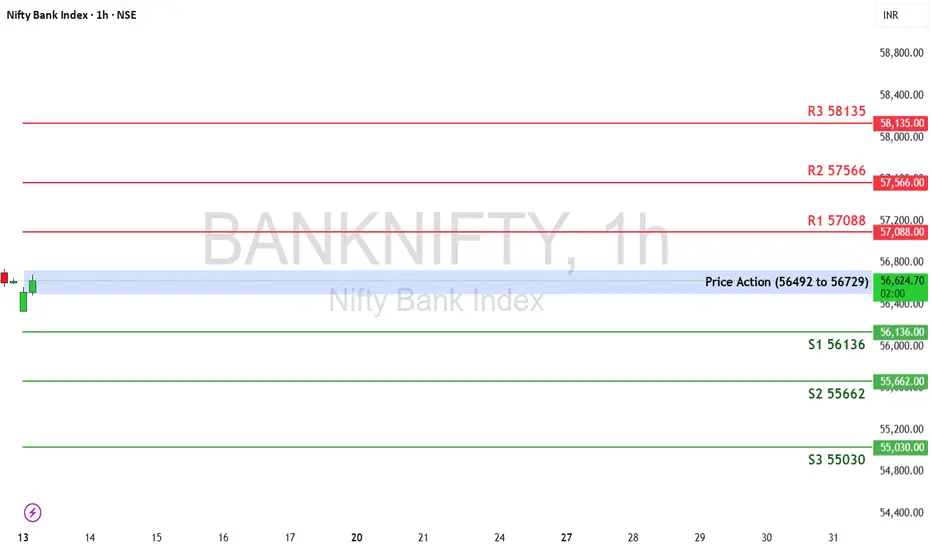

The Bank Nifty ended the week at 56,609.75, gaining +1.84%

🔹 Price Action Pivot Zone:

56,492 – 56,729

This is the crucial price band to watch. A breakout or breakdown from this blue-shaded zone could define this week’s directional bias.

🔻 Support Levels:

S1: 56,136

S2: 55,662

S3: 55,030

🔺 Resistance Levels:

R1: 57,088

R2: 57,566

R3: 58,135

📈 Market Outlook

✅ Bullish Scenario:

If Bank Nifty sustains above the pivot high of 56,729, buyers could push the index toward R1 (57,088). A breakout above this zone may open the path to R2 (57,566) and R3 (58,135).

❌ Bearish Scenario:

A breakdown below the pivot low of 56,492 could trigger profit booking. The index may then retest S1 (56,136), with further weakness extending toward S2 (55,662) and S3 (55,030).

Disclaimer: tinyurl.com/59ypbsrh

🔹 Price Action Pivot Zone:

56,492 – 56,729

This is the crucial price band to watch. A breakout or breakdown from this blue-shaded zone could define this week’s directional bias.

🔻 Support Levels:

S1: 56,136

S2: 55,662

S3: 55,030

🔺 Resistance Levels:

R1: 57,088

R2: 57,566

R3: 58,135

📈 Market Outlook

✅ Bullish Scenario:

If Bank Nifty sustains above the pivot high of 56,729, buyers could push the index toward R1 (57,088). A breakout above this zone may open the path to R2 (57,566) and R3 (58,135).

❌ Bearish Scenario:

A breakdown below the pivot low of 56,492 could trigger profit booking. The index may then retest S1 (56,136), with further weakness extending toward S2 (55,662) and S3 (55,030).

Disclaimer: tinyurl.com/59ypbsrh

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.