DOGE/USD – Bearish Market Structure Breakdown with Minor Supply Rejection (M30)

Overview

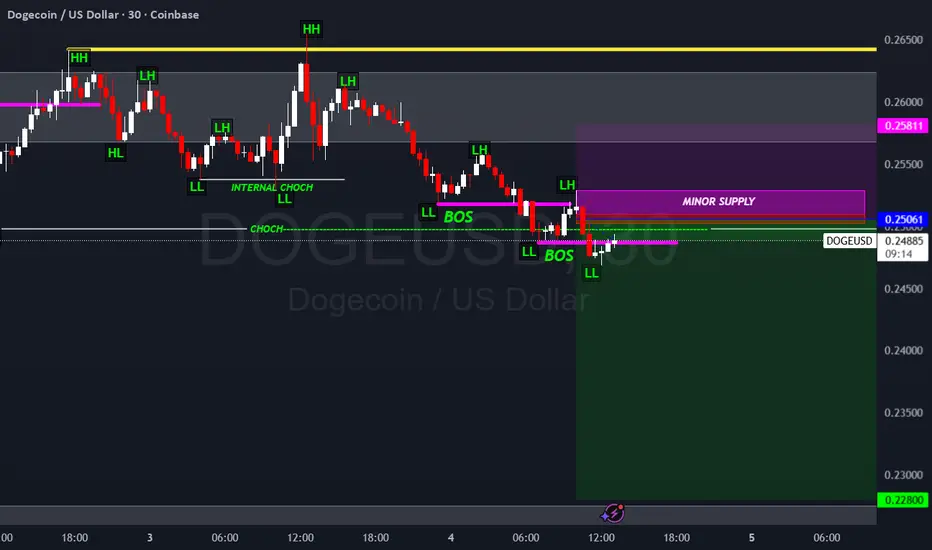

This analysis focuses on the 30-minute chart of Dogecoin (DOGE/USD), where a clear bearish market structure has emerged following a series of lower highs and lower lows. The setup is based on a combination of price action, market structure shifts, and supply zone rejection, aligning with principles of Support & Resistance, Supply & Demand, and Smart Money Concepts.

The trade idea targets a move down to $0.22800, with a stop loss placed 75 pips above the entry, ensuring a favorable risk-to-reward ratio.

Market Structure Analysis

The chart reveals a textbook transition from bullish to bearish structure:

Initial Bullish Structure: The price action began with a series of Higher Highs (HH) and Higher Lows (HL), indicating bullish momentum.

Change of Character (CHOCH): A significant CHOCH is observed, marking the first sign of weakness in the bullish trend. This is a critical signal that buyers are losing control.

Internal CHOCH: A more granular shift within the structure, confirming the weakening of bullish pressure.

Lower High (LH) and Lower Low (LL): These confirm the transition into a bearish structure. The formation of a Lower High followed by a Lower Low is a classic sign of trend reversal.

Break of Structure (BOS): The BOS validates the bearish bias, showing that sellers have taken control and are pushing price lower.

Supply Zone Rejection

A Minor Supply Zone is clearly marked around $0.25061, which aligns with previous resistance levels. Price action shows a rejection from this zone, reinforcing the bearish outlook.

This supply zone is significant because:

It coincides with the Lower High, suggesting institutional selling pressure.

The rejection from this zone adds confluence to the short bias.

It serves as a potential area for re-entry or confirmation if price retests it.

Key Levels

Resistance Zones:

$0.25811: A higher resistance level, previously tested and rejected.

$0.25061: Minor Supply Zone, current rejection point.

Support Zone:

$0.22800: Target level, based on previous structure lows and potential demand zone.

Trade Setup

Entry: Near current price action around $0.24847, ideally after confirmation of continued rejection from the Minor Supply Zone.

Stop Loss: Placed 75 pips above the entry, approximately at $0.25697, just above the Minor Supply Zone and previous resistance.

Take Profit: $0.22800, aligning with the next significant support level and previous structure low.

Risk-to-Reward Analysis

Risk: ~75 pips

Reward: ~204.7 pips (from $0.24847 to $0.22800)

Risk-to-Reward Ratio: Approximately 1:2.7, offering a strong edge for this setup.

Confluence Factors

This trade setup is supported by multiple layers of confluence:

Market Structure Shift: CHOCH, BOS, LH, LL – all point to bearish control.

Supply Zone Rejection: Price failed to break above $0.25061, confirming seller dominance.

Clear Target: $0.22800 is a well-defined support level with historical significance.

Smart Money Concepts: The internal CHOCH and BOS align with institutional behavior patterns.

Timeframe Alignment: The M30 chart provides a balance between precision and broader trend visibility.

Trade Management Strategy

Entry Confirmation: Wait for a bearish engulfing or rejection wick near the Minor Supply Zone.

Partial Take Profit: Consider scaling out at intermediate levels (e.g., $0.23800) to lock in profits.

Stop Loss Adjustment: If price breaks below $0.24000 with momentum, consider trailing the stop to breakeven.

Re-entry Opportunity: If price retests $0.25061 and rejects again, a second entry may be viable.

Risk Considerations

Volatility: DOGE/USD can be highly volatile; ensure proper position sizing.

News Events: Monitor for any crypto-related news that could impact sentiment.

Liquidity: Minor supply zones may not hold under high volume; watch for volume spikes.

Conclusion

This DOGE/USD setup presents a compelling short opportunity based on a well-defined bearish market structure and supply zone rejection. With a clear target at $0.22800 and a disciplined stop loss placement, the trade offers a strong risk-to-reward profile.

The setup is rooted in price action and structure, making it suitable for traders who follow Smart Money Concepts and institutional-style analysis. As always, trade with discipline and manage risk appropriately.

Overview

This analysis focuses on the 30-minute chart of Dogecoin (DOGE/USD), where a clear bearish market structure has emerged following a series of lower highs and lower lows. The setup is based on a combination of price action, market structure shifts, and supply zone rejection, aligning with principles of Support & Resistance, Supply & Demand, and Smart Money Concepts.

The trade idea targets a move down to $0.22800, with a stop loss placed 75 pips above the entry, ensuring a favorable risk-to-reward ratio.

Market Structure Analysis

The chart reveals a textbook transition from bullish to bearish structure:

Initial Bullish Structure: The price action began with a series of Higher Highs (HH) and Higher Lows (HL), indicating bullish momentum.

Change of Character (CHOCH): A significant CHOCH is observed, marking the first sign of weakness in the bullish trend. This is a critical signal that buyers are losing control.

Internal CHOCH: A more granular shift within the structure, confirming the weakening of bullish pressure.

Lower High (LH) and Lower Low (LL): These confirm the transition into a bearish structure. The formation of a Lower High followed by a Lower Low is a classic sign of trend reversal.

Break of Structure (BOS): The BOS validates the bearish bias, showing that sellers have taken control and are pushing price lower.

Supply Zone Rejection

A Minor Supply Zone is clearly marked around $0.25061, which aligns with previous resistance levels. Price action shows a rejection from this zone, reinforcing the bearish outlook.

This supply zone is significant because:

It coincides with the Lower High, suggesting institutional selling pressure.

The rejection from this zone adds confluence to the short bias.

It serves as a potential area for re-entry or confirmation if price retests it.

Key Levels

Resistance Zones:

$0.25811: A higher resistance level, previously tested and rejected.

$0.25061: Minor Supply Zone, current rejection point.

Support Zone:

$0.22800: Target level, based on previous structure lows and potential demand zone.

Trade Setup

Entry: Near current price action around $0.24847, ideally after confirmation of continued rejection from the Minor Supply Zone.

Stop Loss: Placed 75 pips above the entry, approximately at $0.25697, just above the Minor Supply Zone and previous resistance.

Take Profit: $0.22800, aligning with the next significant support level and previous structure low.

Risk-to-Reward Analysis

Risk: ~75 pips

Reward: ~204.7 pips (from $0.24847 to $0.22800)

Risk-to-Reward Ratio: Approximately 1:2.7, offering a strong edge for this setup.

Confluence Factors

This trade setup is supported by multiple layers of confluence:

Market Structure Shift: CHOCH, BOS, LH, LL – all point to bearish control.

Supply Zone Rejection: Price failed to break above $0.25061, confirming seller dominance.

Clear Target: $0.22800 is a well-defined support level with historical significance.

Smart Money Concepts: The internal CHOCH and BOS align with institutional behavior patterns.

Timeframe Alignment: The M30 chart provides a balance between precision and broader trend visibility.

Trade Management Strategy

Entry Confirmation: Wait for a bearish engulfing or rejection wick near the Minor Supply Zone.

Partial Take Profit: Consider scaling out at intermediate levels (e.g., $0.23800) to lock in profits.

Stop Loss Adjustment: If price breaks below $0.24000 with momentum, consider trailing the stop to breakeven.

Re-entry Opportunity: If price retests $0.25061 and rejects again, a second entry may be viable.

Risk Considerations

Volatility: DOGE/USD can be highly volatile; ensure proper position sizing.

News Events: Monitor for any crypto-related news that could impact sentiment.

Liquidity: Minor supply zones may not hold under high volume; watch for volume spikes.

Conclusion

This DOGE/USD setup presents a compelling short opportunity based on a well-defined bearish market structure and supply zone rejection. With a clear target at $0.22800 and a disciplined stop loss placement, the trade offers a strong risk-to-reward profile.

The setup is rooted in price action and structure, making it suitable for traders who follow Smart Money Concepts and institutional-style analysis. As always, trade with discipline and manage risk appropriately.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.