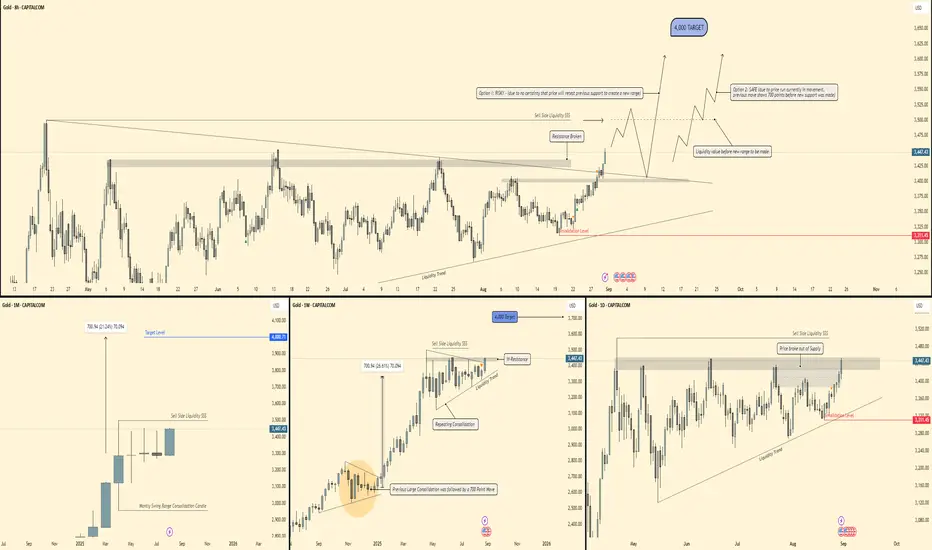

🕰 Monthly View

Strong bullish structure with a massive impulse.

Previous consolidation candle broke out and delivered a 700-point rally – current structure suggests a similar expansion is underway.

Key target level sits at $4,000, aligning with higher timeframe projections.

📆 Weekly View

Price broke through weekly resistance and sell-side liquidity.

Repeating consolidation pattern before breakout – history suggests further continuation.

Liquidity trend supporting higher lows; bullish structure remains intact.

Short-term resistance cleared at 3,450, leaving upside liquidity exposed toward 3,800–4,000.

📅 Daily View

Breakout from daily supply zone (≈3,420–3,450) confirmed bullish momentum.

Now trading above liquidity, with two possible scenarios:

Option 1 (Risky): Immediate continuation higher without creating a new range (less stable).

Option 2 (Safe): Pullback into fresh support (~3,350–3,400) before expansion toward 3,600–4,000.

⏱ 8H View

Resistance broken; liquidity grab confirmed.

Consolidation breakout leaves price trending strongly bullish.

Any dip into support around 3,350–3,375 is a potential buy zone for continuation.

🎯 Bias & Trade Plan

Bias: Strong Bullish

Entry Zone: 3,350–3,400 (safe pullback buys)

Targets:

Short-term → 3,600

Mid-term → 4,000

Invalidation: Daily close below 3,311 (liquidity trend break).

⚠️ Risk Note

Gold is in a parabolic move — chasing without confirmation is risky. Best strategy: wait for pullback/retest before entering heavy positions.

Strong bullish structure with a massive impulse.

Previous consolidation candle broke out and delivered a 700-point rally – current structure suggests a similar expansion is underway.

Key target level sits at $4,000, aligning with higher timeframe projections.

📆 Weekly View

Price broke through weekly resistance and sell-side liquidity.

Repeating consolidation pattern before breakout – history suggests further continuation.

Liquidity trend supporting higher lows; bullish structure remains intact.

Short-term resistance cleared at 3,450, leaving upside liquidity exposed toward 3,800–4,000.

📅 Daily View

Breakout from daily supply zone (≈3,420–3,450) confirmed bullish momentum.

Now trading above liquidity, with two possible scenarios:

Option 1 (Risky): Immediate continuation higher without creating a new range (less stable).

Option 2 (Safe): Pullback into fresh support (~3,350–3,400) before expansion toward 3,600–4,000.

⏱ 8H View

Resistance broken; liquidity grab confirmed.

Consolidation breakout leaves price trending strongly bullish.

Any dip into support around 3,350–3,375 is a potential buy zone for continuation.

🎯 Bias & Trade Plan

Bias: Strong Bullish

Entry Zone: 3,350–3,400 (safe pullback buys)

Targets:

Short-term → 3,600

Mid-term → 4,000

Invalidation: Daily close below 3,311 (liquidity trend break).

⚠️ Risk Note

Gold is in a parabolic move — chasing without confirmation is risky. Best strategy: wait for pullback/retest before entering heavy positions.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.