, but also how they say it." In the high-stakes world of central banking, few things move markets like the subtle wording of a Fed statement, But beyond the headlines and soundbites, one market absorbs this information faster—and with greater clarity—than almost any other: the bond market. 💬 What Is "Fed Speak"? "Fed speak" refers to the...

“In football, some say Messi was born with it, and Ronaldo built it. In trading, the same debate lives on—are the best naturally gifted, or relentlessly crafted?” The Messi vs Ronaldo debate is more than just about football. It’s a lens into how we perceive greatness: Messi, the effortless genius, gliding past defenders like he was born with a ball at his...

Crypto is more than coins and charts. That’s the surface most traders never look beyond. It's a stack of revolutionary technologies working together to build the future of finance, data, and trust. But if you’re serious about understanding crypto’s long-term value—or timing its major shifts—you need to grasp what lies beneath. Here’s your deep-dive into the...

If you've ever asked, “Why is the market going up on bad news?” or “Why did it dump after great earnings?”, you're not alone. Markets may seem logical—economic data in, price action out—but in reality, they’re driven by human emotion, crowd psychology, and reflexive feedback loops. The charts don’t lie, but the reasons behind the moves? Often irrational. Let’s...

📊 What Are Tariffs & Why Should Traders Care? 💱 Tariffs are taxes imposed by a country on imported goods. Think of them as the "price of entry" foreign products must pay to access domestic markets. 🔍 Why Governments Use Them: Protect domestic industries from cheaper foreign goods Retaliate in trade disputes Raise revenue (less common today) 🧠 Why Traders...

Whether you're a forex newbie or a seasoned trader, having the right tools can make or break your trading success. One platform that consistently stands out is @TradingView charting powerhouse packed with features designed to give you an edge. I @currencynerd I'm all about helping traders stay smart and stay sharp, so here’s a look at @TradingView features that...

Money never sleeps — and in certain cities, it practically runs the show. These financial capitals aren't just centers of wealth; they're the beating hearts of global finance, moving trillions every single day. Today, let's take a quick tour through the cities that move markets, set trends, and shape economies. 🌍 1. New York City: The Global Titan Nickname: The...