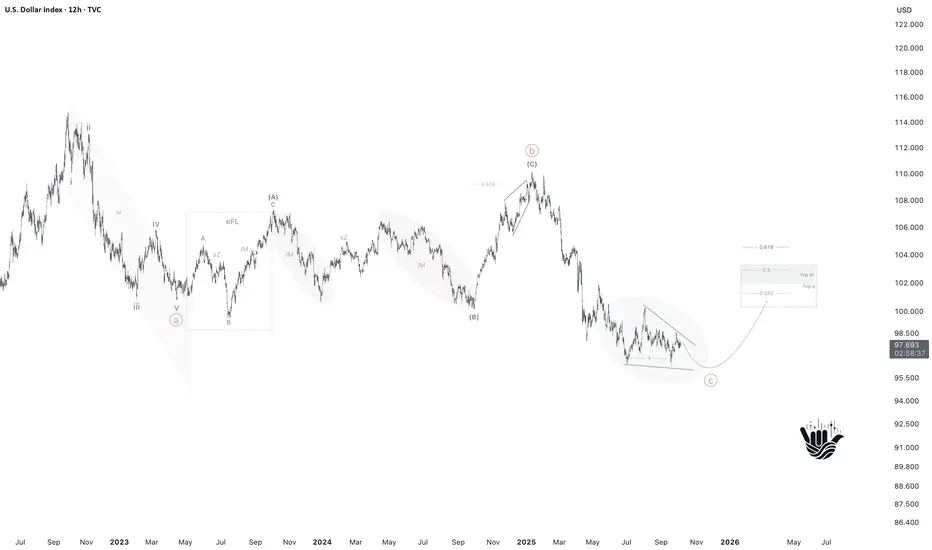

Previous roadmap played out well — time to refresh the view.

Global (1W)

DXY remains in an uptrend. Since 2008 we’ve built a textbook five-wave impulse.

DXY remains in an uptrend. Since 2008 we’ve built a textbook five-wave impulse.

Since 2022/2023 that impulse has been in correction — base read: a single zigzag (SimpleZ).

Base case: correction completes → trend resumes with new highs ahead.

Alternatives

Flat: push toward 114–115, then a deep pullback.

Double zigzag (W–X–Y): bounce first, then one more leg down.

Local (12H)

Finishing ABC where C likely prints an ending diagonal → expecting the down leg to terminate and a rising phase to begin (either corrective or impulsive).

Price Action

Imbalances below may still get tapped; we’re below a key level, but the core scenario is dollar strength ahead.

What’s your take? Which path do you favor — Base (new highs), Flat (114–115 then pullback), or W–X–Y (one more leg lower)?

Global (1W)

Since 2022/2023 that impulse has been in correction — base read: a single zigzag (SimpleZ).

Base case: correction completes → trend resumes with new highs ahead.

Alternatives

Flat: push toward 114–115, then a deep pullback.

Double zigzag (W–X–Y): bounce first, then one more leg down.

Local (12H)

Finishing ABC where C likely prints an ending diagonal → expecting the down leg to terminate and a rising phase to begin (either corrective or impulsive).

Price Action

Imbalances below may still get tapped; we’re below a key level, but the core scenario is dollar strength ahead.

What’s your take? Which path do you favor — Base (new highs), Flat (114–115 then pullback), or W–X–Y (one more leg lower)?

Trade active

DXY — Update

What changed

The bounds of the potential ending diagonal have expanded. Wave 4 extended to 0.786 of Wave 2 — still consistent with the character of the pattern.

Base case unchanged. I still expect one more iteration of USD weakness before a reversal. This could be a shallow retest of this year’s lows or a deeper break of them. The current market structure is bearish (lower highs/lows). Until that changes, it’s premature to talk about a trend reversal.

Key levels

Continuation zone for shorts: 98.7–99 — daily imbalance/FVG acting as resistance. A rejection here will reinforce the bearish scenario.

Full invalidation: 100. A sustained break above opens the door to a recount and alternatives.

PS As long as price is below 98.9, the priority remains trend shorts, aiming for a final leg lower.

📢 Free channels:

🇺🇸 t.me/shakatrade1_618

🇷🇺 t.me/shakatrade_ru

🇷🇺 youtube.com/@shakatrade0618?si=k91J3cRnC0L90ejR

🔒 Pro Club:

🇺🇸 shakatrade.tilda.ws/

🇷🇺 shakatrade0618proclub.tilda.ws

🇺🇸 t.me/shakatrade1_618

🇷🇺 t.me/shakatrade_ru

🇷🇺 youtube.com/@shakatrade0618?si=k91J3cRnC0L90ejR

🔒 Pro Club:

🇺🇸 shakatrade.tilda.ws/

🇷🇺 shakatrade0618proclub.tilda.ws

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

📢 Free channels:

🇺🇸 t.me/shakatrade1_618

🇷🇺 t.me/shakatrade_ru

🇷🇺 youtube.com/@shakatrade0618?si=k91J3cRnC0L90ejR

🔒 Pro Club:

🇺🇸 shakatrade.tilda.ws/

🇷🇺 shakatrade0618proclub.tilda.ws

🇺🇸 t.me/shakatrade1_618

🇷🇺 t.me/shakatrade_ru

🇷🇺 youtube.com/@shakatrade0618?si=k91J3cRnC0L90ejR

🔒 Pro Club:

🇺🇸 shakatrade.tilda.ws/

🇷🇺 shakatrade0618proclub.tilda.ws

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.