Here is the Bottom-Up Analysis for  BTC as requested 🫡

BTC as requested 🫡

At first, we’ll just talk about the charts, and after that, a bit about today’s FOMC meeting and what it means for Bitcoin.

Big Picture:

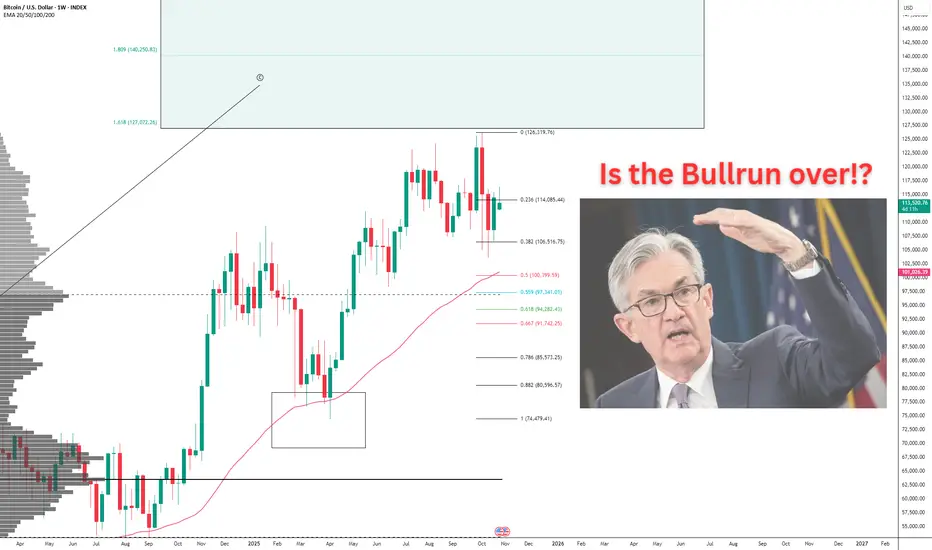

The bull run remains intact as we haven’t had any weekly closes below the 50W moving average.

We bounced from the 0.382 level of the current range and from a major volume support zone built over the last two years.

As long as we stay above these levels, everything remains bullish.

Our target zone for this bull run hasn’t been reached yet — it stretches from 127K to 153K.

Overextansions are always possible, though.

Smaller-Picture:

We remain below the Point of Control, as we bounced off it two days ago.

A smaller sequence has been activated, which could bring us all the way up to new ATHs.

The next big support is at the trend reversal area, where our VAL also comes in as another layer of support.

This area will be key!

Intraday-Timeframe:

We are currently sitting at a local volume support area.

If we lose that, we’ll likely come down to the trend reversal zone, where we also have an intraday Target zone.

This will be a long opportunity for me, as we have the following confluences in this area:

- Trend Reversal Zone

- Target zone of a secondary structure

- Volume Support via the Point of Control

If we can’t hold this area, I expect Bitcoin to break down toward the VAL at 108.8K — that could also mean a bit more ranging over the next week.

Looking even closer, we can see that we just bounced off the latest trend reversal area in the smallest timeframes.

If we move above the latest high, I expect follow-through — no breakdown into my buying area.

Connection to FOMC

Let’s talk a bit about the current economic stance and what we can expect today.

Growth remains strongly positive on a big-picture basis.

The last GDP print came in above expectations, and the GDPNowcast currently sits at 3.9%.

Inflation remains moderate, as we saw in the last print, so there’s nothing to fear there.

Inflation expectations have actually come down over the last month — this could pressure markets if the Fed doesn’t cut fast enough, but we aren’t seeing that right now.

Monitoring inflation remains key at this point.

The long end of the yield curve remains range-bound but has come down a bit, showing no major inflation risk.

Liquidity is expanding, with credit spreads near cycle lows, which has fueled the current melt-up we’re seeing.

Growth → positive

Inflation → moderate

Liquidity → expanding

The Fed said at the last meeting that they expect inflation to remain moderate and growth to increase toward the end of the year — and they’re cutting rates in this environment.

All together, this brings us close to a Goldilocks scenario.

It won’t last forever!

My expectations for today’s FOMC meeting are as always:

👉 This isn’t the most important FOMC of our lives!

I do think there’s a moderate probability that the Fed will stop QT, which would cause the market to pump.

The rate cut is already 100% priced in, so now we need to focus on whether they change their balance sheet policy and on Powell’s forward guidance

----

I don’t know what’s going to happen, but I do know that I’ll go long on BTC if we come down to my buying zone.

BTC if we come down to my buying zone.

We remain bullish on both the macro and micro picture.

One single news headline could trigger an end-of-year rally — or one could spark another liquidation cascade, as we saw on October 10.

Good trading & stay safe!

Feel free to ask me any questions down below!

At first, we’ll just talk about the charts, and after that, a bit about today’s FOMC meeting and what it means for Bitcoin.

Big Picture:

The bull run remains intact as we haven’t had any weekly closes below the 50W moving average.

We bounced from the 0.382 level of the current range and from a major volume support zone built over the last two years.

As long as we stay above these levels, everything remains bullish.

Our target zone for this bull run hasn’t been reached yet — it stretches from 127K to 153K.

Overextansions are always possible, though.

Smaller-Picture:

We remain below the Point of Control, as we bounced off it two days ago.

A smaller sequence has been activated, which could bring us all the way up to new ATHs.

The next big support is at the trend reversal area, where our VAL also comes in as another layer of support.

This area will be key!

Intraday-Timeframe:

We are currently sitting at a local volume support area.

If we lose that, we’ll likely come down to the trend reversal zone, where we also have an intraday Target zone.

This will be a long opportunity for me, as we have the following confluences in this area:

- Trend Reversal Zone

- Target zone of a secondary structure

- Volume Support via the Point of Control

If we can’t hold this area, I expect Bitcoin to break down toward the VAL at 108.8K — that could also mean a bit more ranging over the next week.

Looking even closer, we can see that we just bounced off the latest trend reversal area in the smallest timeframes.

If we move above the latest high, I expect follow-through — no breakdown into my buying area.

Connection to FOMC

Let’s talk a bit about the current economic stance and what we can expect today.

Growth remains strongly positive on a big-picture basis.

The last GDP print came in above expectations, and the GDPNowcast currently sits at 3.9%.

Inflation remains moderate, as we saw in the last print, so there’s nothing to fear there.

Inflation expectations have actually come down over the last month — this could pressure markets if the Fed doesn’t cut fast enough, but we aren’t seeing that right now.

Monitoring inflation remains key at this point.

The long end of the yield curve remains range-bound but has come down a bit, showing no major inflation risk.

Liquidity is expanding, with credit spreads near cycle lows, which has fueled the current melt-up we’re seeing.

Growth → positive

Inflation → moderate

Liquidity → expanding

The Fed said at the last meeting that they expect inflation to remain moderate and growth to increase toward the end of the year — and they’re cutting rates in this environment.

All together, this brings us close to a Goldilocks scenario.

It won’t last forever!

My expectations for today’s FOMC meeting are as always:

👉 This isn’t the most important FOMC of our lives!

I do think there’s a moderate probability that the Fed will stop QT, which would cause the market to pump.

The rate cut is already 100% priced in, so now we need to focus on whether they change their balance sheet policy and on Powell’s forward guidance

----

I don’t know what’s going to happen, but I do know that I’ll go long on

We remain bullish on both the macro and micro picture.

One single news headline could trigger an end-of-year rally — or one could spark another liquidation cascade, as we saw on October 10.

Good trading & stay safe!

Feel free to ask me any questions down below!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.