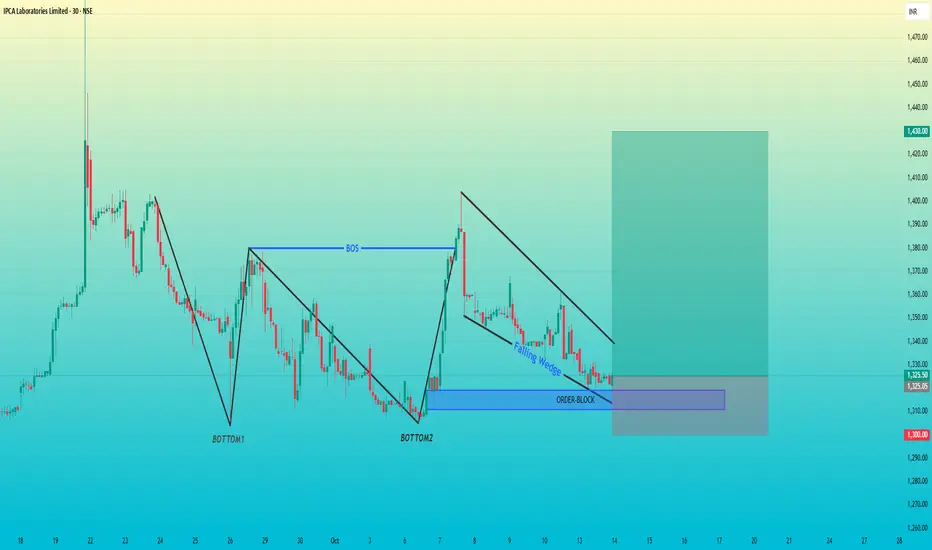

Chart Overview

Pattern: Falling Wedge inside a confirmed bullish structure

Structure Break: BOS (Break of Structure) already confirmed

Key Levels:

Order Block Zone: Around ₹1300–₹1310

Current Price: ₹1325

Target Zone: ₹1430

Stop-Loss: Below ₹1300

Technical Breakdown

1. Double Bottom

The formation of Bottom1 and Bottom2 shows a strong demand base.

The BOS (Break of Structure) after Bottom2 confirms that buyers took control.

2. Falling Wedge Pattern

After the BOS, the price is consolidating in a Falling Wedge, which is typically a bullish continuation pattern.

Price respecting the wedge boundaries suggests compression — a breakout to the upside can trigger momentum.

3. Order Block Zone

The blue rectangular area marks a bullish order block from the last strong bullish rally.

Price has retraced back into this OB, creating an ideal entry point if bullish rejection appears.

4. Trade Setup

Entry: Near ₹1320–₹1325

Stop-Loss: Below ₹1300 (OB invalidation)

Target: ₹1430

RR Ratio: ≈ 1:4

Pattern: Falling Wedge inside a confirmed bullish structure

Structure Break: BOS (Break of Structure) already confirmed

Key Levels:

Order Block Zone: Around ₹1300–₹1310

Current Price: ₹1325

Target Zone: ₹1430

Stop-Loss: Below ₹1300

Technical Breakdown

1. Double Bottom

The formation of Bottom1 and Bottom2 shows a strong demand base.

The BOS (Break of Structure) after Bottom2 confirms that buyers took control.

2. Falling Wedge Pattern

After the BOS, the price is consolidating in a Falling Wedge, which is typically a bullish continuation pattern.

Price respecting the wedge boundaries suggests compression — a breakout to the upside can trigger momentum.

3. Order Block Zone

The blue rectangular area marks a bullish order block from the last strong bullish rally.

Price has retraced back into this OB, creating an ideal entry point if bullish rejection appears.

4. Trade Setup

Entry: Near ₹1320–₹1325

Stop-Loss: Below ₹1300 (OB invalidation)

Target: ₹1430

RR Ratio: ≈ 1:4

Trade closed: stop reached

For more live trades

join t.me/vedindicator

The reason behind Orderblock (Free Trial)

Visit- vedindicator.com

join t.me/vedindicator

The reason behind Orderblock (Free Trial)

Visit- vedindicator.com

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

For more live trades

join t.me/vedindicator

The reason behind Orderblock (Free Trial)

Visit- vedindicator.com

join t.me/vedindicator

The reason behind Orderblock (Free Trial)

Visit- vedindicator.com

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.