Quick Recap: Last week Expected Ranges levels in action

What is Expected Range Volatility (ER)?

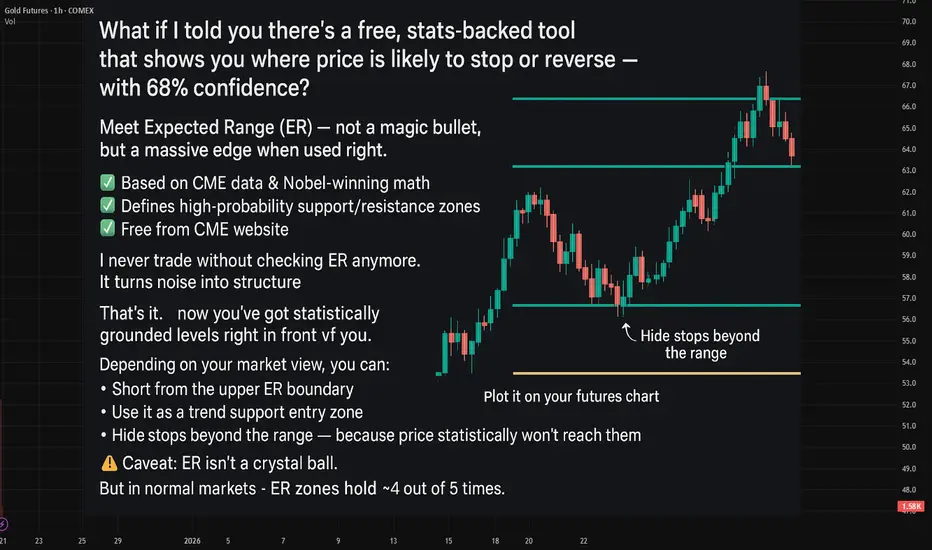

The Expected Range (ER) is a framework that helps traders understand how much an asset is likely to move within a specific timeframe. Based on CME market data and Nobel Prize-winning calculations, price movements within the expected volatility corridor have a 68%-95% probability of staying within those boundaries.

Crude Oil - 6 reactions to levels🔥

EUR - 4 reactions to levels

BTC - 3 reactions

GOLD - 1 reaction to levels

It's really an amazing tool to enhance your market entry💲

!!!- It doesn't guarantee trades every day.

!! it's better to combine it when working with the trend and when there's a clear sideways movement.

What is Expected Range Volatility (ER)?

The Expected Range (ER) is a framework that helps traders understand how much an asset is likely to move within a specific timeframe. Based on CME market data and Nobel Prize-winning calculations, price movements within the expected volatility corridor have a 68%-95% probability of staying within those boundaries.

Crude Oil - 6 reactions to levels🔥

EUR - 4 reactions to levels

BTC - 3 reactions

GOLD - 1 reaction to levels

It's really an amazing tool to enhance your market entry💲

!!!- It doesn't guarantee trades every day.

!! it's better to combine it when working with the trend and when there's a clear sideways movement.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.