🟡 GOLD – Breakout Play Setting Up

🔎 Bias: Bullish

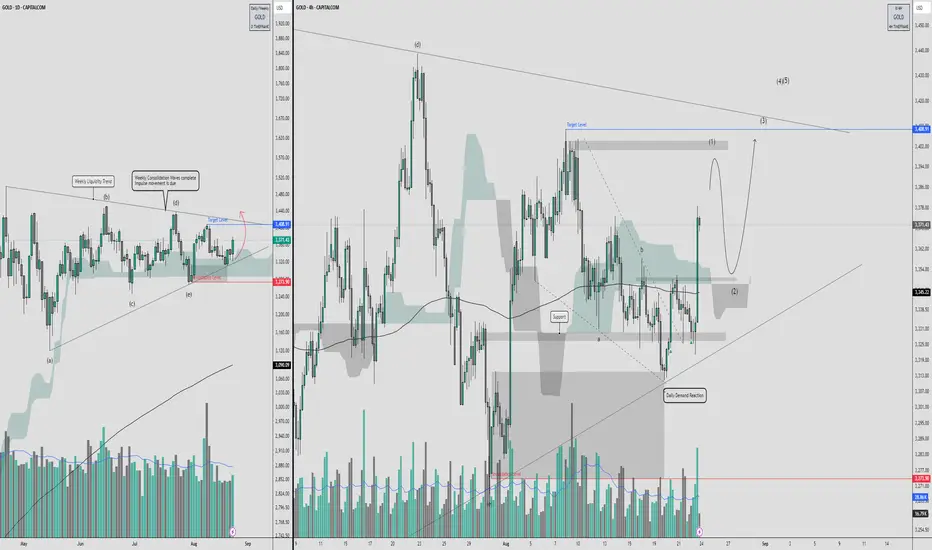

Gold is breaking out of a long consolidation phase. Weekly consolidation waves have completed, meaning an impulsive move is due. The liquidity trend is pointing higher, and demand zones are holding strongly.

📊 Technical Breakdown

Weekly/Daily View (Left Chart):

Price has been trapped in a weekly wedge structure, respecting both liquidity highs and lows.

Wave cycle (a–e) completed, with bullish pressure building.

Key Demand Zone: 3273 – 3330 held firm, rejecting sell pressure.

Target Zone: 3408 (major liquidity target), aligning with wedge resistance.

4H View (Right Chart):

Clear demand reaction after tapping into daily demand block.

Strong impulsive move upward (Wave (1)), expecting a pullback (Wave (2)) to retest structure/support before continuation.

Next projected leg higher towards 3400+, where liquidity and supply converge.

🎯 Trade Plan

Entry Zone: 3330 – 3360 (wait for retracement confirmation)

Target 1: 3408 (liquidity level)

Target 2: 3450 (upper supply wick)

Invalidation: Below 3273 (loss of demand structure)

📌 Summary

Gold is shifting from consolidation into impulse. With demand holding and liquidity resting above, bulls are in control. Watching for a healthy pullback to load into longs targeting 3408+.

🔎 Bias: Bullish

Gold is breaking out of a long consolidation phase. Weekly consolidation waves have completed, meaning an impulsive move is due. The liquidity trend is pointing higher, and demand zones are holding strongly.

📊 Technical Breakdown

Weekly/Daily View (Left Chart):

Price has been trapped in a weekly wedge structure, respecting both liquidity highs and lows.

Wave cycle (a–e) completed, with bullish pressure building.

Key Demand Zone: 3273 – 3330 held firm, rejecting sell pressure.

Target Zone: 3408 (major liquidity target), aligning with wedge resistance.

4H View (Right Chart):

Clear demand reaction after tapping into daily demand block.

Strong impulsive move upward (Wave (1)), expecting a pullback (Wave (2)) to retest structure/support before continuation.

Next projected leg higher towards 3400+, where liquidity and supply converge.

🎯 Trade Plan

Entry Zone: 3330 – 3360 (wait for retracement confirmation)

Target 1: 3408 (liquidity level)

Target 2: 3450 (upper supply wick)

Invalidation: Below 3273 (loss of demand structure)

📌 Summary

Gold is shifting from consolidation into impulse. With demand holding and liquidity resting above, bulls are in control. Watching for a healthy pullback to load into longs targeting 3408+.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.