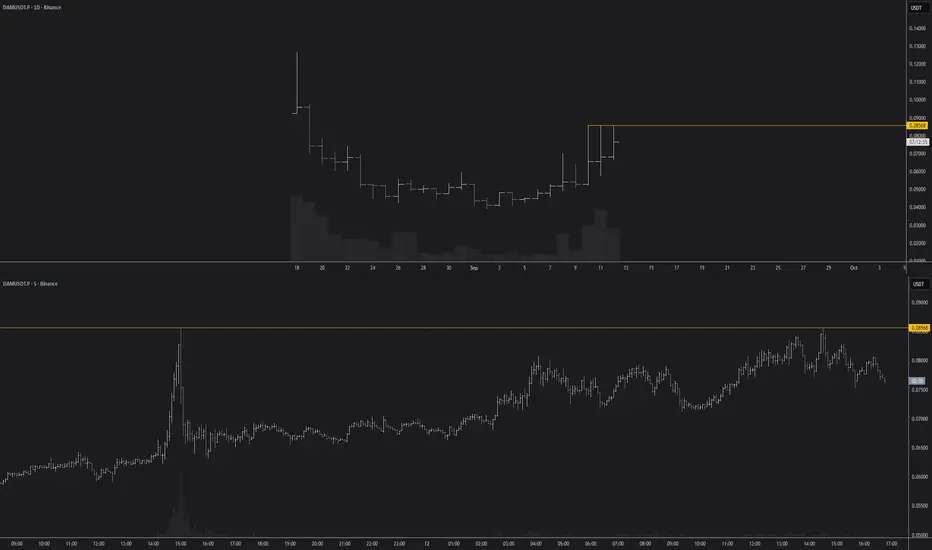

The level is formed by an anomalously large bar from 09.09. Its strength is confirmed by the price stopping just below it on the local timeframe and entering a consolidation. I expect minimal volatility before the level and a continuation of the consolidation. If the consolidation is short, a strong breakout may not occur, resulting in a false breakout.

Scenario:

Do not open a trade if the scenario does not play out.

Do not open a trade solely because the price is crossing a key level, even if it is very strong. Pay attention to how the price crosses the level.

The Trader's House

Scenario:

- Price void / low liquidity zone beyond level

- Volatility contraction on approach

- Immediate retest

- Prolonged consolidation

- Repeated precise tests of the level

- Consolidation with price compression

Do not open a trade if the scenario does not play out.

Do not open a trade solely because the price is crossing a key level, even if it is very strong. Pay attention to how the price crosses the level.

The Trader's House

Trade active

The price has crossed the level, and I am observing the reaction to this false breakout. If a correction occurs, the trade will be invalidated. If there is no deep correction, it will be another signal for a level breakout, and it is worth waiting for my entry point.Order cancelled

The second approach to the level was also with high volatility, which contradicts the scenario. Therefore, after the second false breakout of the level, we now have a full-fledged "запил" (choppy price action) at the level, where there is no specific price for an entry or stop loss. I am no longer observing the asset.

This publication is for informational and educational purposes only. It is not a trade signal or financial advice. Trading involves **high risk**. All decisions and actions taken are your sole responsibility. Always conduct your own research (DYOR).

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

This publication is for informational and educational purposes only. It is not a trade signal or financial advice. Trading involves **high risk**. All decisions and actions taken are your sole responsibility. Always conduct your own research (DYOR).

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.