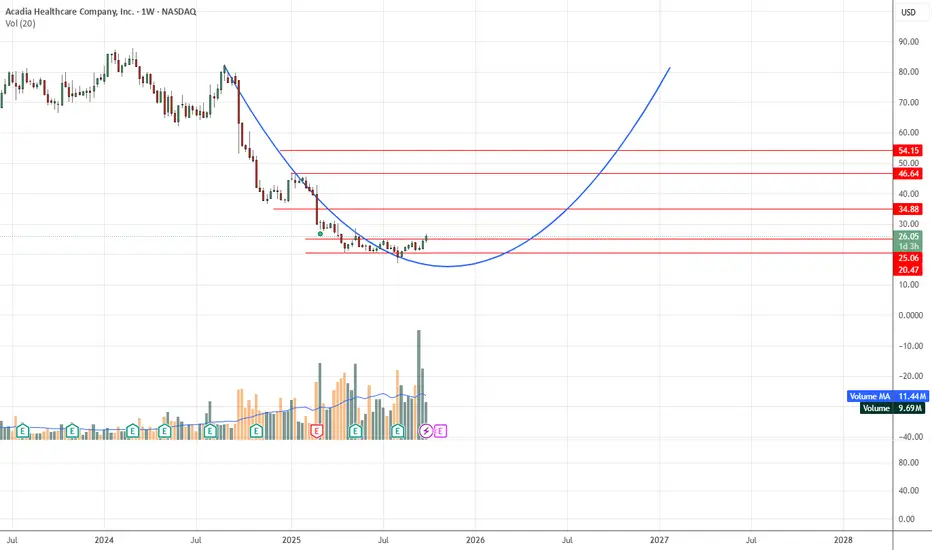

At its current price (~$24-$26), ACHC appears to offer a potentially attractive value—on a relative basis with peers, and especially if one discounts some of the negative sentiment already baked into its legal and regulatory challenges.

That said, it's not a sure thing. The weak free cash flows, regulatory overhang, and debt obligations mean there is a possibility this could be a “value trap” rather than a value opportunity if the downside risks worsen.

That said, it's not a sure thing. The weak free cash flows, regulatory overhang, and debt obligations mean there is a possibility this could be a “value trap” rather than a value opportunity if the downside risks worsen.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.