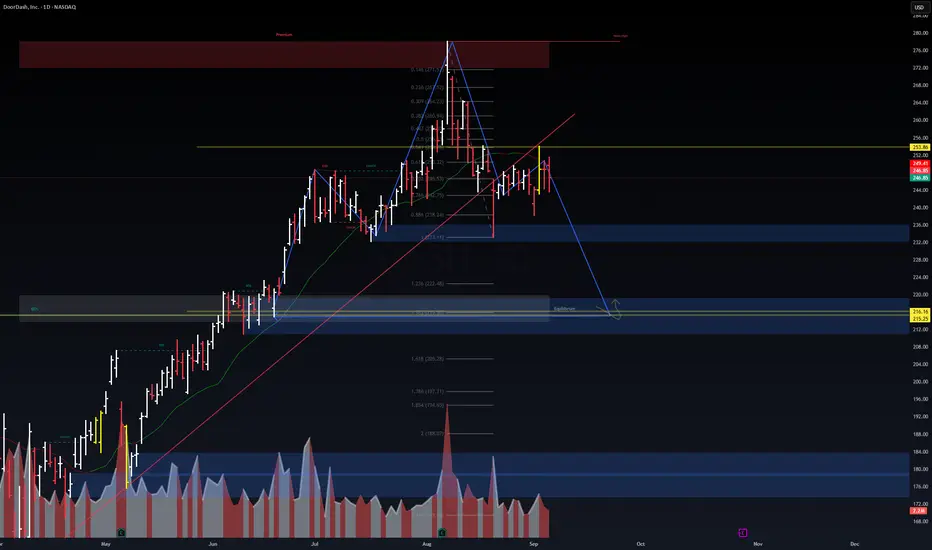

📉 DASH: Correction Ahead

After a strong rebound, DASH is showing overextended momentum.

RSI → leaning into overbought territory.

Volume → tapering off despite higher prints.

Resistance → testing a key supply zone; sellers likely to defend.

Macro flow → broader altcoin sector showing fatigue as BTC dominance firms.

🔎 Outlook

A short-term pullback/correction is highly probable before any sustainable leg higher.

Levels to watch:

Support: $22.50 → $21.80

Resistance: $25.70

Risk management: Keep stops tight; wait for retrace confirmation before fresh entries.

💡 Suggested Caption for Post:

"DASH looks stretched — correction ahead. Watching $22.50–$21.80 support for re-entry opportunities. Always respect risk."

#DASH #CryptoTrading #TechnicalAnalysis #Correction

After a strong rebound, DASH is showing overextended momentum.

RSI → leaning into overbought territory.

Volume → tapering off despite higher prints.

Resistance → testing a key supply zone; sellers likely to defend.

Macro flow → broader altcoin sector showing fatigue as BTC dominance firms.

🔎 Outlook

A short-term pullback/correction is highly probable before any sustainable leg higher.

Levels to watch:

Support: $22.50 → $21.80

Resistance: $25.70

Risk management: Keep stops tight; wait for retrace confirmation before fresh entries.

💡 Suggested Caption for Post:

"DASH looks stretched — correction ahead. Watching $22.50–$21.80 support for re-entry opportunities. Always respect risk."

#DASH #CryptoTrading #TechnicalAnalysis #Correction

Note

Sorry! the support and resistance values are wrong. Please see the chart for correct levels. If any question DM.Trade closed: stop reached

WaverVanir ⚡ To grow and conquer

stocktwits.com/WaverVanir | wavervanir.com | buymeacoffee.com/wavervanir

Not Investment Advice

stocktwits.com/WaverVanir | wavervanir.com | buymeacoffee.com/wavervanir

Not Investment Advice

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

WaverVanir ⚡ To grow and conquer

stocktwits.com/WaverVanir | wavervanir.com | buymeacoffee.com/wavervanir

Not Investment Advice

stocktwits.com/WaverVanir | wavervanir.com | buymeacoffee.com/wavervanir

Not Investment Advice

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.