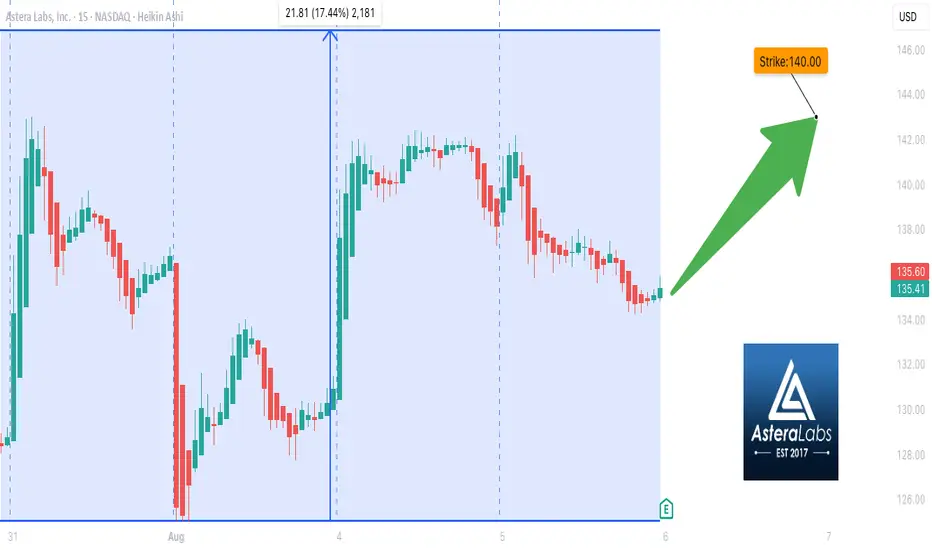

## 🚀 ALAB Earnings Play: High-Conviction Call Option Setup!

**Astera Labs (ALAB)** reports **Friday BMO (Aug 8)** – eyes on breakout potential.

---

### ⚡️ Bullish Thesis:

* 📈 **TTM Revenue Growth:** +144.3%

* 💰 **Gross Margin:** 75.8%

* 🧠 **AI + Cloud Tailwinds** fueling semiconductor strength

* 💥 **Beat Rate:** 5/5 last quarters | Avg surprise: +137.5%

* 📊 **Bullish Options Flow:** Heavy call interest @ \$140 & \$145

* 🔥 **Momentum:** Trading near ATH, outperforming sector

---

### 📉 Weak Spots to Watch:

* ⚠️ EPS Growth expected to dip -12.2%

* ⚖️ Negative EBITDA margin (-3.7%) suggests cost pressure

* 📉 Light volume into earnings could slow post-report follow-through

---

### 💡 Trade Idea:

**🎯 ALAB \$140 CALL**

* 💵 Entry Price: \$7.00

* 📆 Expiry: Aug 8, 2025

* 🎯 Profit Target: \$21.00 (200%)

* 🛑 Stop Loss: \$3.50

* 🕒 Entry: Pre-earnings close (Aug 7)

---

### 🔍 Risk-Reward Snapshot:

* ✅ Favorable macro + sector context

* ✅ 3:1+ reward ratio

* 🚨 Watch \$134.00 support zone

* ⏱ Exit within 2 hours post-earnings if no move

---

**📈 Bullish Confidence: 75%**

Breakout traders are watching \$142.23 — a blowout print could push it toward \$150+.

Trade active

🎯🎯We made the right bet. The earnings report has caused the stock to up 11% . Earnings Printing ...💰💰💰💰💰💰

Free Signals Based on Latest AI models💰: QuantSignals.xyz

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Free Signals Based on Latest AI models💰: QuantSignals.xyz

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.