BTC – SMC Suite Follow-Up: Liquidity Grab at 116K and the Drop That Followed

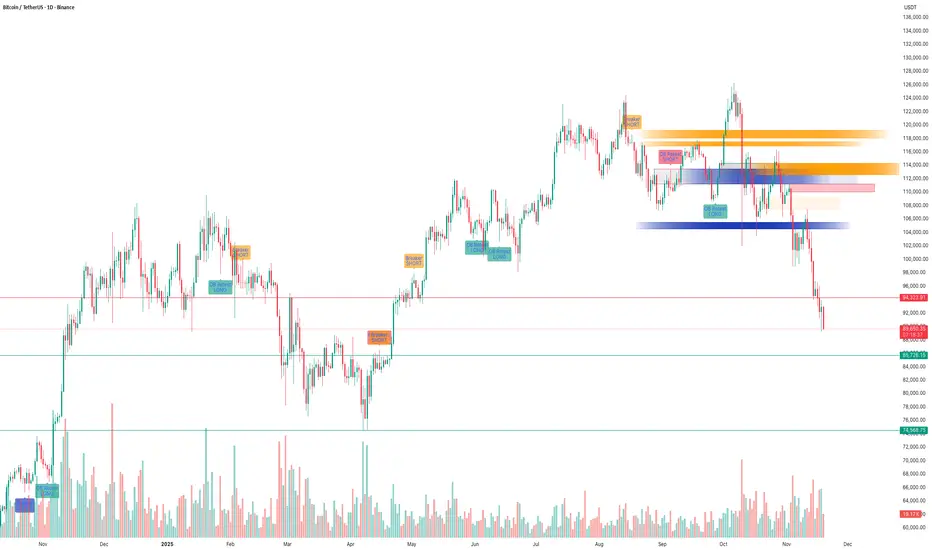

This is a follow-up to my earlier idea “BTC – Liquidity Grab at $116K Before Deep Correction?” where I highlighted the danger of price trading into stacked SMC levels on the 1D chart.

1️⃣ Quick recap of the original idea

In the previous post, price was trading around the $112K–$116K zone.

Using the SMC Suite on the 1D chart, I highlighted:

• A high-timeframe supply / OB cluster around 116K.

• A liquidity grab above prior highs – price spiked into fresh liquidity sitting above the range.

• A confluence of Breaker + OB Re-test + FVG acting as a “danger zone” for fresh longs.

• The idea that this move could be a distribution / liquidity grab before a deeper correction.

The key message was: this is not a safe place to be aggressive long; watch for rejection and potential downside.

2️⃣ How price reacted afterwards

Since that post:

• Price respected the 116K zone as supply – every attempt to hold above it failed.

• The highlighted OB + Breaker block acted as a ceiling; price consolidated there and then rolled over.

• After losing the mid-range structure, BTC started a trend of lower highs and lower lows, confirming distribution.

• We have now traded all the way down into the demand / support zones below 92K and then lower, which were also plotted in advance by the same SMC levels.

In simple terms, the area we marked as a “danger zone for longs” turned out to be the top of the move before this large downside leg.

3️⃣ What the SMC levels showed well

This move is a nice case study of how the SMC concepts aligned:

• Liquidity Sweep: Price ran above previous highs into fresh liquidity, then failed to hold.

• Breaker + OB Re-test: Former demand became supply; retest of this breaker block rejected price.

• FVG + Imbalance Zones: Upside imbalances got filled and then flipped into resistance.

• Structure Shift: After the rejection, market structure shifted bearish with clean breaks of prior swing lows.

None of this is about “perfect prediction”, but about reading where smart money might be offloading risk and where retail is most vulnerable.

4️⃣ Takeaways & what I’m watching next

• HTF SMC levels matter. When multiple concepts cluster (Breaker, OB, FVG, previous highs), treat that zone with respect.

• Liquidity grabs at highs are great warning signals – especially when followed by a clear structure shift.

• For now, I’m watching how price behaves around the current demand zones and whether we see:

• Strong rejection + reclaim of broken levels (potential swing-long areas), or

• Continuation of lower highs pointing to further downside.

This post is for educational purposes only, not financial advice.

This is a follow-up to my earlier idea “BTC – Liquidity Grab at $116K Before Deep Correction?” where I highlighted the danger of price trading into stacked SMC levels on the 1D chart.

1️⃣ Quick recap of the original idea

In the previous post, price was trading around the $112K–$116K zone.

Using the SMC Suite on the 1D chart, I highlighted:

• A high-timeframe supply / OB cluster around 116K.

• A liquidity grab above prior highs – price spiked into fresh liquidity sitting above the range.

• A confluence of Breaker + OB Re-test + FVG acting as a “danger zone” for fresh longs.

• The idea that this move could be a distribution / liquidity grab before a deeper correction.

The key message was: this is not a safe place to be aggressive long; watch for rejection and potential downside.

2️⃣ How price reacted afterwards

Since that post:

• Price respected the 116K zone as supply – every attempt to hold above it failed.

• The highlighted OB + Breaker block acted as a ceiling; price consolidated there and then rolled over.

• After losing the mid-range structure, BTC started a trend of lower highs and lower lows, confirming distribution.

• We have now traded all the way down into the demand / support zones below 92K and then lower, which were also plotted in advance by the same SMC levels.

In simple terms, the area we marked as a “danger zone for longs” turned out to be the top of the move before this large downside leg.

3️⃣ What the SMC levels showed well

This move is a nice case study of how the SMC concepts aligned:

• Liquidity Sweep: Price ran above previous highs into fresh liquidity, then failed to hold.

• Breaker + OB Re-test: Former demand became supply; retest of this breaker block rejected price.

• FVG + Imbalance Zones: Upside imbalances got filled and then flipped into resistance.

• Structure Shift: After the rejection, market structure shifted bearish with clean breaks of prior swing lows.

None of this is about “perfect prediction”, but about reading where smart money might be offloading risk and where retail is most vulnerable.

4️⃣ Takeaways & what I’m watching next

• HTF SMC levels matter. When multiple concepts cluster (Breaker, OB, FVG, previous highs), treat that zone with respect.

• Liquidity grabs at highs are great warning signals – especially when followed by a clear structure shift.

• For now, I’m watching how price behaves around the current demand zones and whether we see:

• Strong rejection + reclaim of broken levels (potential swing-long areas), or

• Continuation of lower highs pointing to further downside.

This post is for educational purposes only, not financial advice.

Thanks.

TradeTech Analysis

Telegram Channel - t.me/Tradetech2024

Youtube Channel - youtube.com/@TradeTechAnalysis

Website - tradetechanalysis.com/

Super Profile - superprofile.bio/tradetechanalysis

TradeTech Analysis

Telegram Channel - t.me/Tradetech2024

Youtube Channel - youtube.com/@TradeTechAnalysis

Website - tradetechanalysis.com/

Super Profile - superprofile.bio/tradetechanalysis

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Thanks.

TradeTech Analysis

Telegram Channel - t.me/Tradetech2024

Youtube Channel - youtube.com/@TradeTechAnalysis

Website - tradetechanalysis.com/

Super Profile - superprofile.bio/tradetechanalysis

TradeTech Analysis

Telegram Channel - t.me/Tradetech2024

Youtube Channel - youtube.com/@TradeTechAnalysis

Website - tradetechanalysis.com/

Super Profile - superprofile.bio/tradetechanalysis

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.