The New Zealand dollar has just posted one of its sharpest reversals since the summer, and the 6NZ5 contract is now trading solidly above 0.57. The strength of the move is striking: a rebound sparked by a less-dovish-than-expected RBNZ tone has turned into an impulse driven by the structural weakness of the US dollar and significant algorithmic repositioning.

December is also historically one of the weakest months for the greenback, creating a natural tailwind for the Kiwi. The market may be on the verge of a broader extension, but the 0.5735–0.5740 area remains a decisive pivot.

Fundamental Analysis

The RBNZ’s message remains the cornerstone of the current rally. The 25 bp cut was widely anticipated, but the central bank gave no indication of urgency to continue easing. The economy is viewed as weak but gradually improving, inflation pressures are easing, and OCR guidance will now be based on a more balanced medium-term outlook. This stance surprised markets, which had expected a more dovish signal and a prolonged easing cycle.

On the US side, USD dynamics have become the primary driver of the NZD. Markets now treat a Fed cut in December as almost guaranteed. US data are deteriorating, and the prospect of a more accommodative future Fed chair reinforces expectations of a sustained easing cycle.

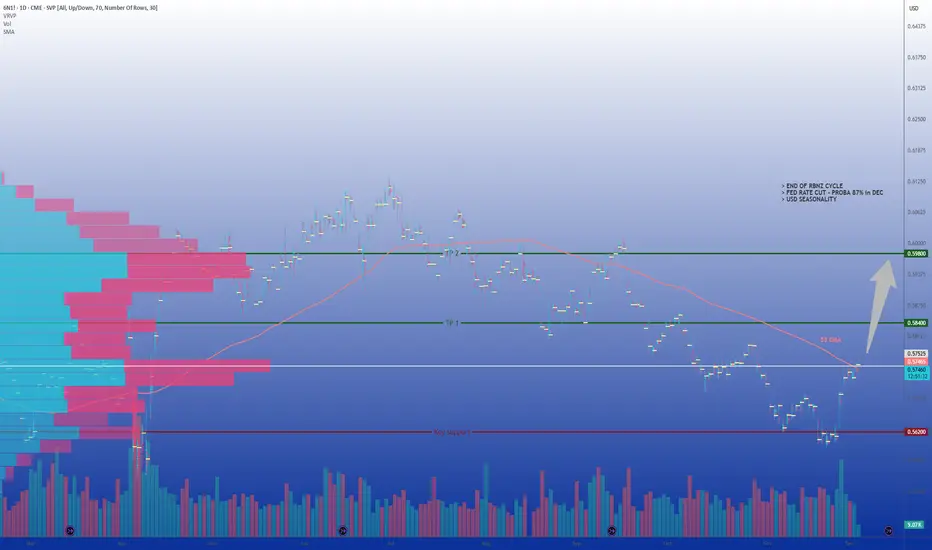

Technical Analysis

The 6NZ5 has broken above 0.57, a level that acted as both horizontal resistance and a former volume-profile POC at 0.567. The market now trades just below the 0.5735–0.5740 zone corresponding to the 55DMA, a level the NZD has not managed to reclaim sustainably since the September decline.

For now, the 0.5620–0.5630 area, identified as the RBNZ reaction low, becomes a major pivot: as long as it holds, the technical bias remains bullish.

If the 55DMA is clearly breached, the next resistance levels are 0.58 and 0.5845. A sustained breakout would open the path toward 0.60, a psychological threshold also corresponding to the filling of the liquidity gap created on 17 September during the Fed event.

Recent trading activity also confirms a gradual transfer of liquidity toward higher zones, signaling accumulation rather than distribution.

Sentiment Analysis

Data from FX/CFD brokers show a balanced retail positioning on NZD/USD, although the pair remains less popular among retail traders.

On the sell-side, ANZ targets 0.58 on the NZD/USD spot. Crédit Agricole notes that December should be a difficult month for the USD, due to seasonality and global flow reallocation. For them, the bias is clearly anti-USD, indirectly supporting the NZD.

JP Morgan is more cautious. Systematic hedge funds have been buying NZD for three consecutive sessions, which supports prices. However, JPM prefers to wait for confirmation from hard data before encouraging new directional longs. In their view, the rally still relies too heavily on sentiment and flow dynamics.

Reuters analysts also note that the NZD continues to struggle with the 55-day moving average, while acknowledging that the probability of further RBNZ cuts has significantly decreased, providing a fundamental floor.

Trade Idea (6NZ5)

With the 6NZ5 contract trading at 0.572–0.573, the most coherent scenario is a conditional long, based on a confirmed break of the 55DMA.

Entry:

Wait for a clear break above 0.5740 (55DMA break + D1 close or possibly H4 close above).

Targets:

- TP1: 0.5840, just below a key resistance

- TP2: 0.5980, a natural post-breakout extension toward 0.60

Stop-loss:

Below 0.5620 (breach of the RBNZ pivot).

The trade aims to capture a persistent USD-weakness environment, renewed bullish positioning on NZD, a more neutral-than-expected central bank, and an improving technical structure. Risk is contained as the stop lies below a level explicitly defended by the market last month.

Final Thoughts

In a very short period of time, the NZD has shifted from an overlooked currency to a tactically sought-after asset. The halt in the RBNZ easing cycle, the structural weakness of the US dollar, and favourable seasonality create a window conducive to long strategies. The true test, however, remains a sustained break of the 55DMA. If the market stabilises above 0.5740, the path toward 0.58, 0.5840, and even 0.60 becomes natural. Conversely, a move back below 0.5620 would suggest the rally was merely a short-covering episode. In a market where flows are rapidly reshuffling, caution is warranted, but the continuation potential for the 6NZ5 contract remains significant.

---

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: tradingview.com/cme/.

This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

December is also historically one of the weakest months for the greenback, creating a natural tailwind for the Kiwi. The market may be on the verge of a broader extension, but the 0.5735–0.5740 area remains a decisive pivot.

Fundamental Analysis

The RBNZ’s message remains the cornerstone of the current rally. The 25 bp cut was widely anticipated, but the central bank gave no indication of urgency to continue easing. The economy is viewed as weak but gradually improving, inflation pressures are easing, and OCR guidance will now be based on a more balanced medium-term outlook. This stance surprised markets, which had expected a more dovish signal and a prolonged easing cycle.

On the US side, USD dynamics have become the primary driver of the NZD. Markets now treat a Fed cut in December as almost guaranteed. US data are deteriorating, and the prospect of a more accommodative future Fed chair reinforces expectations of a sustained easing cycle.

Technical Analysis

The 6NZ5 has broken above 0.57, a level that acted as both horizontal resistance and a former volume-profile POC at 0.567. The market now trades just below the 0.5735–0.5740 zone corresponding to the 55DMA, a level the NZD has not managed to reclaim sustainably since the September decline.

For now, the 0.5620–0.5630 area, identified as the RBNZ reaction low, becomes a major pivot: as long as it holds, the technical bias remains bullish.

If the 55DMA is clearly breached, the next resistance levels are 0.58 and 0.5845. A sustained breakout would open the path toward 0.60, a psychological threshold also corresponding to the filling of the liquidity gap created on 17 September during the Fed event.

Recent trading activity also confirms a gradual transfer of liquidity toward higher zones, signaling accumulation rather than distribution.

Sentiment Analysis

Data from FX/CFD brokers show a balanced retail positioning on NZD/USD, although the pair remains less popular among retail traders.

On the sell-side, ANZ targets 0.58 on the NZD/USD spot. Crédit Agricole notes that December should be a difficult month for the USD, due to seasonality and global flow reallocation. For them, the bias is clearly anti-USD, indirectly supporting the NZD.

JP Morgan is more cautious. Systematic hedge funds have been buying NZD for three consecutive sessions, which supports prices. However, JPM prefers to wait for confirmation from hard data before encouraging new directional longs. In their view, the rally still relies too heavily on sentiment and flow dynamics.

Reuters analysts also note that the NZD continues to struggle with the 55-day moving average, while acknowledging that the probability of further RBNZ cuts has significantly decreased, providing a fundamental floor.

Trade Idea (6NZ5)

With the 6NZ5 contract trading at 0.572–0.573, the most coherent scenario is a conditional long, based on a confirmed break of the 55DMA.

Entry:

Wait for a clear break above 0.5740 (55DMA break + D1 close or possibly H4 close above).

Targets:

- TP1: 0.5840, just below a key resistance

- TP2: 0.5980, a natural post-breakout extension toward 0.60

Stop-loss:

Below 0.5620 (breach of the RBNZ pivot).

The trade aims to capture a persistent USD-weakness environment, renewed bullish positioning on NZD, a more neutral-than-expected central bank, and an improving technical structure. Risk is contained as the stop lies below a level explicitly defended by the market last month.

Final Thoughts

In a very short period of time, the NZD has shifted from an overlooked currency to a tactically sought-after asset. The halt in the RBNZ easing cycle, the structural weakness of the US dollar, and favourable seasonality create a window conducive to long strategies. The true test, however, remains a sustained break of the 55DMA. If the market stabilises above 0.5740, the path toward 0.58, 0.5840, and even 0.60 becomes natural. Conversely, a move back below 0.5620 would suggest the rally was merely a short-covering episode. In a market where flows are rapidly reshuffling, caution is warranted, but the continuation potential for the 6NZ5 contract remains significant.

---

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: tradingview.com/cme/.

This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

Founder of Satelys Ltd, which specializes in developing automated trading systems for the FX market, and a consultant for CME Group.

More info: satelysfx.com/about-us/

More info: satelysfx.com/about-us/

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Founder of Satelys Ltd, which specializes in developing automated trading systems for the FX market, and a consultant for CME Group.

More info: satelysfx.com/about-us/

More info: satelysfx.com/about-us/

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.