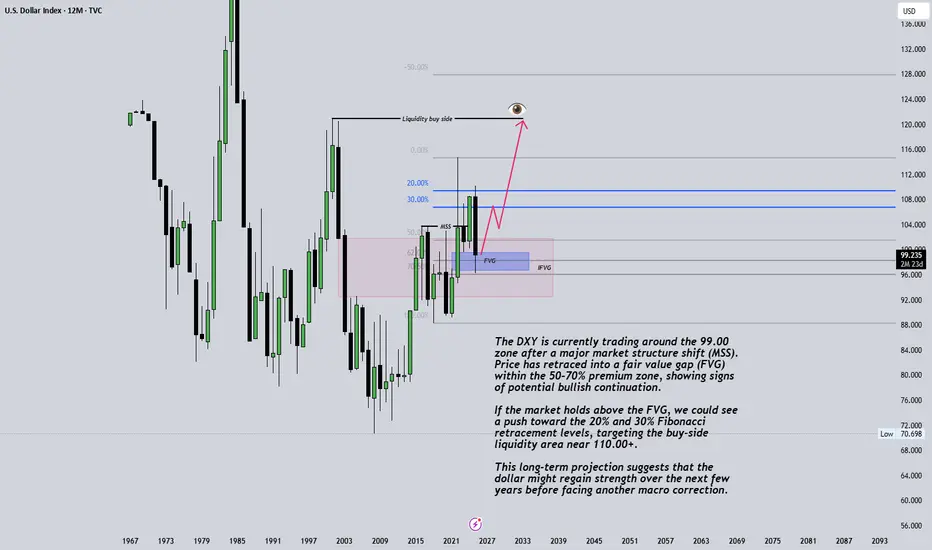

The DXY is currently trading around the 99.00 zone after a major market structure shift (MSS). Price has retraced into a fair value gap (FVG) within the 50–70% premium zone, showing signs of potential bullish continuation.

If the market holds above the FVG, we could see a push toward the 20% and 30% Fibonacci retracement levels, targeting the buy-side liquidity area near 110.00+.

This long-term projection suggests that the dollar might regain strength over the next few years before facing another macro correction.

📅 Timeframe: Monthly

💡 Bias: Bullish towards liquidity highs

⚠️ Disclaimer: This analysis is for educational purposes only and does not constitute financial advice.

#DXY #USDX #DollarIndex #ForexAnalysis #SmartMoneyConcepts #MarketStructure #FVG #Liquidity #Herotraderfx #TradingView

If the market holds above the FVG, we could see a push toward the 20% and 30% Fibonacci retracement levels, targeting the buy-side liquidity area near 110.00+.

This long-term projection suggests that the dollar might regain strength over the next few years before facing another macro correction.

📅 Timeframe: Monthly

💡 Bias: Bullish towards liquidity highs

⚠️ Disclaimer: This analysis is for educational purposes only and does not constitute financial advice.

#DXY #USDX #DollarIndex #ForexAnalysis #SmartMoneyConcepts #MarketStructure #FVG #Liquidity #Herotraderfx #TradingView

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.