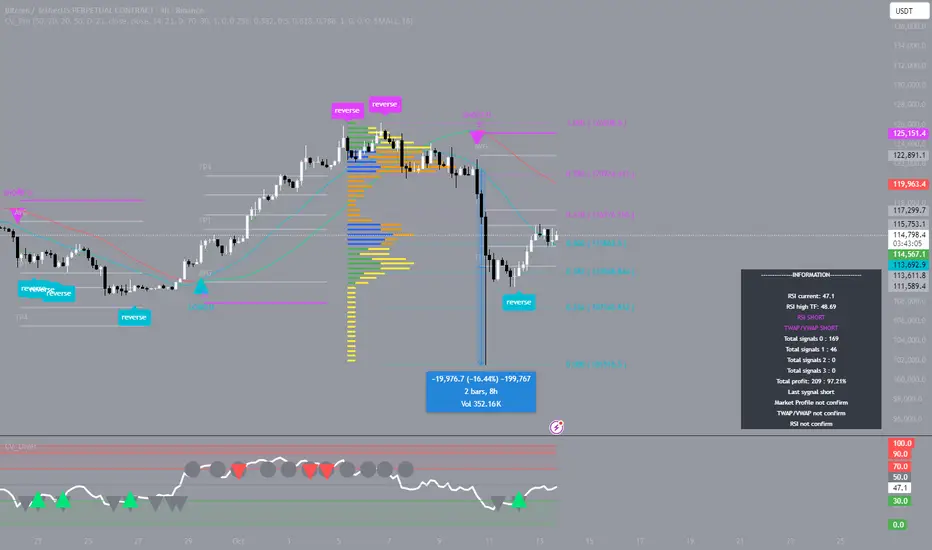

After the massive sell-off on October 10, when Bitcoin dropped, the market is gradually catching its breath. The structure is shifting — sellers’ momentum is fading, and pressure at lower levels is becoming less aggressive. My system hasn’t given a confirmed entry yet, but the groundwork for a possible upward bounce is forming.

It’s interesting to see multiple indicators align — volatility is easing, RSI is exiting oversold territory, and buy volume is picking up on local dips. All of this suggests that larger players are beginning to accumulate positions in anticipation of a potential recovery.

Experience teaches that markets don’t reverse out of the blue — structure forms first. And when the analytical system spots the early signs of an impulse shift, it’s important not to rush but to wait for confirmation. I prefer to hold off until the technical picture fully aligns with the strategy’s logic. Patience and discipline are what separate a trader from a gambler.

It’s interesting to see multiple indicators align — volatility is easing, RSI is exiting oversold territory, and buy volume is picking up on local dips. All of this suggests that larger players are beginning to accumulate positions in anticipation of a potential recovery.

Experience teaches that markets don’t reverse out of the blue — structure forms first. And when the analytical system spots the early signs of an impulse shift, it’s important not to rush but to wait for confirmation. I prefer to hold off until the technical picture fully aligns with the strategy’s logic. Patience and discipline are what separate a trader from a gambler.

🟣indicator: t.me/CryptoVisionPro_news

🟣Forum: t.me/CryptoVision_Forum

🟣Forum: t.me/CryptoVision_Forum

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🟣indicator: t.me/CryptoVisionPro_news

🟣Forum: t.me/CryptoVision_Forum

🟣Forum: t.me/CryptoVision_Forum

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.