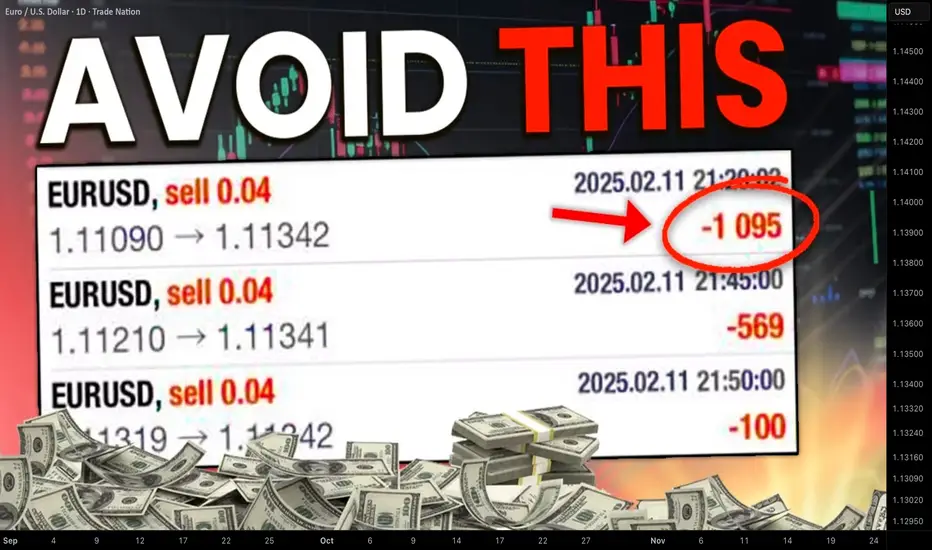

Wrong stop loss is one of the main reasons why newbie traders lose money.

I will share with you a proven stop loss strategy for price action trading Forex.

I will explain how to identify a safe stop loss level for any chart part, trend line and a breakout that you trade.

Learn how to set a safe stop loss easily on any time frame and no matter whether you are day trading, scalping or swing trading.

To correctly put a stop loss for trading price action in forex market, first, let's discuss 2 major types of price action patterns that you should know.

Trend line based patterns

The first type of patterns is called trend line based patterns.

In this category, we put all the patterns where trend lines are used as entries or confirmations.

Here is the list of these patterns:

- Rising/falling parallel channels,

- Rising/falling wedges,

- Rising/falling expanding wedges/channels.

For example, in a rising parallel channel, its support is a strong vertical structure. It provides a safe place to buy the market from.

Alternatively, its breakout will provide a strong confirmation to sell.

Horizontal neckline based patterns

The second type of patterns is called neckline based patterns.

In this category, we include all chart patterns that lie on a horizontal neckline.

A signal that we rely on to trade these patterns is a breakout of their necklines.

Here is the list of these patterns:

- Double top/bottom,

- Head and shoulders and inverted one,

- Ascending/descending triangle,

- Cup and handle and inverted one.

Here is how we set a stop loss in trend line based patterns.

If we buy the market from a support line of a wedge or a channel, expecting a growth, we will need to the last bearish movement from the high of the pattern to the point where it touches a support line - our entry.

Our safe stop loss will be 1.272 fibonacci extension (from its high to low) of this movement.

If we sell the market after a breakout of a support line of a wedge or a channel, we will take the last bearish movement from the high of the pattern to the low of a breakout candle.

Our safe stop loss will be 1.272 fibonacci extension (from its low to high) of this movement.

Look how it works in practice:

If we sell the market from a resistance line of a wedge or a channel,

we will take the last bullish movement from the low of the pattern to the point where it touched a resistance line.

Our safe stop loss will be 1.272 fibonacii extension (from its low to high) of this movement.

Look how it works in practice:

Here is a safe stop loss for selling USDJPY forex pair from a resistance of a falling wedge.

If we buy a bullish breakout of a resistance line of a wedge or a channel, we will take a bullish movement from the low of the pattern to a high of the breakout candle.

Our safe stop loss will be 1.272 fibonacci extension (from its high to its low) of this movement.

Here is how easily we can set a stop loss, using this strategy, buying a breakout of a resistance line of a falling channel on NZDUSD forex pair.

And here is how we set stop loss for neckline based patterns.

If we see a breakout of a neckline of a bearish pattern, and we want to sell, we will need to find a pattern range: a low of the neckline of the pattern and highest high of the pattern.

Based on that, we will draw fibonacci extension (from its lows to high).

Our safe stop loss will be 1.272 extension.

That is how we put a stop loss, using this method on EURUSD, trading head & shoulders.

If we buy a breakout of a neckline of a bullish pattern, our safe stop loss will be based on 1.272 extention (from high to low) of the range of the pattern - the highest high of the neckline and the lowest low of the pattern.

That is how a safe stop loss for a cup & handle pattern on EURUSD looks. I drew fib.extension from the neckline's high to pattern's low.

This simple method will help you to always put a safe stop loss.

Integrate that in your trading plan and avoid losses, trading price action.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅Join My Telegram Channel: t.me/VasilyTrading

❗️YouTube Channel youtube.com/c/VasilyTrader

✅ Facebook: facebook.com/VasilyTrading/

⭐ My Forex & Gold Broker: bit.ly/vasilyforexbroker ⭐

❗️YouTube Channel youtube.com/c/VasilyTrader

✅ Facebook: facebook.com/VasilyTrading/

⭐ My Forex & Gold Broker: bit.ly/vasilyforexbroker ⭐

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

✅Join My Telegram Channel: t.me/VasilyTrading

❗️YouTube Channel youtube.com/c/VasilyTrader

✅ Facebook: facebook.com/VasilyTrading/

⭐ My Forex & Gold Broker: bit.ly/vasilyforexbroker ⭐

❗️YouTube Channel youtube.com/c/VasilyTrader

✅ Facebook: facebook.com/VasilyTrading/

⭐ My Forex & Gold Broker: bit.ly/vasilyforexbroker ⭐

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.