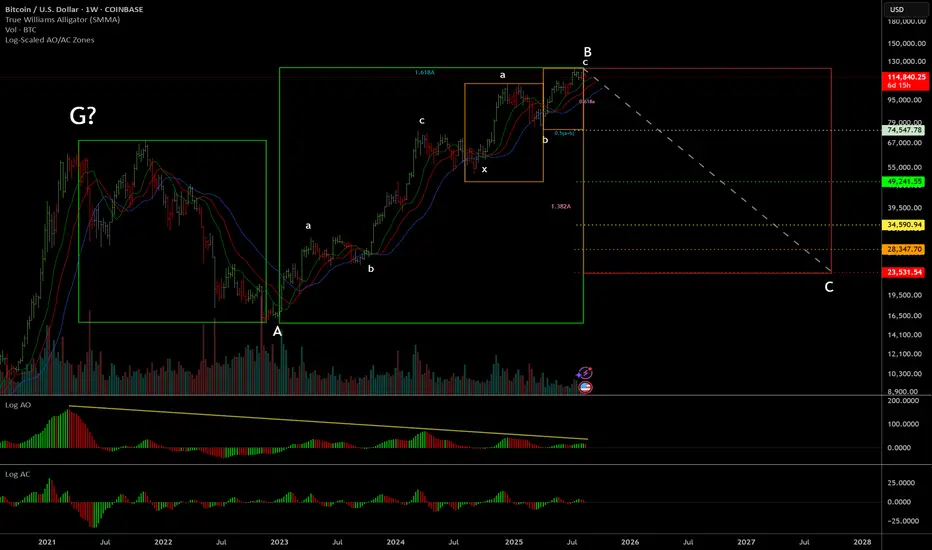

BTC has formed into a double zigzag from the low in 2023 until now. This is the same count that my friend Glenn Neely (the founder of Neowave) is following.

At this point there aren't really any other counts that appear to make sense. Especially considering the terminal impulse that wave-c has formed (see Daily chart).

We've already begun breaking down from the rising wedge pattern, which is a strong indication that wave-c has concluded.

Beyond just Elliott Wave/Neowave considerations, this has also formed long-term momentum divergences on the AO, and a clear weekly wiseman right at the end of wave-5 of c, perfectly aligned with the 0.5(a+b) time target for wave-c.

This perfect confluence of signals here is a very strong signal the market has topped out long-term, and could retrace all the way back to ~$23k in the worst case scenario. Other potential retracement levels are labeled on the chart.

If this does end up breaking $125k, then it may be a good idea to flip bullish as the bull cycle could continue for an unknown amount of time after that. For now, probabilities are starting to stack up indicating that the top is in and a big retracement is coming.

At this point there aren't really any other counts that appear to make sense. Especially considering the terminal impulse that wave-c has formed (see Daily chart).

We've already begun breaking down from the rising wedge pattern, which is a strong indication that wave-c has concluded.

Beyond just Elliott Wave/Neowave considerations, this has also formed long-term momentum divergences on the AO, and a clear weekly wiseman right at the end of wave-5 of c, perfectly aligned with the 0.5(a+b) time target for wave-c.

This perfect confluence of signals here is a very strong signal the market has topped out long-term, and could retrace all the way back to ~$23k in the worst case scenario. Other potential retracement levels are labeled on the chart.

If this does end up breaking $125k, then it may be a good idea to flip bullish as the bull cycle could continue for an unknown amount of time after that. For now, probabilities are starting to stack up indicating that the top is in and a big retracement is coming.

Note

From a William's perspective, I see this long-term set up as exceedingly bearish:

2D and 3D charts have closed under the gator. Both charts have all three wisemen. Both charts have created multi-peaks and have crossed or are approaching the zero line on the AO.

1W and 1M both have first wisemen (1M closes in 2 days).

Virtually all charts have twin or multi-peaks, long-term divergences, and are beginning to turn red on the AO.

This all aligns perfectly with the Wave theory price/time/structure targets which indicate that we've already hit the top. We've also retraced wave-5 of c faster than it was formed, broken down clearly from the rising wedge pattern, and even retested the bottom trendline before heading lower. (see daily rising wedge chart)

The only bullish thing to note on these charts is the 1D first wisemen, but this signal is fairly weak given the rest of the set up.

On the flip side, in the less likely scenario where this does break up above $125k and reverse the long-term wisemen and other signals, it would be a strong buy signal. However, that alternative scenario seems much less likely at this point, so unless it does break $125k, it's best to remain bearish based on Neowave theory and William's indicators.

Trade active

Given that we are starting to veer off course here, unless we see a sharp move down this week, the terminal count for wave-c is probably incorrect and we could still see more upside from here.

The terminal is not totally invalid yet, and even if we get one more wave up it's possible that this last dip was wave-4 and the next wave up will be wave-5 of c. But it's also possible a wider bull market continuation could happen from this point IF the long-term top signals are invalidated AND a wave-5 doesn't form after the invalidation.

At the least, the very short-term seems to be pointing up now while the long-term is still awaiting a confirmation (or invalidation) of the long-term top signals. Given the very early-stage nature of the top signals, the probability that they will hold is not extremely high, but high enough to warrant some level of caution as long as they still remain valid.

Note

The short-term bounce being almost fully retraced at this point is a good sign that the top signals are more likely to hold now. Whether the daily chart has formed into a 5th wave failure or a diametric doesn't really matter. The long-term counts (either double zigzag or diametric) are still completely valid and the chances of a much deeper pull back and multi-year bear market beginning from the all time high is significant.Trade closed: stop reached

BTC has made a new all time high, as I stated previously this means that it is best to flip bullish as long-term bear signals are being reversed into long-term bull signals. While the wave count for the bullish case remains unclear, it is best to assume that the uptrend will continue until there is more information.Find me on x.com/intuit_trading

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Find me on x.com/intuit_trading

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.