November 13th- Daily Trade Plan - 5:18am

*Before reading this trade plan, IF, you did not read yesterdays, or the Weekly Trade Plan take the time to read it first! (You can see both posts in the related publication section) *

If my posts provide quality information that has helped you with your trading journey. Feel free to boost it for others to find and learn, also!

My daily trade plan and real-time notes that I post are intended for myself to easily be able to go back and review my plan and how I did from an execution perspective.

--------------------------------------------------------------------------------------------------------

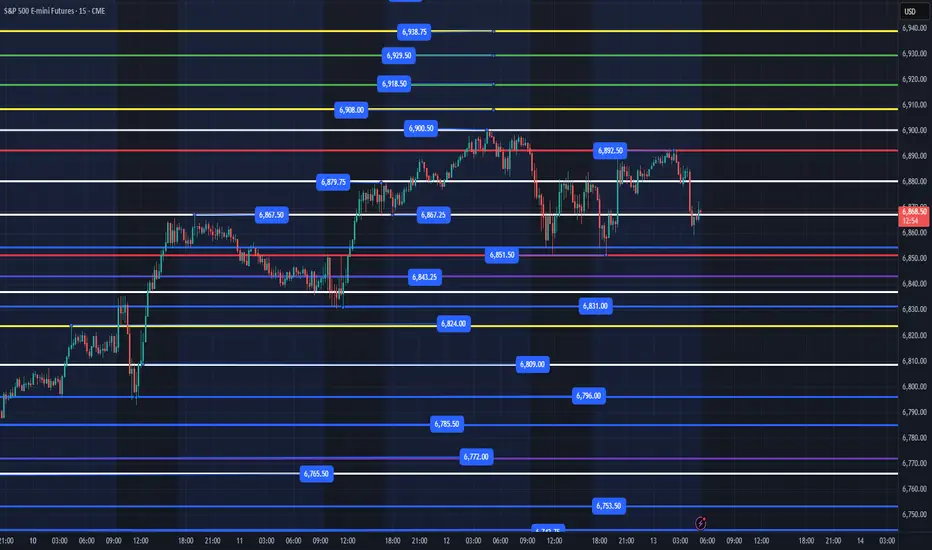

We have CPI at 8:30am and price action this week has been mainly contained to a range between 6831-6900. I expect us to have some volatility today and I am looking at only the best levels to flush and reclaim. Each day there are many levels that can bring points, but the highest quality levels are those where Institutions are entering to ride higher. 6867 has been a magnet inside our range.

Overnight high is 6892 and Overnight low is 6851. As I am typing this post, price just reclaimed 6867 and I anticipate it at least back testing the 6879 level which it broke down from this am.

Key Levels Today -

1. Loss of 6851-53 and reclaim

2. Loss of 6843 and reclaim

3. Loss of 6831 and reclaim

4. Loss of 6796 and reclaim

5. Loss of 6772 and reclaim (possibly as low as 6765 to close the gap)

6. Loss of 6743 and reclaim (possibly down to 6731)

Below those areas and we will most likely need to retest 6654. Price needs to clear 6900 to continue higher with 6918, 6929, 6938, 6953+ being the immediate targets higher.

Key Support Levels - 6867, 6851-53, 6843, 6831-36, 6824, 6809, 6796, 6785, 6772, 6765

Key Resistance Levels - 6879, 6893, 6900, 6908, 6918, 6929, 6938, 6953

We are in a tight range overnight and I still think we need to lose 6851-53 and reclaim for us to move above 6900. Ideally, we can flush down to 6824 and reclaim 6831 or 6837 and reclaim 6843. IF price is selling off, make sure to take your time on entering. Let price flush the level, back test that level, price hold, then you can enter.

I will post an update around 10am EST

----------------------------------------------------------------------------------------------------------------

Couple of things about how I color code my levels.

1. Purple shows the weekly Low

2. Red shows the current overnight session High/Low (time of post)

3. Blue shows the previous day's session Low (also other previous day's lows)

4. Yellow Levels are levels that show support and resistance levels of interest.

5. White Levels are previous day's session High/Low

*Before reading this trade plan, IF, you did not read yesterdays, or the Weekly Trade Plan take the time to read it first! (You can see both posts in the related publication section) *

If my posts provide quality information that has helped you with your trading journey. Feel free to boost it for others to find and learn, also!

My daily trade plan and real-time notes that I post are intended for myself to easily be able to go back and review my plan and how I did from an execution perspective.

--------------------------------------------------------------------------------------------------------

We have CPI at 8:30am and price action this week has been mainly contained to a range between 6831-6900. I expect us to have some volatility today and I am looking at only the best levels to flush and reclaim. Each day there are many levels that can bring points, but the highest quality levels are those where Institutions are entering to ride higher. 6867 has been a magnet inside our range.

Overnight high is 6892 and Overnight low is 6851. As I am typing this post, price just reclaimed 6867 and I anticipate it at least back testing the 6879 level which it broke down from this am.

Key Levels Today -

1. Loss of 6851-53 and reclaim

2. Loss of 6843 and reclaim

3. Loss of 6831 and reclaim

4. Loss of 6796 and reclaim

5. Loss of 6772 and reclaim (possibly as low as 6765 to close the gap)

6. Loss of 6743 and reclaim (possibly down to 6731)

Below those areas and we will most likely need to retest 6654. Price needs to clear 6900 to continue higher with 6918, 6929, 6938, 6953+ being the immediate targets higher.

Key Support Levels - 6867, 6851-53, 6843, 6831-36, 6824, 6809, 6796, 6785, 6772, 6765

Key Resistance Levels - 6879, 6893, 6900, 6908, 6918, 6929, 6938, 6953

We are in a tight range overnight and I still think we need to lose 6851-53 and reclaim for us to move above 6900. Ideally, we can flush down to 6824 and reclaim 6831 or 6837 and reclaim 6843. IF price is selling off, make sure to take your time on entering. Let price flush the level, back test that level, price hold, then you can enter.

I will post an update around 10am EST

----------------------------------------------------------------------------------------------------------------

Couple of things about how I color code my levels.

1. Purple shows the weekly Low

2. Red shows the current overnight session High/Low (time of post)

3. Blue shows the previous day's session Low (also other previous day's lows)

4. Yellow Levels are levels that show support and resistance levels of interest.

5. White Levels are previous day's session High/Low

Note

3pm - Update We are coming into the 0.618 retracement of November low to high that is at 6747. This could be a low that produces the short squeeze into the end of the day. IF price does not close above 6765, we will probably have to test 6706 then 6654 in the coming days. PPI tomorrow at 8:30am and I expect more volatility. Price has to reclaim 6890 to keep price moving to ATH's. IF we close below 6654 this week, it would be bearish and could represent a broader pull back in the coming weeks/months. When price sells off like it has today, we will get a squeeze. Just don't know when. I will post the trade plan around 6am EST tomorrow.

Note

4:25pm - UpdatePrice did hold that 6747 level and has reclaimed the 6772 level. IF it can clear 6785 overnight session, we could squeeze into back testing the 6840, 6850 level. IF we lose 6747, we will need to see if we can get a good reaction at the 6691-95 level or we will most likely retest the 6654 and it should be a good level to get some points. My general lean is that we just consolidate between 6758-6785 in the overnight session and possibly rally once Europe opens up. I don't know of any news event overnight that would trigger liquidity to drive it up beforehand. That does not mean it can't. Trade Plan out around 6am EST.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.