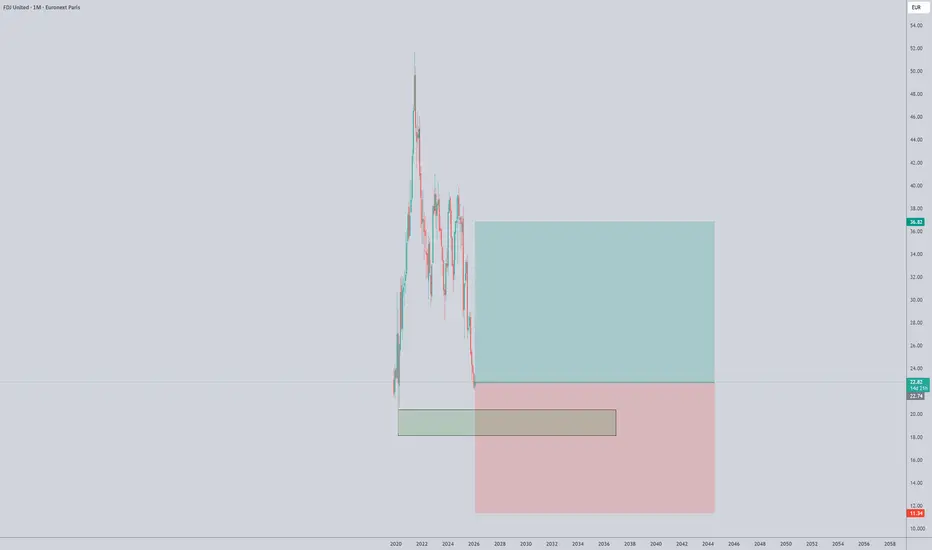

FDJU: High-yield value play (9.0% div) trading at 52-week lows (€22.8) after its pivot to FDJ United. Fails the 'Predator' Gross Margin filter (41.8% vs 80% target), though ROE remains elite at 33.2%. Significant debt (249% D/E) from the Kindred acquisition creates a 57% DCF undervaluation gap, but 118% payout ratio raises dividend sustainability concerns. High government ownership (21%) provides a moat but limits explosive growth. Watch earnings on Feb 19 before entry

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.