Bank Nifty Trading Plan for 21-Nov-2024

Intro:

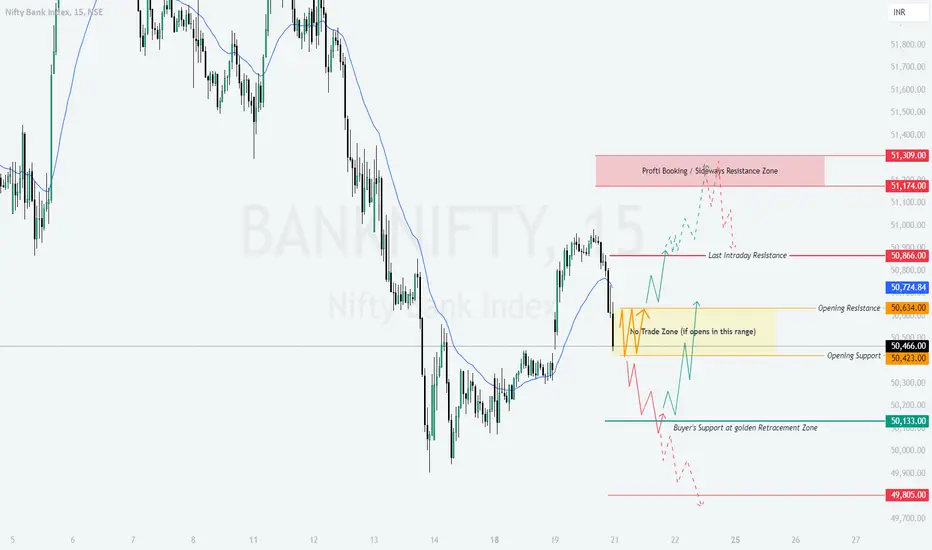

On 20-Nov-2024, Bank Nifty displayed a highly volatile session with price action respecting key levels. The index faced resistance around the 50,866 zone, marking it as the last intraday resistance. The yellow-shaded zone indicated a "No Trade Zone" due to the lack of directional clarity, while buyers found support near 50,133, aligning with the golden Fibonacci retracement level. The green trend showcased bullish movements, while red trends reflected bearish pullbacks. This sets the stage for varied possibilities for 21-Nov-2024.

Trading Plan for 21-Nov-2024:

Intro:

On 20-Nov-2024, Bank Nifty displayed a highly volatile session with price action respecting key levels. The index faced resistance around the 50,866 zone, marking it as the last intraday resistance. The yellow-shaded zone indicated a "No Trade Zone" due to the lack of directional clarity, while buyers found support near 50,133, aligning with the golden Fibonacci retracement level. The green trend showcased bullish movements, while red trends reflected bearish pullbacks. This sets the stage for varied possibilities for 21-Nov-2024.

Trading Plan for 21-Nov-2024:

- Gap Up Opening (200+ points above 50,724):

If Bank Nifty opens above 50,866, watch for a sustained breakout above 51,174. This could lead to a bullish continuation towards the Profit Booking Zone (51,309).

Avoid immediate entry post-gap up; let the index settle for the first 15–30 minutes.

A failure to hold above 50,866 may signal a reversal, with the potential to retrace back to 50,634. - Flat Opening (Near 50,634):

A flat opening near 50,634 suggests indecision. If prices break above 50,724 with volume, consider a bullish trade targeting 50,866.

Conversely, if the price breaks below 50,466, expect bearish momentum targeting 50,133.

Remain cautious in the yellow-shaded "No Trade Zone." Focus on clear breakout/rejection signals before entering trades. - Gap Down Opening (200+ points below 50,466):

A gap down below 50,466 may lead to further bearish momentum towards the key support at 50,133.

If 50,133 holds, look for signs of recovery to 50,466 or higher.

A break below 50,133 could trigger a strong bearish trend, targeting 49,805. Trade with a tight stop-loss if initiating shorts.

Risk Management Tips for Options Traders:

Always define your maximum loss before entering a trade.

For intraday trades, use stop-losses based on the hourly candle close to avoid getting whipsawed by volatility.

Avoid over-leveraging. Stick to 1–2% risk per trade relative to your trading capital.

For gap openings, prefer directional options strategies like debit spreads to manage premium erosion effectively.

Summary and Conclusion:

Bank Nifty's key levels for the day are 50,133 (Buyer’s Support) and 50,866 (Resistance Zone).

Trade cautiously within the "No Trade Zone" (50,466 – 50,634).

Watch for clear directional moves, as trends are likely to be driven by intraday volatility.

Disclaimer:

I am not a SEBI-registered analyst. This trading plan is for educational purposes only. Traders are advised to conduct their analysis or consult a financial advisor before making any trading decisions.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.