Policy/Scope: Informational market commentary. Not financial advice. No guarantees. Manage your own risk. Please, as always, DYOFR.

Snapshot (USD, approx.)

• BTC: ~112,400 (recent ATH ~125,000)

• ETH: ~3,838 (recent peak ~4,780)

• SOL: ~184 (weekly high ~224)

Volatility remains high after the Oct 10 tariff-headline shock and large derivatives liquidations.

Sentiment & Macro (neutral summary)

• Early October optimism (“Uptober”) flipped to caution after the Oct 10 risk-off event. Fear & Greed moved from Greed to Fear intraday.

• Rates: Market implies further Fed easing in 2025; a hawkish surprise is a downside risk.

• USD: 2025 USD softness has coincided with stronger crypto; renewed USD strength can pressure prices.

• Equities: Index swings continue to bleed into crypto via positioning and liquidity.

Technical Maps & If/Then Plans

Levels = areas of interest, not market orders. “Invalidation” = close beyond level on your execution timeframe.

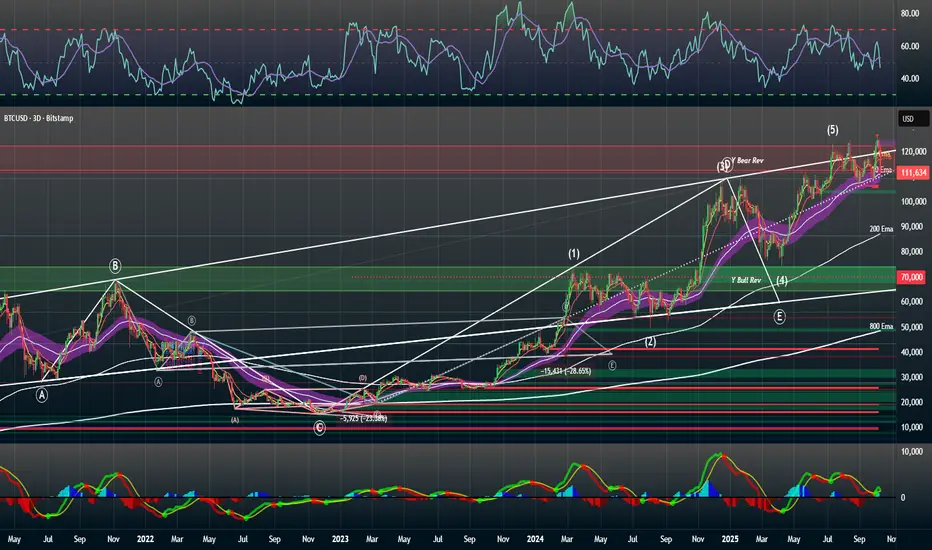

Bitcoin (BTC) — ~112,400

• Support: 110,000; 100,000.

• Resistance: 113,500; 120,000; 125,000.

• Mean-reversion: Confirmed holds 108,000–110,000 → TP 120,000 → 125,000 → 135,000. SL <108,000.

• Breakout: 4H/D close >113,500 with volume → 118,000 → 122,000. SL ~111,000.

• Invalidation: D close <110,000 weakens; <100,000 = deeper risk.

Ethereum (ETH) — ~3,838

• Support: 3,600; 3,400.

• Resistance: 4,000; 4,300; 4,780–4,865 (ATH zone).

• Mean-reversion: Hold 3,600 → TP 4,000 → 4,300 → 4,800. SL ~3,350.

• Breakout: D close >4,000 with volume → 4,300 → 4,600. SL <3,900.

• Invalidation: D close <3,300.

Solana (SOL) — ~184

• Support: 176–175; 150.

• Resistance: 200; 224; 250.

• Mean-reversion: Retest/hold 170–175 → TP 200 → 224 → 250. SL ~165.

• Breakout: Close >200 with volume → 210 → 224. SL <190.

• Invalidation: D close <150.

Altcoins (concise setups; USD)

• PENGU (~0.023): Support 0.020; Resistance 0.030 → 0.040.

Idea: Mean-revert near 0.020 (if tagged) → TP 0.030 / 0.040. SL <0.018. High risk.

• JUP (~0.34): Support 0.30 / 0.25; Resistance 0.40 / 0.46.

Idea: Breakout >0.40 → TP 0.46 / 0.55. SL ~0.36. Or buy deeper retrace ~0.25 with tight risk.

• ME (~0.40): Support 0.30; Resistance 0.50 / 0.64.

Idea: Speculative swing toward 0.50 / 0.60. SL <0.29. New token; unlock risk.

• S (Sonic, ~0.18): Support 0.10; Resistance 0.27 / 0.50.

Idea: High-beta mean-reversion 0.12–0.15 → TP 0.27 / 0.50. SL 0.09. Very high risk.

• LTC (~120): Support 115 / 100; Resistance 130 / 145–150.

Idea: Swing near 110–115 → TP 130 / 145. SL <99.

• SNS (~0.00223): Support 0.0020; Resistance 0.0028 / 0.0035.

Idea: Small-size accumulation near 0.0020 → TP 0.0028 / 0.0035. SL 0.0015.

• GRASS (~0.55): Support 0.50 / 0.30; Resistance 0.70 / 0.84 / 1.00.

Idea: Mean-revert 0.45–0.50 → TP 0.70 / 0.85. SL 0.40. Extreme volatility.

• DOGE (~0.19): Support 0.16 / 0.13; Resistance 0.22 / 0.25 / 0.30.

Idea: Buy dips 0.16–0.17 → TP 0.22 / 0.25 / 0.30. SL 0.14.

• AVAX (~28): Support 25 / 22; Resistance 30 / 35 / 40.

Idea: Accumulate 25–26 → TP 30 / 35 / 40. SL 22.

• ADA (~0.80): Support 0.75 / 0.67 / 0.60; Resistance 0.93 / 1.00.

Idea: Dip buy ~0.70 → TP 0.90 / 1.00 / 1.10. SL 0.62. Breakout >0.93 → 1.00.

Solana NFT Floors (informational; floors in SOL ≈ USD using SOL~$184)

NFT TA is illiquid and imprecise. Use wider mental stops. Consider fees/royalties.

• DeGods (Solana): Floor ~6.1 SOL (~$1,120).

Context: Legacy Solana stub after migration; very low liquidity.

Levels: Support ~5 SOL; Resistance ~10 SOL then 20 SOL.

Idea: Mean-reversion only; tiny size. Break <5 SOL = caution.

• y00ts (Solana “reveal” stub): Floor ~0.85 SOL (~$162).

Context: Chain-migrated; minimal activity.

Levels: Support 0.75; Resistance 1.0 then 1.5.

Idea: Technical scalps only; liquidity risk is high.

• Cets on Creck (CETS): Floor ~0.30 SOL (~$67).

Levels: Support 0.25; Resistance 0.50 then 1.0.

Idea: Base-range mean-reversion; SL if floor <0.25.

• Udder Chaos: Floor ~1.06 SOL (~$197).

Levels: Support 0.90 / 0.75; Resistance 1.2 then 1.5.

Idea: Relative-strength candidate; swing toward 1.3 / 1.8 / 2.2 if market stabilizes.

• Primates: Floor ~0.18 SOL (~$40).

Levels: Support 0.15; Resistance 0.30 then 0.4–0.5.

Idea: Lotto-style mean-reversion; tiny size; pre-list targets.

Risk framework (for all sections)

• Risk 1–3% of account to the hard stop per idea.

• Scale out 40% / 40% / 20% at TP1 / TP2 / runner; move stop to breakeven after TP1.

• Pause alt exposure if BTC closes below 110,000 or if USD strength spikes materially.

• Revalidate levels after policy data, tariff headlines, or outsized equity moves.

Pine Script®

Snapshot (USD, approx.)

• BTC: ~112,400 (recent ATH ~125,000)

• ETH: ~3,838 (recent peak ~4,780)

• SOL: ~184 (weekly high ~224)

Volatility remains high after the Oct 10 tariff-headline shock and large derivatives liquidations.

Sentiment & Macro (neutral summary)

• Early October optimism (“Uptober”) flipped to caution after the Oct 10 risk-off event. Fear & Greed moved from Greed to Fear intraday.

• Rates: Market implies further Fed easing in 2025; a hawkish surprise is a downside risk.

• USD: 2025 USD softness has coincided with stronger crypto; renewed USD strength can pressure prices.

• Equities: Index swings continue to bleed into crypto via positioning and liquidity.

Technical Maps & If/Then Plans

Levels = areas of interest, not market orders. “Invalidation” = close beyond level on your execution timeframe.

Bitcoin (BTC) — ~112,400

• Support: 110,000; 100,000.

• Resistance: 113,500; 120,000; 125,000.

• Mean-reversion: Confirmed holds 108,000–110,000 → TP 120,000 → 125,000 → 135,000. SL <108,000.

• Breakout: 4H/D close >113,500 with volume → 118,000 → 122,000. SL ~111,000.

• Invalidation: D close <110,000 weakens; <100,000 = deeper risk.

Ethereum (ETH) — ~3,838

• Support: 3,600; 3,400.

• Resistance: 4,000; 4,300; 4,780–4,865 (ATH zone).

• Mean-reversion: Hold 3,600 → TP 4,000 → 4,300 → 4,800. SL ~3,350.

• Breakout: D close >4,000 with volume → 4,300 → 4,600. SL <3,900.

• Invalidation: D close <3,300.

Solana (SOL) — ~184

• Support: 176–175; 150.

• Resistance: 200; 224; 250.

• Mean-reversion: Retest/hold 170–175 → TP 200 → 224 → 250. SL ~165.

• Breakout: Close >200 with volume → 210 → 224. SL <190.

• Invalidation: D close <150.

Altcoins (concise setups; USD)

• PENGU (~0.023): Support 0.020; Resistance 0.030 → 0.040.

Idea: Mean-revert near 0.020 (if tagged) → TP 0.030 / 0.040. SL <0.018. High risk.

• JUP (~0.34): Support 0.30 / 0.25; Resistance 0.40 / 0.46.

Idea: Breakout >0.40 → TP 0.46 / 0.55. SL ~0.36. Or buy deeper retrace ~0.25 with tight risk.

• ME (~0.40): Support 0.30; Resistance 0.50 / 0.64.

Idea: Speculative swing toward 0.50 / 0.60. SL <0.29. New token; unlock risk.

• S (Sonic, ~0.18): Support 0.10; Resistance 0.27 / 0.50.

Idea: High-beta mean-reversion 0.12–0.15 → TP 0.27 / 0.50. SL 0.09. Very high risk.

• LTC (~120): Support 115 / 100; Resistance 130 / 145–150.

Idea: Swing near 110–115 → TP 130 / 145. SL <99.

• SNS (~0.00223): Support 0.0020; Resistance 0.0028 / 0.0035.

Idea: Small-size accumulation near 0.0020 → TP 0.0028 / 0.0035. SL 0.0015.

• GRASS (~0.55): Support 0.50 / 0.30; Resistance 0.70 / 0.84 / 1.00.

Idea: Mean-revert 0.45–0.50 → TP 0.70 / 0.85. SL 0.40. Extreme volatility.

• DOGE (~0.19): Support 0.16 / 0.13; Resistance 0.22 / 0.25 / 0.30.

Idea: Buy dips 0.16–0.17 → TP 0.22 / 0.25 / 0.30. SL 0.14.

• AVAX (~28): Support 25 / 22; Resistance 30 / 35 / 40.

Idea: Accumulate 25–26 → TP 30 / 35 / 40. SL 22.

• ADA (~0.80): Support 0.75 / 0.67 / 0.60; Resistance 0.93 / 1.00.

Idea: Dip buy ~0.70 → TP 0.90 / 1.00 / 1.10. SL 0.62. Breakout >0.93 → 1.00.

Solana NFT Floors (informational; floors in SOL ≈ USD using SOL~$184)

NFT TA is illiquid and imprecise. Use wider mental stops. Consider fees/royalties.

• DeGods (Solana): Floor ~6.1 SOL (~$1,120).

Context: Legacy Solana stub after migration; very low liquidity.

Levels: Support ~5 SOL; Resistance ~10 SOL then 20 SOL.

Idea: Mean-reversion only; tiny size. Break <5 SOL = caution.

• y00ts (Solana “reveal” stub): Floor ~0.85 SOL (~$162).

Context: Chain-migrated; minimal activity.

Levels: Support 0.75; Resistance 1.0 then 1.5.

Idea: Technical scalps only; liquidity risk is high.

• Cets on Creck (CETS): Floor ~0.30 SOL (~$67).

Levels: Support 0.25; Resistance 0.50 then 1.0.

Idea: Base-range mean-reversion; SL if floor <0.25.

• Udder Chaos: Floor ~1.06 SOL (~$197).

Levels: Support 0.90 / 0.75; Resistance 1.2 then 1.5.

Idea: Relative-strength candidate; swing toward 1.3 / 1.8 / 2.2 if market stabilizes.

• Primates: Floor ~0.18 SOL (~$40).

Levels: Support 0.15; Resistance 0.30 then 0.4–0.5.

Idea: Lotto-style mean-reversion; tiny size; pre-list targets.

Risk framework (for all sections)

• Risk 1–3% of account to the hard stop per idea.

• Scale out 40% / 40% / 20% at TP1 / TP2 / runner; move stop to breakeven after TP1.

• Pause alt exposure if BTC closes below 110,000 or if USD strength spikes materially.

• Revalidate levels after policy data, tariff headlines, or outsized equity moves.

Disclosure: Educational only. Not investment advice. No solicitations or performance claims. Data reflects the provided context and can change rapidly. Verify with real-time sources before acting.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.