Fear & Greed Index: 21 — still in Fear.

📰 Market Overview

As mentioned in my previous analyses, the short entry trigger played out perfectly.

I personally opened a short on STX, and the trade has now closed at 2R profit. ✔️

So… what now?

To answer that, we need to double-check the trend analysis and evaluate where buyers and sellers currently stand.

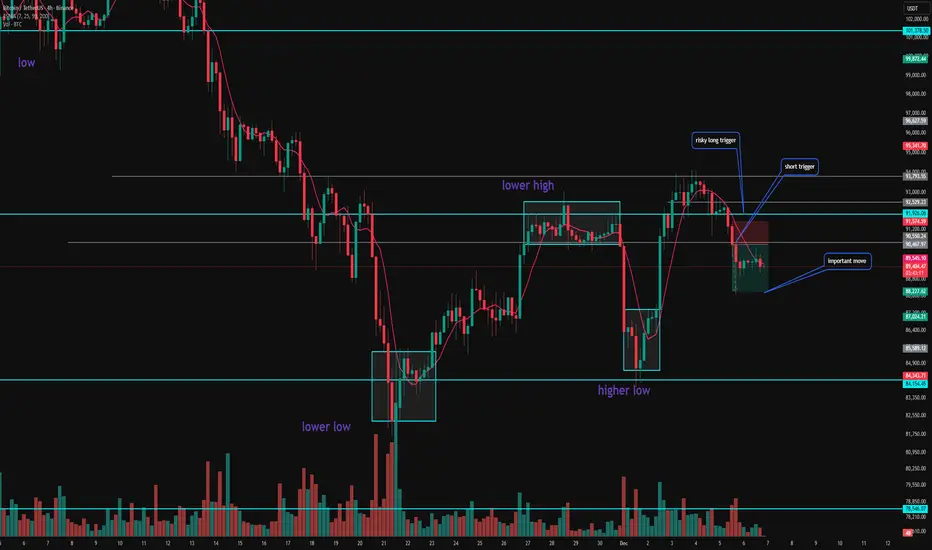

📉 Understanding the Current Trend

If you’ve been following my earlier posts, you already know how important it is to watch:

Candle shapes

Volume in bullish vs bearish legs

Where buyers actually step in

And how strongly they can push the market upward

We entered shorts because:

The daily structure is still bearish,

Sellers still control the larger trend,

And the first real signs of buyer weakness appeared — exactly what we waited for.

Now we need to analyze this downward leg in detail:

❓ Key Questions to Ask

Will this drop reach $84,000, the previous major low?

If it reaches that level, will it break?

Will this bearish leg be stronger or weaker than the previous one?

Or… will we fail early and enter a December range?

Your answers to these questions decide your trading plan.

🟦 Scenario 1: December Range (No Man’s Land)

If Bitcoin can’t reach $84k and instead starts moving sideways above it,

this entire region becomes No Man’s Land — no clear control by buyers or sellers.

If that happens, we may spend all of December ranging here.

➡️ Long-term positions would NOT make sense in this scenario.

🔻 Scenario 2: Breakdown Toward $84,000

If price continues downward and reaches $84,000,

shorting becomes extremely important — but entering directly at a major support is always tricky.

My advice:

If you’ve made decent profit recently,

💡 hold one short position without full take-profit,

or set your stop to breakeven once your trade hits your desired R:R.

Because if $84k breaks, panic can accelerate fast —

and we may see some very unusual numbers on the downside.

🎯 Short Entry Plan

Right now, the 4H timeframe does not yet have a clean structure for a new short entry.

But likely around 1 UTC, U.S. session volume will enter the market,

and the structure may become clear enough for a proper short trigger.

🚀 Scenario 3: Bullish Reversal

If sellers show weakness and buyers regain control:

Long Trigger: $91,900

But I need at least one 1H reaction to form a structure

so I can place a reliable stop-loss.

No reaction = no long.

✅ Final Notes

Thanks for reading my analysis — I appreciate every one of you!

Remember:

💛 Risk management is what keeps you alive in the market.

If you enjoy these daily updates, feel free to follow —

I share exactly what I’m doing in the market every day.

Stay safe, stay profitable, and have an amazing trading day! 🚀📊

📰 Market Overview

As mentioned in my previous analyses, the short entry trigger played out perfectly.

I personally opened a short on STX, and the trade has now closed at 2R profit. ✔️

So… what now?

To answer that, we need to double-check the trend analysis and evaluate where buyers and sellers currently stand.

📉 Understanding the Current Trend

If you’ve been following my earlier posts, you already know how important it is to watch:

Candle shapes

Volume in bullish vs bearish legs

Where buyers actually step in

And how strongly they can push the market upward

We entered shorts because:

The daily structure is still bearish,

Sellers still control the larger trend,

And the first real signs of buyer weakness appeared — exactly what we waited for.

Now we need to analyze this downward leg in detail:

❓ Key Questions to Ask

Will this drop reach $84,000, the previous major low?

If it reaches that level, will it break?

Will this bearish leg be stronger or weaker than the previous one?

Or… will we fail early and enter a December range?

Your answers to these questions decide your trading plan.

🟦 Scenario 1: December Range (No Man’s Land)

If Bitcoin can’t reach $84k and instead starts moving sideways above it,

this entire region becomes No Man’s Land — no clear control by buyers or sellers.

If that happens, we may spend all of December ranging here.

➡️ Long-term positions would NOT make sense in this scenario.

🔻 Scenario 2: Breakdown Toward $84,000

If price continues downward and reaches $84,000,

shorting becomes extremely important — but entering directly at a major support is always tricky.

My advice:

If you’ve made decent profit recently,

💡 hold one short position without full take-profit,

or set your stop to breakeven once your trade hits your desired R:R.

Because if $84k breaks, panic can accelerate fast —

and we may see some very unusual numbers on the downside.

🎯 Short Entry Plan

Right now, the 4H timeframe does not yet have a clean structure for a new short entry.

But likely around 1 UTC, U.S. session volume will enter the market,

and the structure may become clear enough for a proper short trigger.

🚀 Scenario 3: Bullish Reversal

If sellers show weakness and buyers regain control:

Long Trigger: $91,900

But I need at least one 1H reaction to form a structure

so I can place a reliable stop-loss.

No reaction = no long.

✅ Final Notes

Thanks for reading my analysis — I appreciate every one of you!

Remember:

💛 Risk management is what keeps you alive in the market.

If you enjoy these daily updates, feel free to follow —

I share exactly what I’m doing in the market every day.

Stay safe, stay profitable, and have an amazing trading day! 🚀📊

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.