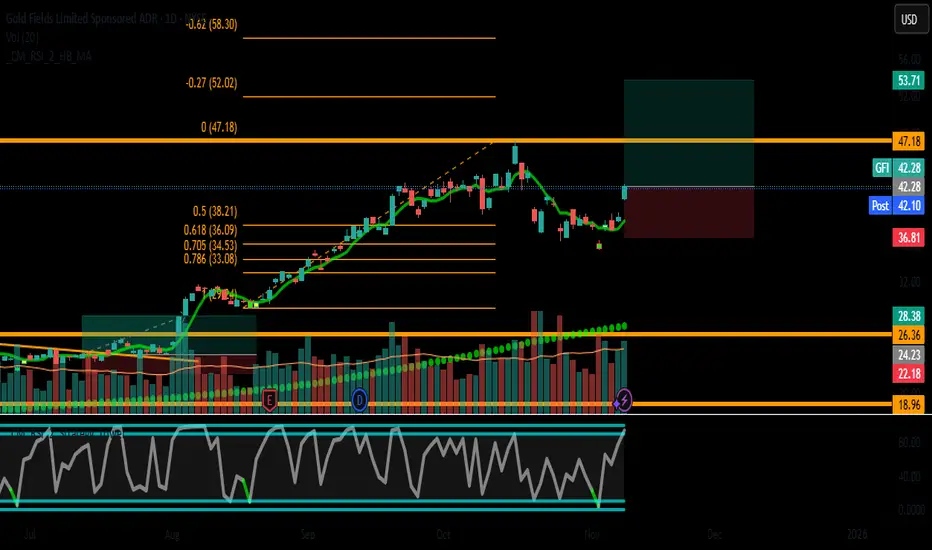

TradingView Idea: GFI (Gold Fields Limited) - Swing Long Setup (Fundamental + Technical + Momentum Convergence)

🎯 Ticker: GFI (NYSE)

📈 Type: Swing Long / Position Trade

⏰ Timeframe: Daily (D1)

📊 Multi-Timeframe Analysis:

Daily Trend: BULLISH ✅

Daily Technical Recommendation: Neutral, consolidating before a potential breakout.

Momentum Signal: Connors RSI2 Buy Signal (Triggered on 04-Nov, indicating short-term bullish momentum).

💡 Integrated Investment Thesis:

GFI presents a rare and powerful convergence of positive factors:

SOLID FUNDAMENTALS (Score: 7/9):

Strong Growth: Solid increases in both Revenue (+15%) and Net Income (+77%).

Fair Valuation: P/E ratio of ~20, considered fair for its sector and growth profile.

PERFECT Debt Health (10/10): Manageable debt with an excellent Debt-to-EBITDA ratio.

TECHNICAL MOMENTUM (Connors Signal):

The Connors RSI2 Buy Signal detected this week provides precise entry timing, indicating the asset is rebounding from a short-term oversold condition within a larger bullish trend.

BULLISH SENTIMENT (Gold):

As a gold producer, it benefits from the current macroeconomic environment (rate cut expectations, safe-haven demand), adding a tailwind to the trade.

⚡ Trading Plan:

🎯 Entry: $42.10(Confirmation zone following the buy signal)

🛑 Stop Loss: $36.81(Below key support and the 50-day moving average)

💰 Profit Target: $53.71(Based on Fibonacci extension and structural resistance)

📊 Risk/Reward Ratio: 1:2.4 (Highly favorable for a swing trade)

✅ Trade Summary:

Metric Detail

Direction Long

Entry $42.10

Stop Loss $36.81

Take Profit $53.71

R/R Ratio 1:2.4

Catalyst Connors RSI2 Signal + Strong Fundamentals

Conclusion: This trade combines the best of three analytical frameworks: a solid fundamental base, a bullish technical trend, and precise entry timing from a proven momentum signal. A high-probability setup for a swing trade.

Good luck, and trade safe!

Disclaimer: This is not investment advice. Please conduct your own research and manage risk according to your personal tolerance.

#GFI #SwingTrading #Long #Gold #RSI2 #Connors #FundamentalAnalysis #TechnicalAnalysis

🎯 Ticker: GFI (NYSE)

📈 Type: Swing Long / Position Trade

⏰ Timeframe: Daily (D1)

📊 Multi-Timeframe Analysis:

Daily Trend: BULLISH ✅

Daily Technical Recommendation: Neutral, consolidating before a potential breakout.

Momentum Signal: Connors RSI2 Buy Signal (Triggered on 04-Nov, indicating short-term bullish momentum).

💡 Integrated Investment Thesis:

GFI presents a rare and powerful convergence of positive factors:

SOLID FUNDAMENTALS (Score: 7/9):

Strong Growth: Solid increases in both Revenue (+15%) and Net Income (+77%).

Fair Valuation: P/E ratio of ~20, considered fair for its sector and growth profile.

PERFECT Debt Health (10/10): Manageable debt with an excellent Debt-to-EBITDA ratio.

TECHNICAL MOMENTUM (Connors Signal):

The Connors RSI2 Buy Signal detected this week provides precise entry timing, indicating the asset is rebounding from a short-term oversold condition within a larger bullish trend.

BULLISH SENTIMENT (Gold):

As a gold producer, it benefits from the current macroeconomic environment (rate cut expectations, safe-haven demand), adding a tailwind to the trade.

⚡ Trading Plan:

🎯 Entry: $42.10(Confirmation zone following the buy signal)

🛑 Stop Loss: $36.81(Below key support and the 50-day moving average)

💰 Profit Target: $53.71(Based on Fibonacci extension and structural resistance)

📊 Risk/Reward Ratio: 1:2.4 (Highly favorable for a swing trade)

✅ Trade Summary:

Metric Detail

Direction Long

Entry $42.10

Stop Loss $36.81

Take Profit $53.71

R/R Ratio 1:2.4

Catalyst Connors RSI2 Signal + Strong Fundamentals

Conclusion: This trade combines the best of three analytical frameworks: a solid fundamental base, a bullish technical trend, and precise entry timing from a proven momentum signal. A high-probability setup for a swing trade.

Good luck, and trade safe!

Disclaimer: This is not investment advice. Please conduct your own research and manage risk according to your personal tolerance.

#GFI #SwingTrading #Long #Gold #RSI2 #Connors #FundamentalAnalysis #TechnicalAnalysis

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.