October 13th - 8:15am

*Before reading this trade plan, IF, you did not read yesterdays, or the Weekly Trade Plan take the time to read it first! (You can see both posts in the related publication section) *

If my posts provide quality information that has helped you with your trading journey. Feel free to boost it for others to find and learn, also!

My daily trade plan and real-time notes that I post are intended for myself to easily be able to go back and review my plan and how I did from an execution perspective.

-----------------------------------------------------------------------------------------------------------------

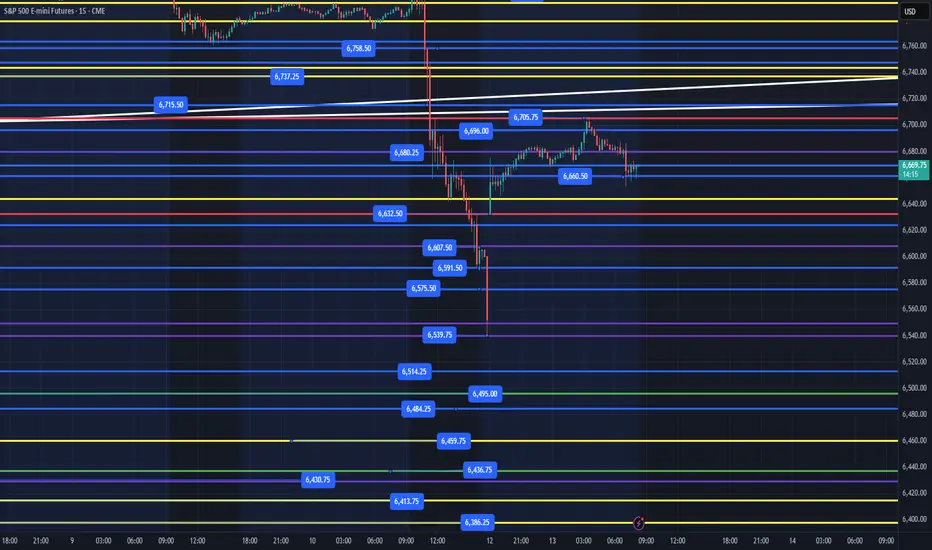

ES sold off on Friday, and we gapped up last night with our overnight high at 6705 and low of 6632. We have a massive gap below that needs to be filled at some point in the coming days. Today, we should start to build some structure as we work on evaluating key levels that Institutions are looking to build positions at. When price gaps up like it did last night, I would be cautious on longs until we can fill the gap below.

Today I will look to find some points at the following levels:

1. Flush and reclaim of 6632

2. Flush and reclaim of 6540

IF, price does fill the gap and retest the 6540 level, we could go to 6495, 6436 and any reclaim of level above those levels, should take us higher.

Key Support Levels - 6660, 6645, 6632, 6607, 6591, 6575, 6540, 6514

Key Resistance Levels - 6680, 6705, 6715, 6737, 6750-56

IF, we lose 6632 and can't reclaim quickly, we should fill the gap below pretty quickly. Be patient today and let's see what happens in the first hour of trading.

I will post an update around 10am EST.

----------------------------------------------------------------------------------------------------------------

Couple of things about how I color code my levels.

1. Purple shows the weekly Low

2. Red shows the current overnight session High/Low (time of post)

3. Blue shows the previous day's session Low (also other previous day's lows)

4. Yellow Levels are levels that show support and resistance levels of interest.

5. White shows the trendline from the August lows

*Before reading this trade plan, IF, you did not read yesterdays, or the Weekly Trade Plan take the time to read it first! (You can see both posts in the related publication section) *

If my posts provide quality information that has helped you with your trading journey. Feel free to boost it for others to find and learn, also!

My daily trade plan and real-time notes that I post are intended for myself to easily be able to go back and review my plan and how I did from an execution perspective.

-----------------------------------------------------------------------------------------------------------------

ES sold off on Friday, and we gapped up last night with our overnight high at 6705 and low of 6632. We have a massive gap below that needs to be filled at some point in the coming days. Today, we should start to build some structure as we work on evaluating key levels that Institutions are looking to build positions at. When price gaps up like it did last night, I would be cautious on longs until we can fill the gap below.

Today I will look to find some points at the following levels:

1. Flush and reclaim of 6632

2. Flush and reclaim of 6540

IF, price does fill the gap and retest the 6540 level, we could go to 6495, 6436 and any reclaim of level above those levels, should take us higher.

Key Support Levels - 6660, 6645, 6632, 6607, 6591, 6575, 6540, 6514

Key Resistance Levels - 6680, 6705, 6715, 6737, 6750-56

IF, we lose 6632 and can't reclaim quickly, we should fill the gap below pretty quickly. Be patient today and let's see what happens in the first hour of trading.

I will post an update around 10am EST.

----------------------------------------------------------------------------------------------------------------

Couple of things about how I color code my levels.

1. Purple shows the weekly Low

2. Red shows the current overnight session High/Low (time of post)

3. Blue shows the previous day's session Low (also other previous day's lows)

4. Yellow Levels are levels that show support and resistance levels of interest.

5. White shows the trendline from the August lows

Note

10:10am - UpdatePrice action has been moving sideways between 6650-6692 overnight. IF, price pops above 6705 and can't hold that level, we will most likely head lower. IF, price loses 6650, we should fill gap below and reclaim of 6611 would be bullish to keep us moving up the levels without retesting 6540 lows. We are in a choppy range between 6650-6692 and the immediate place I see value is a flush below 6632 and reclaim of that level to keep us pushing higher.

Note

1:39pm - UpdatePrice reached 6711.50, just above the 6705 overnight high, price fell back inside the range and we need to hold the 6690 level, or it will be a caution that price needs to flush lower. IF, price does hold 6690 and reclaims 6706, that would be bullish. Ideally, we grind lower this afternoon and overnight and setup a nice short squeeze at lower levels for us to grab points in tomorrow's session. I will keep an eye on price this afternoon and see what happens. Update will be posted before 4pm EST.

Note

2:58pm - UpdatePrice finally lost the 6690 level and we should continue lower in the last hour of trading. I anticipate closing the gap below today/overnight or by tomorrow am. I will send out my Daily Trade Plan by 6am EST on Tuesday. IF, price holds 6653 this afternoon, we will be looking for flush and reclaim of 6632, IF, price does not reclaim 6660 from below, we will need to retest Friday's lows of 6540.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.