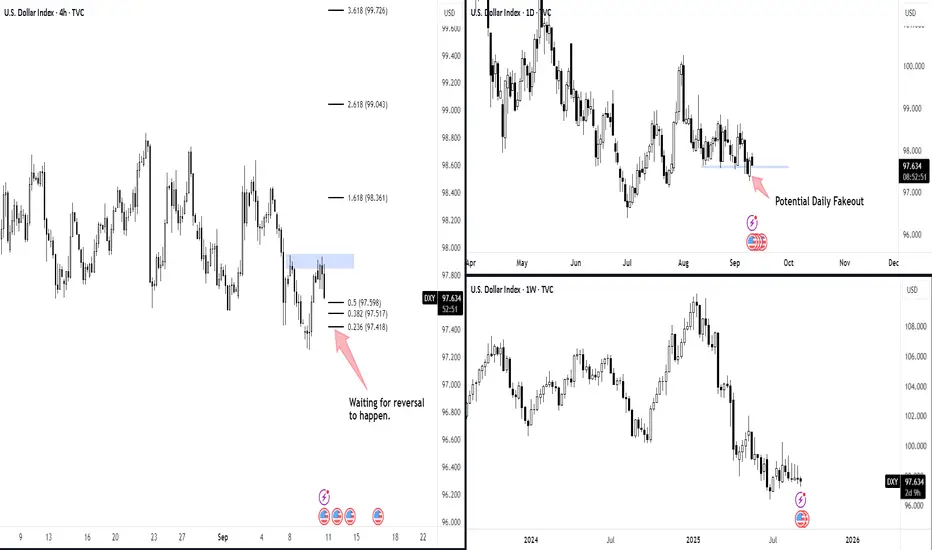

The Dollar Index (DXY) is showing signs of a possible bullish reversal.

On the Daily timeframe, price has swept below support and is now indicating a potential fakeout. This often signals trapped sellers and can provide fuel for a bullish recovery if price reclaims above the broken level.

On the H4 timeframe, I see a V-shape continuation pattern forming. Price has also made multiple retests in the same zone, showing strong buying interest. This confluence strengthens the bullish bias.

For execution, I will wait for a clear reversal signal on H4 (such as a strong bullish engulfing candle or momentum break) before confirming the entry. If the reversal holds, the next upside targets could align with the Fib extension levels (1.618, 2.618, and 3.618).

Risk management remains key – if price fails to hold the fakeout level, then the bearish trend may still continue.

Disclaimer: This is not financial advice or a trade call. Analysis shared here is for educational purposes only. Please manage your own risk accordingly.

On the Daily timeframe, price has swept below support and is now indicating a potential fakeout. This often signals trapped sellers and can provide fuel for a bullish recovery if price reclaims above the broken level.

On the H4 timeframe, I see a V-shape continuation pattern forming. Price has also made multiple retests in the same zone, showing strong buying interest. This confluence strengthens the bullish bias.

For execution, I will wait for a clear reversal signal on H4 (such as a strong bullish engulfing candle or momentum break) before confirming the entry. If the reversal holds, the next upside targets could align with the Fib extension levels (1.618, 2.618, and 3.618).

Risk management remains key – if price fails to hold the fakeout level, then the bearish trend may still continue.

Disclaimer: This is not financial advice or a trade call. Analysis shared here is for educational purposes only. Please manage your own risk accordingly.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.