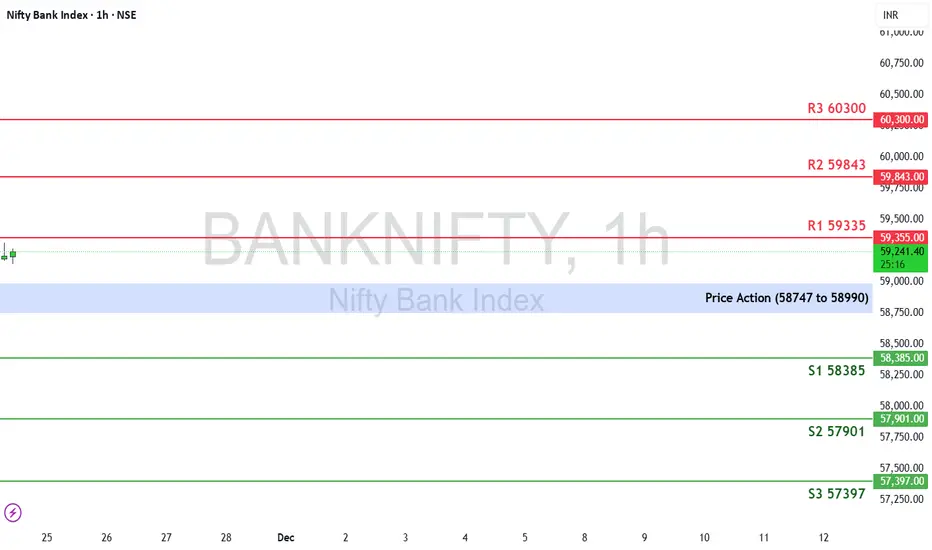

The Nifty Bank Index last week ended at 58,867.70, posting a healthy gain of +0.60%. The index continued its upward momentum and is now trading near a crucial supply zone, indicating that the market is at an important decision point for the coming week.

🔹 Key Levels for the Upcoming Week

📌 Price Action Pivot Zone: (58,747 to 58,990)

This blue-shaded zone marks the key decision area. Sustaining above 58,990 may invite strong buying interest. Rejection from this zone could lead to mild profit booking.

🔻 Support Levels

S1: 58,385

S2: 57,901

S3: 57,397

🔺 Resistance Levels

R1: 59,355

R2: 59,843

R3: 60,300

📈 Market Outlook

✅ Bullish Scenario:

If Bank Nifty sustains above the Pivot Zone (58,990), the index may move toward R1 (59,355).

A strong breakout above this level could extend the rally toward R2 (59,843) and eventually R3 (60,300).

❌ Bearish Scenario:

If the index falls below 58,747, short-term weakness may drag it toward S1 (58,385), followed by S2 (57,901) and S3 (57,397).

A weekly close below 57,400 could indicate the beginning of a deeper corrective phase.

Disclaimer: aliceblueonline.com/legal-documentation/disclaimer/

🔹 Key Levels for the Upcoming Week

📌 Price Action Pivot Zone: (58,747 to 58,990)

This blue-shaded zone marks the key decision area. Sustaining above 58,990 may invite strong buying interest. Rejection from this zone could lead to mild profit booking.

🔻 Support Levels

S1: 58,385

S2: 57,901

S3: 57,397

🔺 Resistance Levels

R1: 59,355

R2: 59,843

R3: 60,300

📈 Market Outlook

✅ Bullish Scenario:

If Bank Nifty sustains above the Pivot Zone (58,990), the index may move toward R1 (59,355).

A strong breakout above this level could extend the rally toward R2 (59,843) and eventually R3 (60,300).

❌ Bearish Scenario:

If the index falls below 58,747, short-term weakness may drag it toward S1 (58,385), followed by S2 (57,901) and S3 (57,397).

A weekly close below 57,400 could indicate the beginning of a deeper corrective phase.

Disclaimer: aliceblueonline.com/legal-documentation/disclaimer/

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.