APT Swing Long Idea

📊 Market Sentiment

FED has resumed its rate-cutting cycle, starting with a 0.25% cut in September, with two more 0.25% cuts expected in the coming months. Additionally, institutional liquidity inflows have accelerated as the U.S. officially adopts crypto as part of its reserves. While inflation remains elevated, the weakening labor market is forcing the FED to ease, driving more capital into risk-on assets.

📈 Technical Analysis

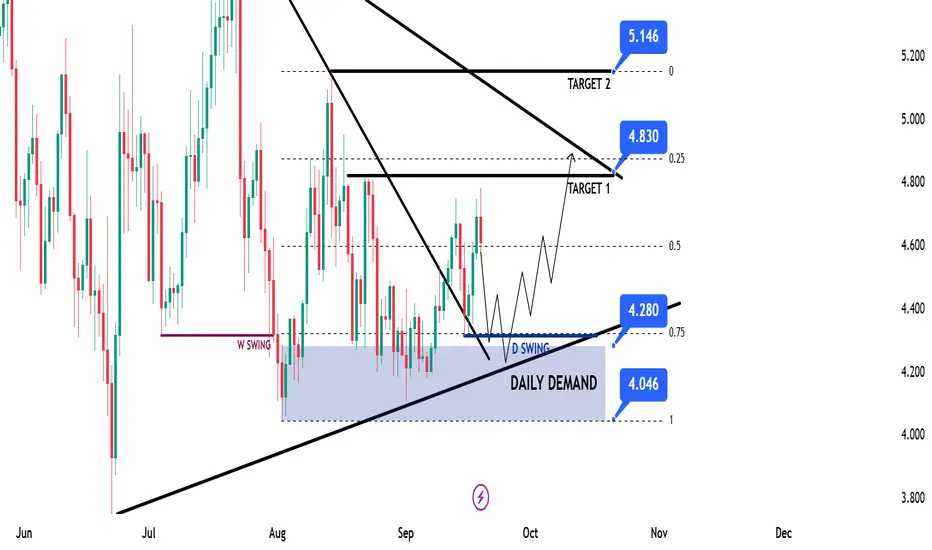

Price ran HTF liquidity and got rejected, creating a strong Daily Demand Zone.

This zone is further supported by the HTF bullish trendline, so I will only look for longs as long as the HTF bullish structure holds.

📌 Game Plan

1-Price to revisit and reprice the Daily Demand Zone at $4.28

2-Price to run and close above $4.30 daily swing liquidity (engineered liquidity for expansion higher)

3-Price to reprice into the 0.75 max discount of the range

4-Possible retest of the HTF bullish trendline

🎯 Setup Trigger

I’ll be looking for a 12H break of structure before entering long.

📋 Trade Management

Stoploss: 12H swing low that breaks the market

Targets:

• TP1: $4.83

• TP2: $5.14

💬 Like, follow, and comment if you find this setup valuable!

⚠️ Disclaimer: This content is for informational and educational purposes only and does not constitute financial, investment, or trading advice. Always DYOR before making any financial decisions.

📊 Market Sentiment

FED has resumed its rate-cutting cycle, starting with a 0.25% cut in September, with two more 0.25% cuts expected in the coming months. Additionally, institutional liquidity inflows have accelerated as the U.S. officially adopts crypto as part of its reserves. While inflation remains elevated, the weakening labor market is forcing the FED to ease, driving more capital into risk-on assets.

📈 Technical Analysis

Price ran HTF liquidity and got rejected, creating a strong Daily Demand Zone.

This zone is further supported by the HTF bullish trendline, so I will only look for longs as long as the HTF bullish structure holds.

📌 Game Plan

1-Price to revisit and reprice the Daily Demand Zone at $4.28

2-Price to run and close above $4.30 daily swing liquidity (engineered liquidity for expansion higher)

3-Price to reprice into the 0.75 max discount of the range

4-Possible retest of the HTF bullish trendline

🎯 Setup Trigger

I’ll be looking for a 12H break of structure before entering long.

📋 Trade Management

Stoploss: 12H swing low that breaks the market

Targets:

• TP1: $4.83

• TP2: $5.14

💬 Like, follow, and comment if you find this setup valuable!

⚠️ Disclaimer: This content is for informational and educational purposes only and does not constitute financial, investment, or trading advice. Always DYOR before making any financial decisions.

Trade active

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.