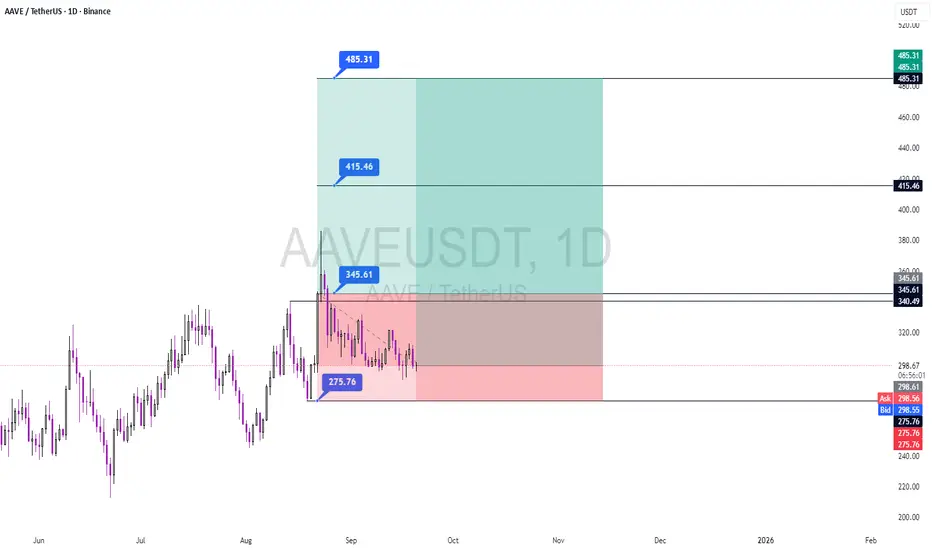

Current Setup:

AAVE has delivered a buy signal following a successful breakout and consolidation above the key $340.49 resistance level, with confirmation at $345.61. Although the second candle after the signal touched $380 and formed a large upper shadow (indicating short-term profit-taking and buyer trapping), the overall structure remains aligned with the bullish trajectory. The asset is now consolidating within the $345.61–$275.76 range, offering a potential entry zone for strategic buyers.

Trigger & Confirmation:

The buy signal was confirmed at $345.61. While the rejection at $380 suggests increased short-term volatility, it does not invalidate the broader bullish outlook. Traders may consider entries near the $345–$350 support zone, with a decisive close above $380 reaffirming momentum.

Projection:

Upon sustained bullish momentum, AAVE is poised to target $415.46 (Target 1) and $485.31 (Target 2). The recent rejection at $380 implies potential consolidation before upward resumption. A breakout above $380 could accelerate momentum toward higher targets.

Risk Management:

Stop-Loss: $275.76 (daily close below).

Position Strategy:

Given the recent volatility, limit orders near $345–$350 are advised for optimal risk-reward.

Use SPOT trading or low leverage (≤3x) to mitigate volatility risks.

Risk ≤5% of capital per position.

At $415.46 (Target 1), close 75% of the position to secure profits and adjust the stop to breakeven.

Hold the remainder toward $485.31 (Target 2).

Note: The upper shadow at $380 underscores the need for disciplined entry and risk management. This signal remains valid unless $275.76 is lost.

Trade Safe,

S.Reza Mehrjuyan / CEO FNS

Analyst, Manager

AAVE has delivered a buy signal following a successful breakout and consolidation above the key $340.49 resistance level, with confirmation at $345.61. Although the second candle after the signal touched $380 and formed a large upper shadow (indicating short-term profit-taking and buyer trapping), the overall structure remains aligned with the bullish trajectory. The asset is now consolidating within the $345.61–$275.76 range, offering a potential entry zone for strategic buyers.

Trigger & Confirmation:

The buy signal was confirmed at $345.61. While the rejection at $380 suggests increased short-term volatility, it does not invalidate the broader bullish outlook. Traders may consider entries near the $345–$350 support zone, with a decisive close above $380 reaffirming momentum.

Projection:

Upon sustained bullish momentum, AAVE is poised to target $415.46 (Target 1) and $485.31 (Target 2). The recent rejection at $380 implies potential consolidation before upward resumption. A breakout above $380 could accelerate momentum toward higher targets.

Risk Management:

Stop-Loss: $275.76 (daily close below).

Position Strategy:

Given the recent volatility, limit orders near $345–$350 are advised for optimal risk-reward.

Use SPOT trading or low leverage (≤3x) to mitigate volatility risks.

Risk ≤5% of capital per position.

At $415.46 (Target 1), close 75% of the position to secure profits and adjust the stop to breakeven.

Hold the remainder toward $485.31 (Target 2).

Note: The upper shadow at $380 underscores the need for disciplined entry and risk management. This signal remains valid unless $275.76 is lost.

Trade Safe,

S.Reza Mehrjuyan / CEO FNS

Analyst, Manager

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.