👋🏻 Hey everyone! Hope you’re doing great! Welcome to SatoshiFrame channel.

✨ Today we’re diving into the 1-Day Bitcoin Dominance analysis. Stay tuned and follow along!

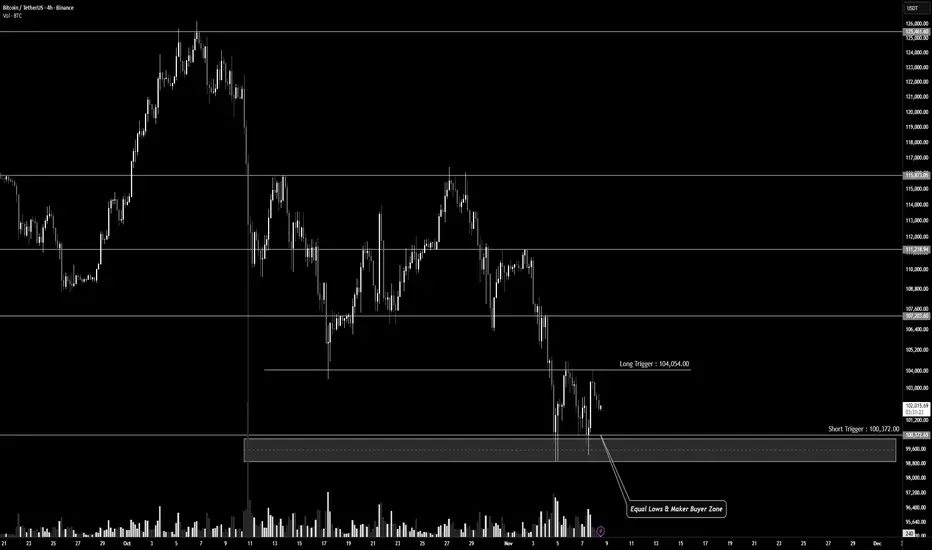

🪙 On the 4-hour timeframe, Bitcoin is currently moving within a clear trading range.

The highs and lows in lower timeframes are nearly equal, providing solid trigger zones for potential trades.

The range resistance is around $104,054, while the range support lies near $100,372, which can be considered a micro buyer zone.

💰 During Bitcoin’s first upward move, the volume increased, indicating an attempt to shift momentum bullishly.

However, after forming a lower high, buyers experienced FOMO but failed to push the price further up.

A pullback then occurred toward the support zone at $100,372, where another equal low was formed.

As price moved upward again, buying volume decreased, showing weakening buyer strength, and the move concluded with a blow-off 4H candle near the previous top.

✍️ Below are the potential trading scenarios for Bitcoin.

Review them and align with your own strategy and risk management before taking positions.

↗️ Long Position Scenario

A breakout above the resistance zone (the 4H trend-change area) around $104,054, followed by the formation of a higher low on that level, could provide a solid long setup.

Ensure this move is confirmed by increasing volume and buying pressure convergence for a higher win rate.

📉 Short Position Scenario

A breakdown below the support zone (two equal lows and a key weekly/daily support) around $100,372, combined with the formation of a lower high below that zone and strong selling pressure, could offer a short opportunity.

Watch out for large whale candles — it’s best to wait for confirmation before entering.

❤️ Disclaimer : This analysis is purely based on my personal opinion and I only trade if the stated triggers are activated .

✨ Today we’re diving into the 1-Day Bitcoin Dominance analysis. Stay tuned and follow along!

🪙 On the 4-hour timeframe, Bitcoin is currently moving within a clear trading range.

The highs and lows in lower timeframes are nearly equal, providing solid trigger zones for potential trades.

The range resistance is around $104,054, while the range support lies near $100,372, which can be considered a micro buyer zone.

💰 During Bitcoin’s first upward move, the volume increased, indicating an attempt to shift momentum bullishly.

However, after forming a lower high, buyers experienced FOMO but failed to push the price further up.

A pullback then occurred toward the support zone at $100,372, where another equal low was formed.

As price moved upward again, buying volume decreased, showing weakening buyer strength, and the move concluded with a blow-off 4H candle near the previous top.

✍️ Below are the potential trading scenarios for Bitcoin.

Review them and align with your own strategy and risk management before taking positions.

↗️ Long Position Scenario

A breakout above the resistance zone (the 4H trend-change area) around $104,054, followed by the formation of a higher low on that level, could provide a solid long setup.

Ensure this move is confirmed by increasing volume and buying pressure convergence for a higher win rate.

📉 Short Position Scenario

A breakdown below the support zone (two equal lows and a key weekly/daily support) around $100,372, combined with the formation of a lower high below that zone and strong selling pressure, could offer a short opportunity.

Watch out for large whale candles — it’s best to wait for confirmation before entering.

❤️ Disclaimer : This analysis is purely based on my personal opinion and I only trade if the stated triggers are activated .

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.