Fastly (FSLY) reported $127.82 million in revenue for the quarter ended September 2023, representing a year-over-year increase of 17.8%. EPS of -$0.06 for the same period compares to -$0.14 a year ago.

Here is how Fastly performed in the just reported quarter in terms of the metrics most widely monitored and projected by Wall Street analysts:

1. Total Customer Count: 3,102 versus 3,107 estimated by two analysts on average.

2. Revenue- Non-enterprise customers: $11.62 million compared to the $12.30 million average estimate based on two analysts.

3. Revenue- Enterprise customers: $116.19 million compared to the $114.62 million average estimate based on two analysts.

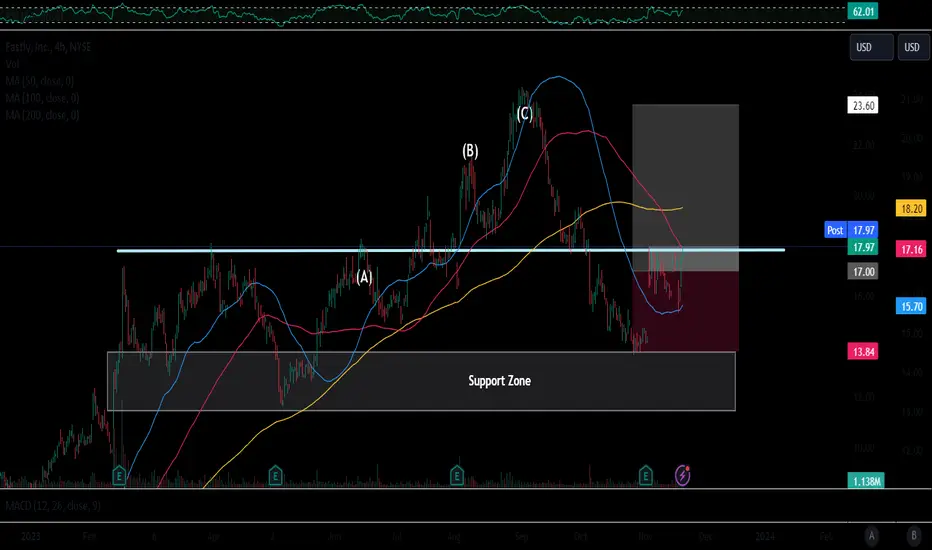

Technical Analysist

Price Momentum

FSLY is trading in the middle of its 52-week range and above its 200-day simple moving average.

What does this mean?

Investors are still evaluating the share price, but the stock still appears to have some upward momentum. This is a positive sign for the stock's future value.

Market cap: $2.12B

A market capitalization between $2 billion and $10 billion places FSLY in the mid-capitalization category.

Here is how Fastly performed in the just reported quarter in terms of the metrics most widely monitored and projected by Wall Street analysts:

1. Total Customer Count: 3,102 versus 3,107 estimated by two analysts on average.

2. Revenue- Non-enterprise customers: $11.62 million compared to the $12.30 million average estimate based on two analysts.

3. Revenue- Enterprise customers: $116.19 million compared to the $114.62 million average estimate based on two analysts.

Technical Analysist

Price Momentum

FSLY is trading in the middle of its 52-week range and above its 200-day simple moving average.

What does this mean?

Investors are still evaluating the share price, but the stock still appears to have some upward momentum. This is a positive sign for the stock's future value.

Market cap: $2.12B

A market capitalization between $2 billion and $10 billion places FSLY in the mid-capitalization category.

⭐⭐⭐ Sign Up for Free ⭐⭐⭐

1) Download our Mobile App >> link-to.app/dexwirenews

2) Join our Telegram >> t.me/DEXWireNews

3) Sign Up for Text Alerts >>

dexwirenews.com/TEXT

4) Follow @DEXWireNews on Social Media

1) Download our Mobile App >> link-to.app/dexwirenews

2) Join our Telegram >> t.me/DEXWireNews

3) Sign Up for Text Alerts >>

dexwirenews.com/TEXT

4) Follow @DEXWireNews on Social Media

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

⭐⭐⭐ Sign Up for Free ⭐⭐⭐

1) Download our Mobile App >> link-to.app/dexwirenews

2) Join our Telegram >> t.me/DEXWireNews

3) Sign Up for Text Alerts >>

dexwirenews.com/TEXT

4) Follow @DEXWireNews on Social Media

1) Download our Mobile App >> link-to.app/dexwirenews

2) Join our Telegram >> t.me/DEXWireNews

3) Sign Up for Text Alerts >>

dexwirenews.com/TEXT

4) Follow @DEXWireNews on Social Media

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.