Arista Networks (ANET) is setting up for a potential breakout backed by strong fundamentals and AI momentum.

🔹 Technical Setup

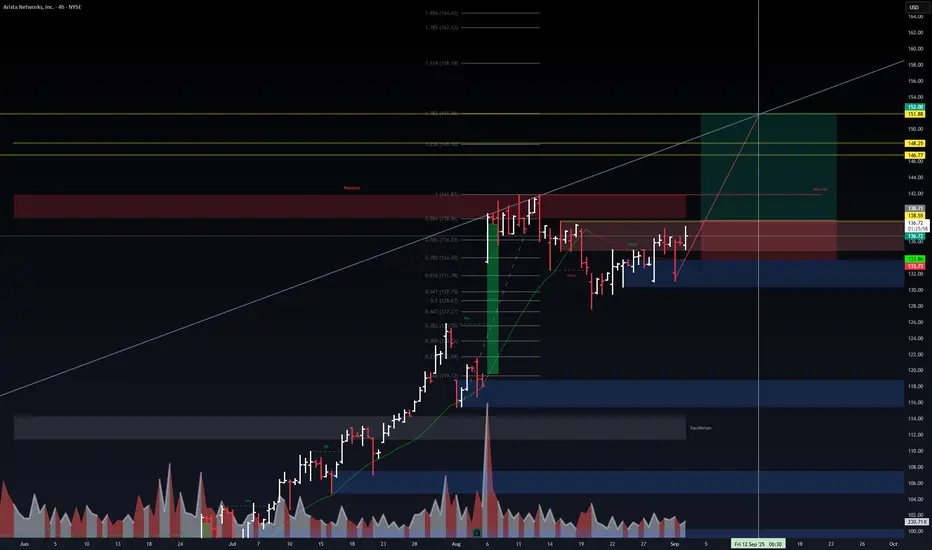

Price holding support at $133–136 zone.

Clear structure of higher lows; volume spikes confirm institutional activity.

Next resistance levels at $146.7 → $151.8.

Fibonacci extensions point toward $158+ medium-term.

🔹 Catalysts

Q2 Earnings Beat: Revenue +30% YoY, guidance raised to $8.75B FY25.

AI Growth: $1.5B AI revenue forecasted in 2025; accelerating hyperscaler demand.

Ethernet Leadership: Gaining share vs NVIDIA’s InfiniBand with Ultra Ethernet Consortium.

Expansion: VeloCloud acquisition strengthens enterprise & SD-WAN positioning.

Investor Day (Sept 11): Possible roadmap updates + new product pipeline.

📈 Trade Idea

Entry Zone: $134–136 support retest

Target 1: $146.7

Target 2: $151.8

Stretch Target: $158+ (Fibo extension)

Risk Management: Stop below $132

⚡ AI, hyperscaler spend, and enterprise expansion provide strong tailwinds. If momentum holds, ANET could be a leader in AI-driven networking into 2026.

Trade active

Trade closed: target reached

WaverVanir ⚡ To grow and conquer

stocktwits.com/WaverVanir | wavervanir.com | buymeacoffee.com/wavervanir

Not Investment Advice

stocktwits.com/WaverVanir | wavervanir.com | buymeacoffee.com/wavervanir

Not Investment Advice

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

WaverVanir ⚡ To grow and conquer

stocktwits.com/WaverVanir | wavervanir.com | buymeacoffee.com/wavervanir

Not Investment Advice

stocktwits.com/WaverVanir | wavervanir.com | buymeacoffee.com/wavervanir

Not Investment Advice

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.