TradingView Idea: DHT (DHT Holdings) - Precision Swing Long (Perfect Technical Alignment + Value)

🎯 Ticker: DHT (NYSE)

📈 Type: Swing Long

⏰ Timeframe: Daily & 4H

📊 Technical Analysis:

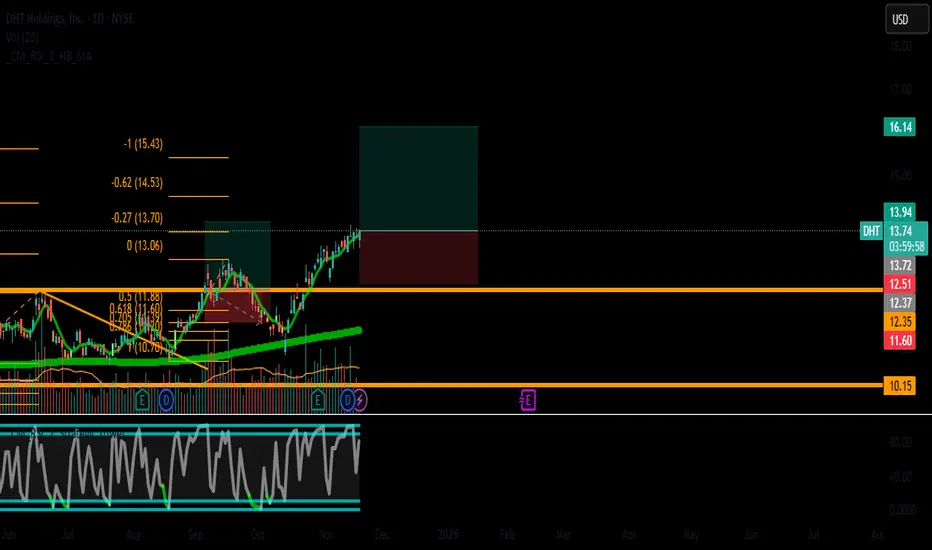

Multi-Timeframe Trend: BULLISH Across All Timeframes (Daily, 4H, 1H) ✅

Technical Consensus: RARE "Triple Buy" Signal (Daily, 4H, 1H Recommendations)

Momentum: RSI (67.6) shows strong bullish momentum without being overbought

Pattern: Trading in a tight consolidation range, poised for a breakout above $13.70

💡 Trading Thesis:

DHT presents an exceptional technical setup combined with attractive valuation:

PERFECT TECHNICAL ALIGNMENT:

Uncommon "Triple Buy" signal across all major timeframes indicates unified bullish pressure.

Price is above all key moving averages, confirming the uptrend.

Consolidation near highs suggests accumulation before a potential breakout.

STRONG FUNDAMENTAL SUPPORT:

Undervalued: P/E ratio of ~11 is attractive for the sector.

Healthy Balance Sheet: Perfect 10/10 Debt Health Score with manageable leverage.

Stable Operations: Moderate earnings growth provides a solid foundation.

SECTOR TAILWINDS:

Tanker shipping rates showing resilience, providing a favorable backdrop.

⚡ Trading Plan:

🎯 Entry: $13.72 (Breakout above consolidation resistance)

🛑 Stop Loss: $12.50 (Below key support and the 50-day SMA)

💰 Profit Target: $16.14 (Measured move from consolidation pattern)

📊 Risk/Reward Ratio: 1:3.1 (Exceptional for a swing trade)

📉 Risk Management Notes:

Stop Loss is placed to protect against a false breakout and a shift in the daily trend.

Consider taking partial profits near $15.00 if momentum slows.

The excellent R/R ratio allows for a smaller position size to maintain strict risk control.

Only enter if the breakout above $13.70 is confirmed with volume.

Conclusion: DHT offers a high-probability, high-reward setup driven by a rare perfect technical alignment and supported by a value-oriented fundamental case. The 1:3.1 risk/reward ratio makes this a compelling swing trade opportunity.

Trade with discipline!

Disclaimer: This is not investment advice. Conduct your own research and manage risk according to your personal tolerance and strategy.

#DHT #SwingTrading #Long #Shipping #TechnicalAnalysis #Breakout #ValueInvesting

🎯 Ticker: DHT (NYSE)

📈 Type: Swing Long

⏰ Timeframe: Daily & 4H

📊 Technical Analysis:

Multi-Timeframe Trend: BULLISH Across All Timeframes (Daily, 4H, 1H) ✅

Technical Consensus: RARE "Triple Buy" Signal (Daily, 4H, 1H Recommendations)

Momentum: RSI (67.6) shows strong bullish momentum without being overbought

Pattern: Trading in a tight consolidation range, poised for a breakout above $13.70

💡 Trading Thesis:

DHT presents an exceptional technical setup combined with attractive valuation:

PERFECT TECHNICAL ALIGNMENT:

Uncommon "Triple Buy" signal across all major timeframes indicates unified bullish pressure.

Price is above all key moving averages, confirming the uptrend.

Consolidation near highs suggests accumulation before a potential breakout.

STRONG FUNDAMENTAL SUPPORT:

Undervalued: P/E ratio of ~11 is attractive for the sector.

Healthy Balance Sheet: Perfect 10/10 Debt Health Score with manageable leverage.

Stable Operations: Moderate earnings growth provides a solid foundation.

SECTOR TAILWINDS:

Tanker shipping rates showing resilience, providing a favorable backdrop.

⚡ Trading Plan:

🎯 Entry: $13.72 (Breakout above consolidation resistance)

🛑 Stop Loss: $12.50 (Below key support and the 50-day SMA)

💰 Profit Target: $16.14 (Measured move from consolidation pattern)

📊 Risk/Reward Ratio: 1:3.1 (Exceptional for a swing trade)

📉 Risk Management Notes:

Stop Loss is placed to protect against a false breakout and a shift in the daily trend.

Consider taking partial profits near $15.00 if momentum slows.

The excellent R/R ratio allows for a smaller position size to maintain strict risk control.

Only enter if the breakout above $13.70 is confirmed with volume.

Conclusion: DHT offers a high-probability, high-reward setup driven by a rare perfect technical alignment and supported by a value-oriented fundamental case. The 1:3.1 risk/reward ratio makes this a compelling swing trade opportunity.

Trade with discipline!

Disclaimer: This is not investment advice. Conduct your own research and manage risk according to your personal tolerance and strategy.

#DHT #SwingTrading #Long #Shipping #TechnicalAnalysis #Breakout #ValueInvesting

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.