October 29th - 6:44am

*Before reading this trade plan, IF, you did not read yesterdays, or the Weekly Trade Plan take the time to read it first! (You can see both posts in the related publication section) *

If my posts provide quality information that has helped you with your trading journey. Feel free to boost it for others to find and learn, also!

My daily trade plan and real-time notes that I post are intended for myself to easily be able to go back and review my plan and how I did from an execution perspective.

---------------------------------------------------------------------------------------------------------

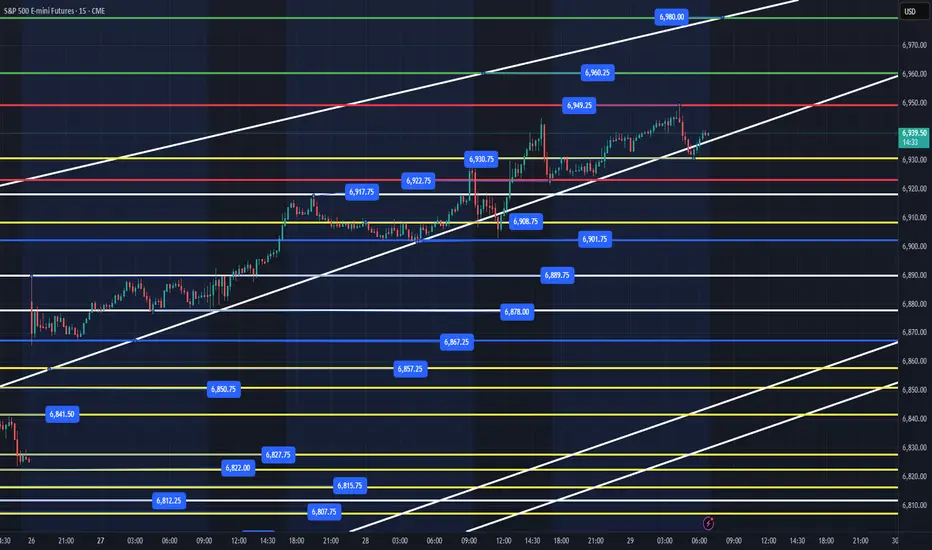

Yesterday at 4:05pm I wrote the following note on the Daily Trade Plan "Price has come back down to the VWAP session price at 6922. 6917 is a good support level and any reclaim of 6923 should give us a chance to retest the 6930, 6946 levels. FOMC tomorrow and I do not anticipate price losing 6917, 6908 in the overnight session. Any flush of 6901 and reclaim should give us a nice opportunity for some points."

Overnight session low was 6922 and the overnight high is 6950. We bounced off 6930 around 5:30am and have been respecting this trendline all week. Today is FOMC & Big Tech Earnings after the bell. As I have mentioned many times in my trade plans that when ES sells off you need to just get out the way. October 10th, 13th, 16th, 22nd are the 4 big sell offs we have had this month. I expect another big sell off this week or early next week. The RSI is very extended and since we have end of month in 2 days. We could easily keep moving higher. I do expect some pullbacks for us to grab points over the coming days.

We could easily reach 6980 today or fill the gap of Sunday's open at 6827. That is how unpredictable FOMC can be. Usually, the first move after FOMC can be a trap. Either way, today I would not trade unless your edge presents itself. I will be trying to grab points before noon today if at all possible!

Key Levels Today -

1. Loss of 6930 and reclaim

2. Loss of 6922 and reclaim

3. Loss of 6901 and reclaim with (6908 being a level to be reclaimed for a safer entry)

4. Loss of 6889 and reclaim

Below these levels and we will probably be selling off pretty hard, and I would probably let price find a support level below and build a base to move higher.

Key Support Levels - 6930, 6922, 6917, 6908, 6901, 6889,6878, 6867, 6857, 6841, 6827, 6812

Key Resistance Levels - 6949, 6960, 6980

I will post an update around 10am EST.

----------------------------------------------------------------------------------------------------------------

Couple of things about how I color code my levels.

1. Purple shows the weekly Low

2. Red shows the current overnight session High/Low (time of post)

3. Blue shows the previous day's session Low (also other previous day's lows)

4. Yellow Levels are levels that show support and resistance levels of interest.

5. White shows the trendline from the August lows

*Before reading this trade plan, IF, you did not read yesterdays, or the Weekly Trade Plan take the time to read it first! (You can see both posts in the related publication section) *

If my posts provide quality information that has helped you with your trading journey. Feel free to boost it for others to find and learn, also!

My daily trade plan and real-time notes that I post are intended for myself to easily be able to go back and review my plan and how I did from an execution perspective.

---------------------------------------------------------------------------------------------------------

Yesterday at 4:05pm I wrote the following note on the Daily Trade Plan "Price has come back down to the VWAP session price at 6922. 6917 is a good support level and any reclaim of 6923 should give us a chance to retest the 6930, 6946 levels. FOMC tomorrow and I do not anticipate price losing 6917, 6908 in the overnight session. Any flush of 6901 and reclaim should give us a nice opportunity for some points."

Overnight session low was 6922 and the overnight high is 6950. We bounced off 6930 around 5:30am and have been respecting this trendline all week. Today is FOMC & Big Tech Earnings after the bell. As I have mentioned many times in my trade plans that when ES sells off you need to just get out the way. October 10th, 13th, 16th, 22nd are the 4 big sell offs we have had this month. I expect another big sell off this week or early next week. The RSI is very extended and since we have end of month in 2 days. We could easily keep moving higher. I do expect some pullbacks for us to grab points over the coming days.

We could easily reach 6980 today or fill the gap of Sunday's open at 6827. That is how unpredictable FOMC can be. Usually, the first move after FOMC can be a trap. Either way, today I would not trade unless your edge presents itself. I will be trying to grab points before noon today if at all possible!

Key Levels Today -

1. Loss of 6930 and reclaim

2. Loss of 6922 and reclaim

3. Loss of 6901 and reclaim with (6908 being a level to be reclaimed for a safer entry)

4. Loss of 6889 and reclaim

Below these levels and we will probably be selling off pretty hard, and I would probably let price find a support level below and build a base to move higher.

Key Support Levels - 6930, 6922, 6917, 6908, 6901, 6889,6878, 6867, 6857, 6841, 6827, 6812

Key Resistance Levels - 6949, 6960, 6980

I will post an update around 10am EST.

----------------------------------------------------------------------------------------------------------------

Couple of things about how I color code my levels.

1. Purple shows the weekly Low

2. Red shows the current overnight session High/Low (time of post)

3. Blue shows the previous day's session Low (also other previous day's lows)

4. Yellow Levels are levels that show support and resistance levels of interest.

5. White shows the trendline from the August lows

Note

9:45am - UpdatePrice is holding the 6941 level at the open. IF price loses 6935, we will need to see IF 6930 can hold. Ideally, we pull back to 6920 level, reclaim the overnight low and we can move up the levels. IF price tests 6950 for the 3x, we should clear it and test 6960 with 6980 being the big target if it can clear 6960. Below 6936 and we should pull back.

Note

12:58pm - UpdateI was able to take a position at 6933 and sold 1/2 position at 6940. Runner stop is at 6937. Since we are heading into the last hour before FOMC, I am not sure if this level will hold, but will leave runner in place and see if it can keep going higher.

Note

5:30pm - UpdatePrice back tested the 6937 level we sold off from, and we need to hold 6908, 6894 in the overnight session. There is a bull/bear line at 6908 that was battled today. My general lean is that we need to continue lower to the 6864-67 level or close the gap at 6827 and then move higher. We are still in a bullish trend and nothing bearish changes the trend until we lose 6690. I think we can continue higher, IF price can flush lower, close the gap and then move higher and clear 6950.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.