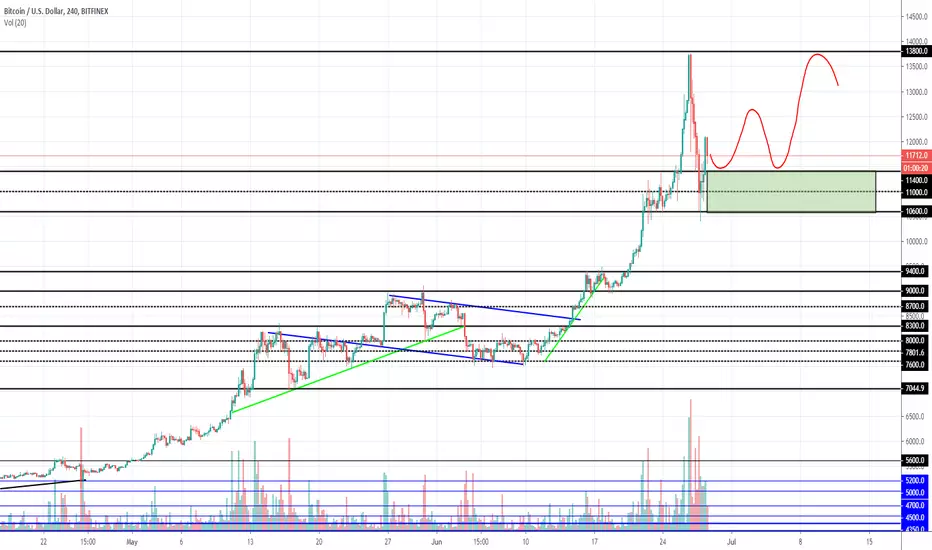

Bitcoin has updated new annual maximum near $13900. After that, the vertical trend was replaced by a pulse dawnward correction, which was eventually bought off only from $10600-11000. Technical and psychological indicators that have been in the overbought zone for a long time period have come out of it. Fear and greed index has recently updated its historical maximum, at 95 points out of 100 possible, and then corrected to 62. It can be concluded that FOMO has pushed the price up lately.

Together with the price of Bitcoin, the total market capitalization was also growing, with the local peak was $386 billion, returning to the values of May last year. It should also be noted that growth was provided basically by BTC, altcoins did not add much value at the time of its growth.

As a result, BTC dominance exceeded 62%. Last time this index reached such value in December 2017 and large-scale growth of altcoins began after. That's the same time they have updated their ATH along with the total market capitalization. In mid-May 2019, index also reached 60%, after which the indicator began to decline, while capital moved into altcoins. It can be assumed that in the near future this will happen again. Altcoins are currently heavily oversold in the relation to bitcoin.

Given the overall positive correlation, they should begin to adjuste in the short term. In other words, the growth of the main alts should begin. And when it starts, it will be possible to draw conclusions about the beginning of the cryptosummer. Bitcoin, of course, is the first and dominant cryptocurrency, but this is not entirely the whole market.

As for the BTCUSD chart, it is very likely that it will consolidate with attempts to grow up to $13000-14000. Buying from $10600 was critically important, $10600-11000 zone will serve as local support in th short term. Breaking through this zone probably will be the beginning of a local panic sale down to $ 8,000.

Together with the price of Bitcoin, the total market capitalization was also growing, with the local peak was $386 billion, returning to the values of May last year. It should also be noted that growth was provided basically by BTC, altcoins did not add much value at the time of its growth.

As a result, BTC dominance exceeded 62%. Last time this index reached such value in December 2017 and large-scale growth of altcoins began after. That's the same time they have updated their ATH along with the total market capitalization. In mid-May 2019, index also reached 60%, after which the indicator began to decline, while capital moved into altcoins. It can be assumed that in the near future this will happen again. Altcoins are currently heavily oversold in the relation to bitcoin.

Given the overall positive correlation, they should begin to adjuste in the short term. In other words, the growth of the main alts should begin. And when it starts, it will be possible to draw conclusions about the beginning of the cryptosummer. Bitcoin, of course, is the first and dominant cryptocurrency, but this is not entirely the whole market.

As for the BTCUSD chart, it is very likely that it will consolidate with attempts to grow up to $13000-14000. Buying from $10600 was critically important, $10600-11000 zone will serve as local support in th short term. Breaking through this zone probably will be the beginning of a local panic sale down to $ 8,000.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.