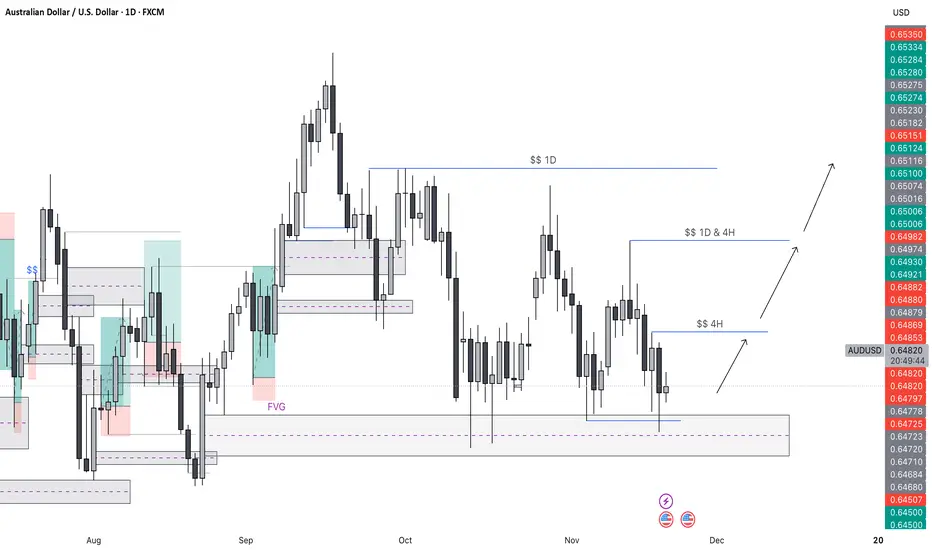

This chart highlights a multi-timeframe liquidity framework, combining 1D and 4H supply/demand zones to outline potential price reactions. Current price action is consolidating within a higher-timeframe demand zone, suggesting the possibility of a bullish response. The marked 4H and 1D liquidity pools above price represent key upside targets if the market confirms a reversal from this zone. Fair Value Gaps (FVGs), imbalances, and structural breaks provide additional confluence for a potential shift in order flow. Arrows illustrate the projected path toward liquidity objectives on both the 4H and 1D levels.

Macro-Fundamental Context:

Recent labor market data has shown a rise in unemployment during August, indicating early signs of cooling conditions. The latest FOMC comments reinforce that policymakers are becoming increasingly sensitive to any further softening in employment. This raises the possibility of a more cautious or even accommodative stance if data continues to weaken. Today’s September release is expected to come in negative as well, and if confirmed, it could further pressure the Fed’s tightening narrative.

Alongside this, DXY has been losing bullish momentum, reflecting hesitation from dollar buyers as rate expectations begin to shift. A weakening dollar often aligns with risk-on flows across major markets, which could support the bullish reaction anticipated in the technical setup. If DXY continues to soften, it may add confluence to a potential upward move toward the higher-timeframe liquidity pools highlighted on the chart.

Macro-Fundamental Context:

Recent labor market data has shown a rise in unemployment during August, indicating early signs of cooling conditions. The latest FOMC comments reinforce that policymakers are becoming increasingly sensitive to any further softening in employment. This raises the possibility of a more cautious or even accommodative stance if data continues to weaken. Today’s September release is expected to come in negative as well, and if confirmed, it could further pressure the Fed’s tightening narrative.

Alongside this, DXY has been losing bullish momentum, reflecting hesitation from dollar buyers as rate expectations begin to shift. A weakening dollar often aligns with risk-on flows across major markets, which could support the bullish reaction anticipated in the technical setup. If DXY continues to soften, it may add confluence to a potential upward move toward the higher-timeframe liquidity pools highlighted on the chart.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.