Kaynes Technology has demonstrated strong financial performance, with significant growth in both sales and profits over the past year. Net sales increased by over 55% and net profit rose nearly 75%, supporting its position as a market leader with robust fundamentals and high institutional confidence. The stock has outperformed the broader market, delivering a return of over 43% in the past year.

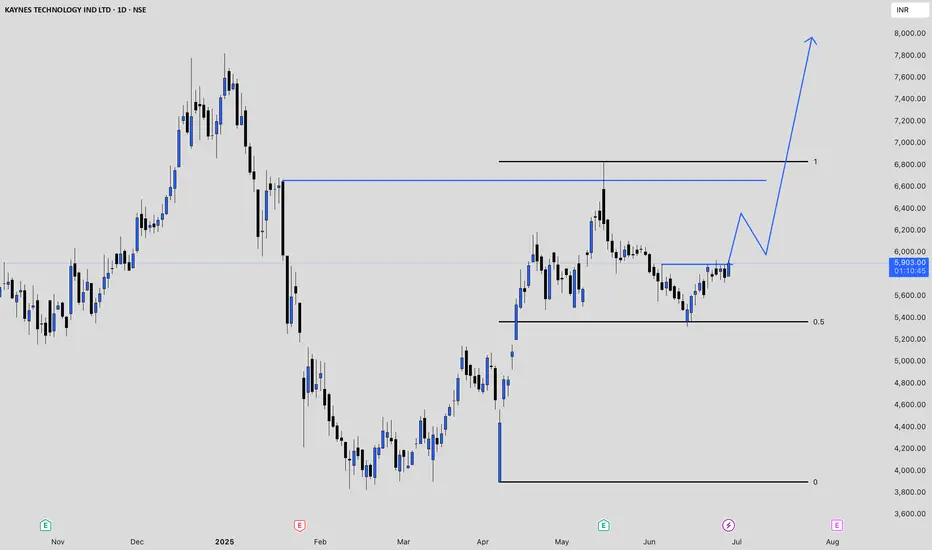

Recently, the stock has shown some volatility. After reaching highs above 6,000 INR in May and early June 2025, the price has pulled back, with recent closes in the 5,700–5,900 INR range. Short-term technical indicators present a mixed picture: the RSI is around 55, suggesting neither overbought nor oversold conditions, while the MACD is slightly negative, indicating mild bearish momentum. The technical strength is rated as mildly bearish, but profitability remains strong.

Despite the recent dip, long-term forecasts remain positive, with projections suggesting potential for double-digit percentage gains over the next year and substantial growth over a five-year horizon. Institutional holdings are high, reflecting continued confidence from large investors. In summary, Kaynes Technology combines strong financials and market leadership with short-term technical caution, but its long-term outlook remains constructive.

Recently, the stock has shown some volatility. After reaching highs above 6,000 INR in May and early June 2025, the price has pulled back, with recent closes in the 5,700–5,900 INR range. Short-term technical indicators present a mixed picture: the RSI is around 55, suggesting neither overbought nor oversold conditions, while the MACD is slightly negative, indicating mild bearish momentum. The technical strength is rated as mildly bearish, but profitability remains strong.

Despite the recent dip, long-term forecasts remain positive, with projections suggesting potential for double-digit percentage gains over the next year and substantial growth over a five-year horizon. Institutional holdings are high, reflecting continued confidence from large investors. In summary, Kaynes Technology combines strong financials and market leadership with short-term technical caution, but its long-term outlook remains constructive.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.