🙀🧐Conclusion 🧐🙀

🤔While JSW Cement demonstrates ambition and operational scale in India’s vibrant cement sector, its financial health is tempered by high leverage and modest returns. Strong governance, strategic debt management, and transparent reporting will be critical as the company seeks market leadership among robust peers. Long-term investors should closely monitor improvements in cash flows and efficiency, given sector opportunities and competitive dynamics.

🧐The cement sector shows strong growth led by robust leaders; JSW Cement is a promising but highly leveraged mid-cap facing profitability and liquidity challenges. Sector fundamentals remain resilient, but JSW’s turnaround depends on prudent financial and governance reforms

🌺🌺About JSW Cement🌺🌺

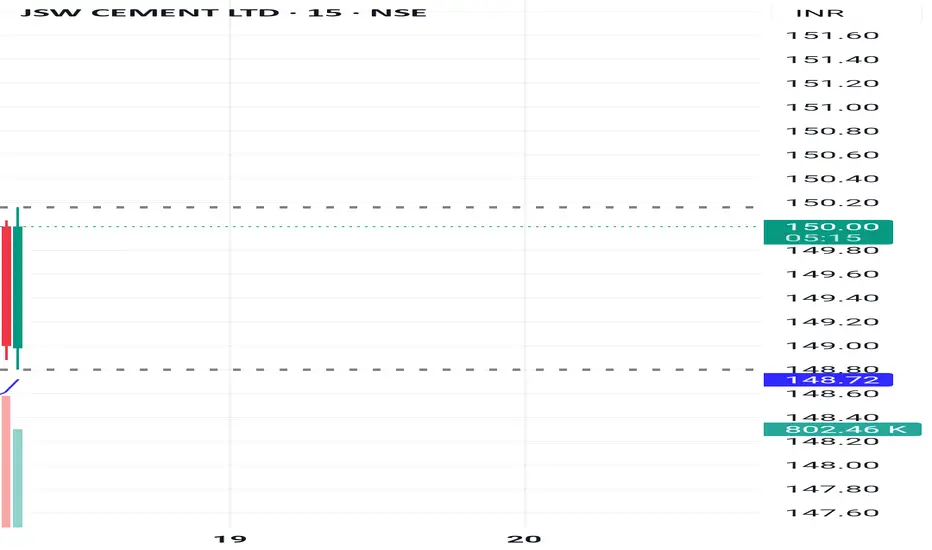

JSW Cement is a prominent Indian cement manufacturer, recently listed on BSE and NSE in August 2025. The company aims to rapidly expand its production capacity and footprint across key markets with a focus on sustainable manufacturing and innovative processes.

🤯Cement Sector Growth & Future Potential🤯

- India’s cement demand driven by government infrastructure push and urbanization.

- Sector CAGR expected at 7-9% over the next five years with rapid capacity additions.

- Companies investing in green cement, alternative fuels, and digital operations.

- Consolidation and entry of large players signal a highly competitive future market landscape.

🧐Financials Snapshot (FY25)🧐

- Revenue: ₹6,028 crore

- Operating Margin: 15.3%

- EBITDA Margin: 16%

- Net Margin: 1%

- Market Cap: ₹7,400 crore

- Free Cash Flow: Negative

😶🌫️Key Ratios😶🌫️

- Debt/Equity Ratio: 2.6 (sector high)

- Return on Equity (ROE): 0.6% (below industry average)

- Return on Capital Employed (ROCE): 8%

- Current Ratio: 0.65

- Dividend Payout: 0%

👷🏻 Peer Analysis👷🏻

- UltraTech Cement, Shree Cement, and Ambuja Cement lead with stronger margins and lower debt.

- JSW Cement’s leverage (high debt) impacts profitability and shareholder returns.

- Sector leaders maintain ROE and ROCE above 10-13%; JSW lags in these metrics.

- Free cash flow in JSW Cement lags behind top peers due to high investment and operational pressures.

- Margins are competitive but net profitability is limited compared to industry best.

- JSW Cement is positioned as a mid-cap, growth-oriented player with room for efficiency improvement.

- Company’s focus on expansion adds long-term growth potential.

- Peer companies show higher liquidity and sustainable dividend payout records.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.