October 28th - 8:30am

*Before reading this trade plan, IF, you did not read yesterdays, or the Weekly Trade Plan take the time to read it first! (You can see both posts in the related publication section) *

If my posts provide quality information that has helped you with your trading journey. Feel free to boost it for others to find and learn, also!

My daily trade plan and real-time notes that I post are intended for myself to easily be able to go back and review my plan and how I did from an execution perspective.

---------------------------------------------------------------------------------------------------------------

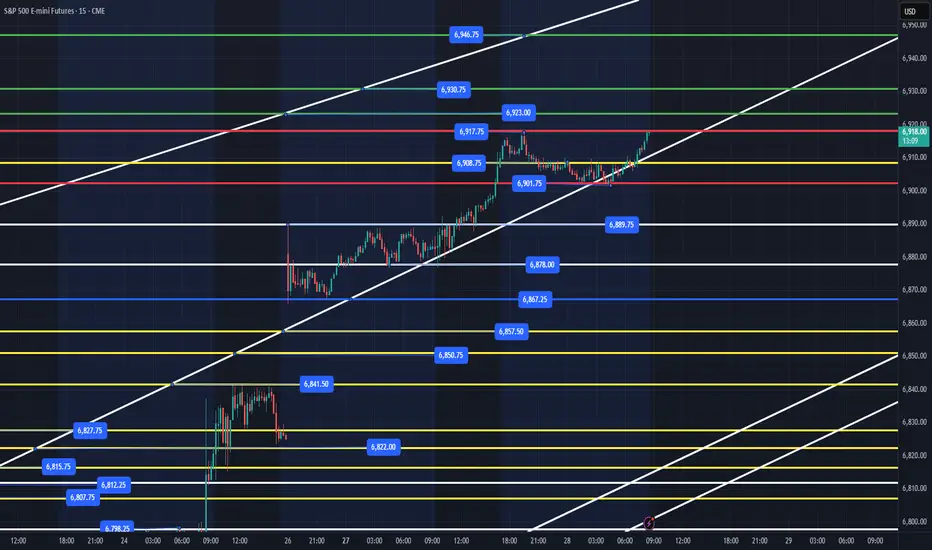

Our overnight session high is 6917 (which we are coming into this area as I type this). We still have a massive gap that should be filled at some point this week. We have a lot of earnings, FOMC, Economic Data and Trump in Asia tour. It is also the end of the month with Institutions looking to keep price moving higher and trapping retail investors to fill their liquidity needs.

We are very extended on RSI with all time frames needing a pullback to reset and continue higher. We can sell off all the way down to 6810 and still be in a bullish trend. My lean is that we fill the gap and work our way down to the 6812-17 level and then continue higher. Ideally, we would sell off hard, scare retail investors, lose yesterday's low at 6867, reclaim and squeeze us higher. That could take a couple of days to do that, or we could get a rug pull any time.

Key Levels Today -

1. Loss of 6908 and reclaim

2. Loss of 6901 and reclaim

3. Loss of 6889 and reclaim

4. Loss of 6878 and reclaim

5. Loss of 6867 and reclaim

6. Loss of 6841 and reclaim

Key Support Levels - 6908, 6901, 6889,6878, 6867, 6857, 6841, 6827, 6812

Key Resistance Levels - 6917, 6923, 6930, 6946

We have to view price action as bullish until the trend changes. That would need a loss of 6720, 6690 to become bearish. Until then I anticipate the overnight gap closing, losing the 6812 level and reclaim would be a great spot, but we can easily move up with the loss of the key levels above and reclaims to grab points at.

In summary, IF price clears 6917 and then price can't hold 6906, we could flush lower. You can see the white trendline that has been respected overnight and below 6901, we are looking at 6889 to flush and reclaim. Below there and the loss of 6867 (yesterday's low) would be a great spot for some points.

I will post an update around 10am EST.

----------------------------------------------------------------------------------------------------------------

Couple of things about how I color code my levels.

1. Purple shows the weekly Low

2. Red shows the current overnight session High/Low (time of post)

3. Blue shows the previous day's session Low (also other previous day's lows)

4. Yellow Levels are levels that show support and resistance levels of interest.

5. White shows the trendline from the August lows

*Before reading this trade plan, IF, you did not read yesterdays, or the Weekly Trade Plan take the time to read it first! (You can see both posts in the related publication section) *

If my posts provide quality information that has helped you with your trading journey. Feel free to boost it for others to find and learn, also!

My daily trade plan and real-time notes that I post are intended for myself to easily be able to go back and review my plan and how I did from an execution perspective.

---------------------------------------------------------------------------------------------------------------

Our overnight session high is 6917 (which we are coming into this area as I type this). We still have a massive gap that should be filled at some point this week. We have a lot of earnings, FOMC, Economic Data and Trump in Asia tour. It is also the end of the month with Institutions looking to keep price moving higher and trapping retail investors to fill their liquidity needs.

We are very extended on RSI with all time frames needing a pullback to reset and continue higher. We can sell off all the way down to 6810 and still be in a bullish trend. My lean is that we fill the gap and work our way down to the 6812-17 level and then continue higher. Ideally, we would sell off hard, scare retail investors, lose yesterday's low at 6867, reclaim and squeeze us higher. That could take a couple of days to do that, or we could get a rug pull any time.

Key Levels Today -

1. Loss of 6908 and reclaim

2. Loss of 6901 and reclaim

3. Loss of 6889 and reclaim

4. Loss of 6878 and reclaim

5. Loss of 6867 and reclaim

6. Loss of 6841 and reclaim

Key Support Levels - 6908, 6901, 6889,6878, 6867, 6857, 6841, 6827, 6812

Key Resistance Levels - 6917, 6923, 6930, 6946

We have to view price action as bullish until the trend changes. That would need a loss of 6720, 6690 to become bearish. Until then I anticipate the overnight gap closing, losing the 6812 level and reclaim would be a great spot, but we can easily move up with the loss of the key levels above and reclaims to grab points at.

In summary, IF price clears 6917 and then price can't hold 6906, we could flush lower. You can see the white trendline that has been respected overnight and below 6901, we are looking at 6889 to flush and reclaim. Below there and the loss of 6867 (yesterday's low) would be a great spot for some points.

I will post an update around 10am EST.

----------------------------------------------------------------------------------------------------------------

Couple of things about how I color code my levels.

1. Purple shows the weekly Low

2. Red shows the current overnight session High/Low (time of post)

3. Blue shows the previous day's session Low (also other previous day's lows)

4. Yellow Levels are levels that show support and resistance levels of interest.

5. White shows the trendline from the August lows

Note

8:32am - UpdateI was late getting my trade plan posted today. When I woke up and checked price, I noticed that we had set a low at 6902 around 1:40am. Around 4:30am we lost that level by 1pt and continued higher. I took a position around 6:15am at 6907 with a stop at 6904. (The reason I took this trade was due to the fact we flushed the low of the evening and made higher highs, higher lows. It was also testing the 6908 level for the 3x overnight. That is usually a good sign that price wants to move higher.) I sold 1/2 position at 6915 since we are coming into resistance and now have my runner at 6912. I think we can pull back before moving higher but will hold runner until it is stopped out or ideally, we clear 6918 before and then continue higher.

Note

9:05am - Update I sold my runner at 6924 and have had a great morning. I will be looking for one more trade for the day. Since price has broken out above the overnight high, we really need to hold 6914, with 6906 being the lowest or we could get a nice flush lower. As I have mentioned the RSI on the 1hr, 3hr, 6hr are very extended. Does not mean it will sell off, but it does make me more cautious with us clearing the overnight high before the 9:30am open. If you remember yesterday, we built a really nice base below the overnight high and then broke out later in the day. I expect retail to have FOMO and chase at the open. While price can just keep going higher, and potentially to 6930, 6946, 6960. I would rather wait on a pullback to enter. Any loss of 6917 and reclaim would be bullish and you could wait for the reclaim of 6923 to be extra cautious. I will send out an update around 10am EST.

Note

9:57am - UpdateTook a position at 6908. I have my stop at 6906.75. Will sell 1/2 position at 6914 and keep runner at 6908 breakeven. We could find the low here or it might need to flush 6901 and reclaim.

Note

10:40am - UpdateSold 1/2 position at 6914. Stop moved to 6911. Price should clear 6917 and move higher, IF price can hold 6908 level. Since we did fall back into the overnight zone, we can still sell off here. Price is respecting the white trendline, but really needs to move higher here or we could flush lower. Below 6908 and we should look to flush of 6901 or 6889 and reclaim to move higher.

Note

1pm -UpdateMy runner stopped out, and we flushed the 6908 level, reclaimed the white trendline and spiked up to 6930. As long as price holds 6901 today/overnight then we should be continuing higher towards the 6946, 6960 targets. IF price loses 6901, we will need to look at the flush and reclaim of the levels I have detailed in the trade plan. I will send out the daily trade plan by 6am EST tomorrow am.

Note

4:05pm - UpdatePrice has come back down to the VWAP session price at 6922. 6917 is a good support level and any reclaim of 6923 should give us a chance to retest the 6930, 6946 levels. FOMC tomorrow and I do not anticipate price losing 6917, 6908 in the overnight session. Any flush of 6901 and reclaim should give us a nice opportunity for some points. I will post the daily trade plan tomorrow by 6am EST.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.