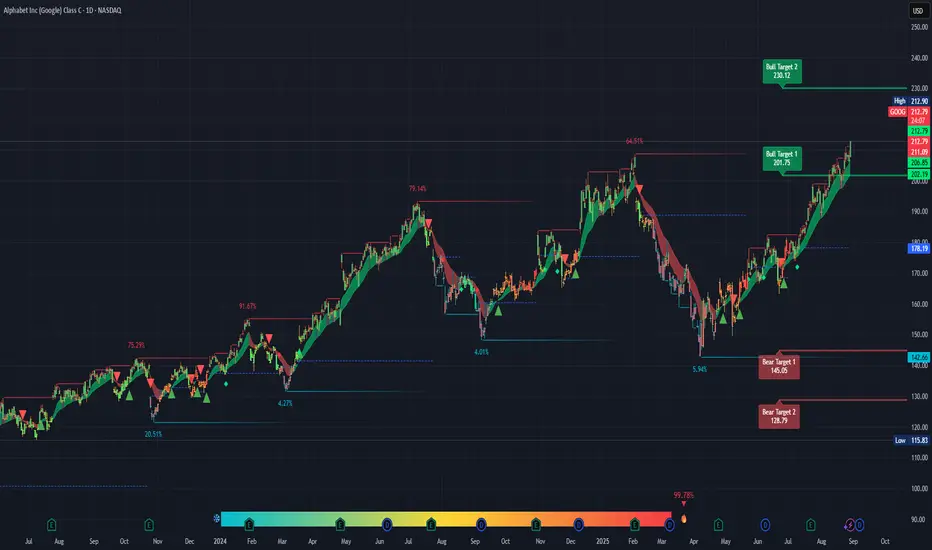

Strong Trend: Price has been pushing higher since April 2025, with higher highs and higher lows intact. The green zone shows momentum is with the bulls.

Breakout Attempt: You’re sitting near recent highs around 212.90, which shows buyers are in control. If it clears that resistance cleanly, Bull Target 1 (201.75) is already hit, and Target 2 (230.12) is in play.

Volume Uptick: Volume looks supportive of the breakout move (12.61M shown). More buyers stepping in usually confirms the move.

⚠️ Concerns (Why It Might Fail)

Overextended Run: The stock has already run ~40+% since April. Moves like this often see consolidation or pullbacks before the next leg.

Bear Targets Still in Play: If the breakout fails, your downside risk is real: 142.66 → 145.05 (Bear Target 1), and possibly 128.79 (Bear Target 2). That’s a nasty ~30–35% potential drop.

Resistance at 212.90: If it can’t close strong above here, you may get a short-term double top.

🎯 Cost vs. Benefit

Upside to Bull Target 2 (230.12): ~8% gain.

Downside to Bear Target 1 (145.05): ~32% risk.

Risk/Reward: About 1:4 against you right now unless you use a tight stop. That’s not attractive for a fresh entry.

🤔 Too Good to Be True Filter

“This chart looks like it’s going straight to 230” — probably not that easy. Expect chop and possible pullbacks around the 210–215 zone. If it does blast through with high volume, then you’ve got confirmation.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.