HCA - HCA Healthcare, Inc.

🏥 Strong Buy Signal | Confirmed by Fundamentals, Technicals & Connors RSI2

🎯 Trade Idea Overview

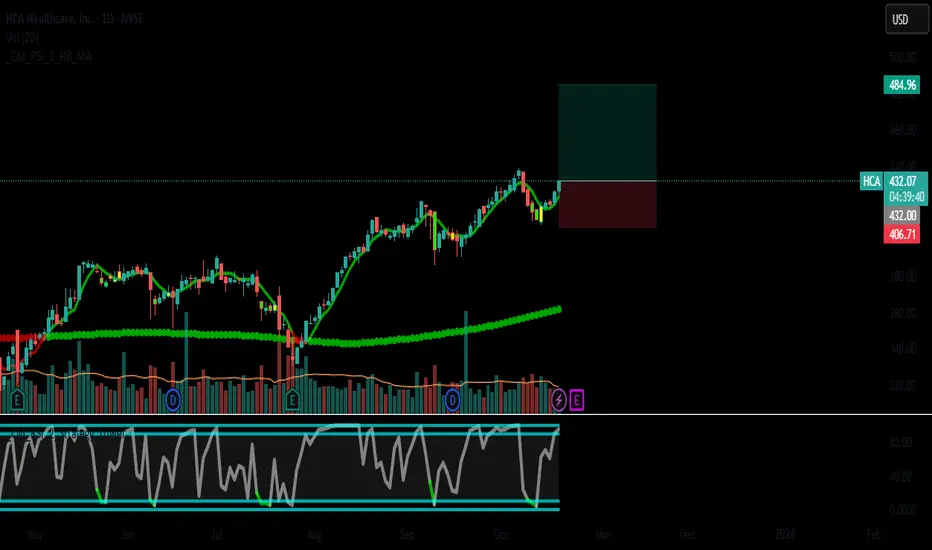

Direction: LONG

Entry Zone: $429 - $433

Stop Loss: $406.70

Take Profit: $484.96

Strategy: Swing to Position Trade (2–6 weeks)

Confidence Level: High (85%)

📊 Why HCA?

✅ Fundamental Strength (Score: 5/9)

Revenue Growth: Moderate 📈

Net Income Growth: Moderate 💹

Valuation: Fairly Valued (P/E 17.6)

Debt Health: Acceptable (Score: 7/10)

Sector Stability: Healthcare – Defensive Sector 🛡️

✅ Technical Alignment

Daily Trend: ✅ Bullish

4H Trend: ✅ Bullish

1H Trend: 🔁 Bearish (Short-term Pullback) → Ideal Entry Opportunity

Price Action: Trading near key support, poised for continuation

Momentum: Bullish structure intact across higher timeframes

✅ Connors RSI2 Confirmation

Buy Signal: Active on Oct 10 & 13 (Double Confirmation)

Strategy: RSI2 momentum shift + trend alignment

Timing: Signal remains valid within optimal 5-10 day window

📍 Entry & Risk Management

Recommended Entry: $431 (market or limit)

Stop Loss: $406.70 (5.6% risk)

Take Profit: $484.96 (12.5% reward)

R/R Ratio: 1:2.23 ✅

🧠 Trade Rationale

HCA presents a strong technical setup aligned with defensive sector strength.

Double Connors RSI2 buy signal (Oct 10 & 13) confirms short-term momentum shift.

Current pullback to $430 zone offers optimal risk/reward entry.

Healthcare sector provides stability during market uncertainty.

📆 Watch List

Monitor for bullish confirmation above $435.

Watch healthcare sector news and overall market sentiment.

Key earnings date: November (Q3 2025)

✅ Summary

Asset: HCA

Action: BUY

Entry: $431

SL: $406.70

TP: $484.96

Signal Type: Multi-timeframe + Double Connors RSI2 Confirmed

‼️ Disclaimer

This analysis is for informational purposes only and does not constitute financial advice or a recommendation to buy or sell any security. Trading involves substantial risk and is not suitable for every investor. You should carefully consider your investment objectives, experience level, and risk tolerance before acting on any information provided. The author is not a registered financial advisor and assumes no liability for any trading losses or damages resulting from this information. Past performance is not indicative of future results. Always conduct your own due diligence and consult with a qualified financial professional before making any investment decisions.

🏥 Strong Buy Signal | Confirmed by Fundamentals, Technicals & Connors RSI2

🎯 Trade Idea Overview

Direction: LONG

Entry Zone: $429 - $433

Stop Loss: $406.70

Take Profit: $484.96

Strategy: Swing to Position Trade (2–6 weeks)

Confidence Level: High (85%)

📊 Why HCA?

✅ Fundamental Strength (Score: 5/9)

Revenue Growth: Moderate 📈

Net Income Growth: Moderate 💹

Valuation: Fairly Valued (P/E 17.6)

Debt Health: Acceptable (Score: 7/10)

Sector Stability: Healthcare – Defensive Sector 🛡️

✅ Technical Alignment

Daily Trend: ✅ Bullish

4H Trend: ✅ Bullish

1H Trend: 🔁 Bearish (Short-term Pullback) → Ideal Entry Opportunity

Price Action: Trading near key support, poised for continuation

Momentum: Bullish structure intact across higher timeframes

✅ Connors RSI2 Confirmation

Buy Signal: Active on Oct 10 & 13 (Double Confirmation)

Strategy: RSI2 momentum shift + trend alignment

Timing: Signal remains valid within optimal 5-10 day window

📍 Entry & Risk Management

Recommended Entry: $431 (market or limit)

Stop Loss: $406.70 (5.6% risk)

Take Profit: $484.96 (12.5% reward)

R/R Ratio: 1:2.23 ✅

🧠 Trade Rationale

HCA presents a strong technical setup aligned with defensive sector strength.

Double Connors RSI2 buy signal (Oct 10 & 13) confirms short-term momentum shift.

Current pullback to $430 zone offers optimal risk/reward entry.

Healthcare sector provides stability during market uncertainty.

📆 Watch List

Monitor for bullish confirmation above $435.

Watch healthcare sector news and overall market sentiment.

Key earnings date: November (Q3 2025)

✅ Summary

Asset: HCA

Action: BUY

Entry: $431

SL: $406.70

TP: $484.96

Signal Type: Multi-timeframe + Double Connors RSI2 Confirmed

‼️ Disclaimer

This analysis is for informational purposes only and does not constitute financial advice or a recommendation to buy or sell any security. Trading involves substantial risk and is not suitable for every investor. You should carefully consider your investment objectives, experience level, and risk tolerance before acting on any information provided. The author is not a registered financial advisor and assumes no liability for any trading losses or damages resulting from this information. Past performance is not indicative of future results. Always conduct your own due diligence and consult with a qualified financial professional before making any investment decisions.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.