- IBM broke resistance area

- Likely to rise to resistance level 265.00

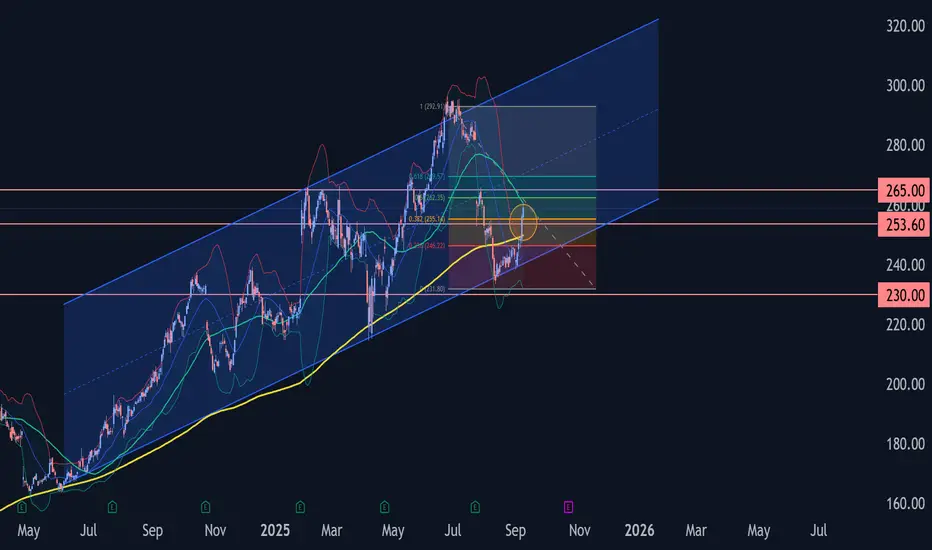

IBM recently broke resistance area between the resistance level 253.60 (which has been reversing the price from the start of August) and the 38.2% Fibonacci correction of the downward impulse C from July.

The breakout of this resistance area accelerated active short-term impulse wave 3 of wave (5) from the start of August.

IBM can be expected to rise toward the next resistance level 265.00 (former top of wave iv from July and the target price for the completion of the active impulse wave 3).

- Likely to rise to resistance level 265.00

IBM recently broke resistance area between the resistance level 253.60 (which has been reversing the price from the start of August) and the 38.2% Fibonacci correction of the downward impulse C from July.

The breakout of this resistance area accelerated active short-term impulse wave 3 of wave (5) from the start of August.

IBM can be expected to rise toward the next resistance level 265.00 (former top of wave iv from July and the target price for the completion of the active impulse wave 3).

By the FxPro Analyst Team

Follow our dedicated Telegram channel t.me/fxpro for insightful market analysis and expert commentary.

Reach out to media.comments@fxpro.com for PR and media inquiries

Follow our dedicated Telegram channel t.me/fxpro for insightful market analysis and expert commentary.

Reach out to media.comments@fxpro.com for PR and media inquiries

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

By the FxPro Analyst Team

Follow our dedicated Telegram channel t.me/fxpro for insightful market analysis and expert commentary.

Reach out to media.comments@fxpro.com for PR and media inquiries

Follow our dedicated Telegram channel t.me/fxpro for insightful market analysis and expert commentary.

Reach out to media.comments@fxpro.com for PR and media inquiries

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.