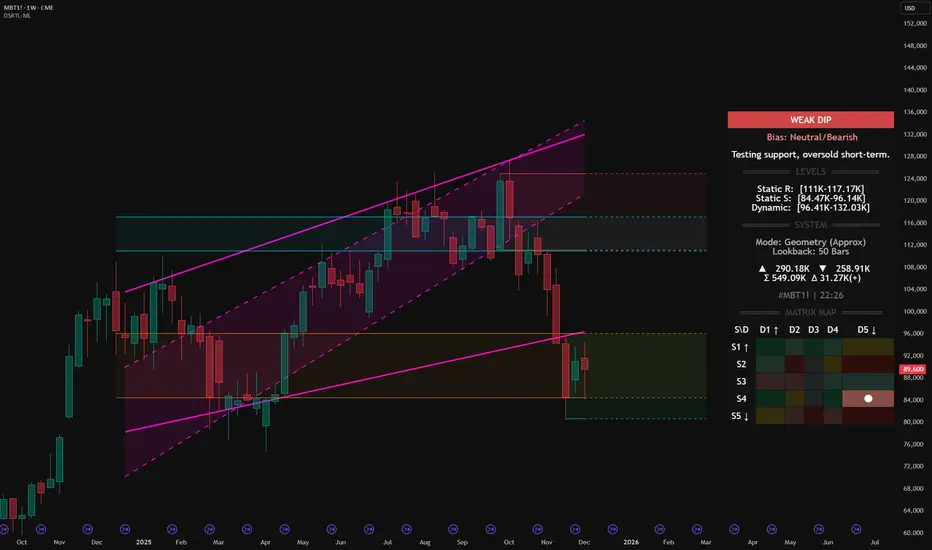

Micro Bitcoin Futures (MBT1!) – DSRTL‑ML Weak Dip at S4–D5 Support

We are analyzing the weekly structure of Micro Bitcoin Futures (MBT1!) using the institutional DSRTL‑ML support/resistance engine. On this bar the indicator classifies the state as WEAK DIP with a Neutral/Bearish bias and the system message:

Testing support, oversold short-term.

This reading comes from the current matrix position S4–D5 on the Matrix Map and defines the context for the price action inside this support zone.

1. DSRTL Matrix Diagnosis – State S4–D5

S4 – Static Support in Control

Price is trading inside the DSRTL Static Support band:

Static S: 84.47K – 96.14K

In the logic of DSRTL‑ML, this green support zone marks a historical high‑volume demand node where passive buy liquidity has previously absorbed aggressive selling. It behaves as a structural floor rather than a neutral price area.

D5 – Overshoot Below the Dynamic Channel

At the same time, price is positioned below the 5‑Point Dynamic Channel:

Dynamic Band: 96.41K – 132.03K

State D5 describes a downside extension beneath the lower boundary of the dynamic channel. Within this framework, that move is read as an oversold displacement away from the equilibrium path of the trend geometry, not as a fully confirmed new downtrend on its own.

Combined Reading – WEAK DIP with Neutral/Bearish Bias

The overlap of:

price sitting inside Static Support S4, and

price being oversold relative to the Dynamic Channel (D5)

produces the WEAK DIP classification. The Neutral/Bearish bias tells us that the dominant leg into this area is still downward, but the current candle represents a weaker phase of that dip occurring directly into a pre‑defined demand floor.

2. Key DSRTL Levels on This Chart

From the Levels and System panels on the chart:

Static Resistance (Supply Block): 111K – 117.17K

Upper structural ceiling derived from the DSRTL matrix of historical volume and price interaction.

Static Support (Demand Block): 84.47K – 96.14K

The active S4 floor where the current weekly bar is developing.

Dynamic Channel (Trend Geometry): 96.41K – 132.03K

The 5‑Point trend channel that defines the dynamic path of price; its lower edge around 96.41K is the first mean‑reversion checkpoint above the market.

Volume Metrics on This Bar:

Buying volume (▲): 290.18K

Selling volume (▼): 258.91K

Total volume (Σ): 549.09K

Delta volume (Δ): +31.27K

The positive delta together with the WEAK DIP label supports the idea that, inside S4, aggressive selling is meeting responsive buying rather than progressing as a fresh impulsive breakdown.

3. My Structural View Based on DSRTL‑ML

From a structural perspective, I read this configuration as follows:

Context of the Trend

The Neutral/Bearish bias confirms that the larger move into this zone is still a downward leg. The market is not flagged by DSRTL‑ML as a confirmed bullish reversal; instead, we are in a weak phase of the decline, pressing into defined support while the geometry is stretched.

Support Floor and Invalidation

As long as weekly closes remain above roughly 84.5K – the lower boundary of the S4 block – I consider this area a working demand floor for the current sequence. A decisive weekly close below that level would invalidate the weak‑dip narrative and shift the focus to a more developed breakdown of support.

Primary Path While S4 Holds

If S4 continues to hold, my expectation is that the oversold S4–D5 state will tend to resolve through mean reversion back toward the lower edge of the Dynamic Channel around 96.41K. In DSRTL terms, that is the first structural magnet above price once an overshoot has occurred.

Next Reference Above the Channel

Should price manage to re‑enter and hold inside the Dynamic Channel, the next major reference becomes the Static Resistance block at 111K – 117.17K. In my view, that zone represents the upper boundary of the current weekly structure and the area where I would expect supply and volatility to increase again.

In short, DSRTL‑ML currently maps MBT1! as a weak dip into S4 support with a still‑bearish background trend. My directional view is that, while this support holds, the structure favors a corrective mean‑reversion phase toward the dynamic band rather than an immediate continuation breakdown, with any weekly close below the S4 floor acting as a clear structural invalidation.

Indicator used for this analysis: DSRTL‑ML (Dynamic Support & Resistance Trend Logic).

Disclaimer: This publication expresses my personal opinion on the MBT1! chart based solely on the DSRTL‑ML indicator and standard price/volume analysis. It is not financial or investment advice and does not constitute a recommendation to buy or sell any instrument.

We are analyzing the weekly structure of Micro Bitcoin Futures (MBT1!) using the institutional DSRTL‑ML support/resistance engine. On this bar the indicator classifies the state as WEAK DIP with a Neutral/Bearish bias and the system message:

Testing support, oversold short-term.

This reading comes from the current matrix position S4–D5 on the Matrix Map and defines the context for the price action inside this support zone.

1. DSRTL Matrix Diagnosis – State S4–D5

S4 – Static Support in Control

Price is trading inside the DSRTL Static Support band:

Static S: 84.47K – 96.14K

In the logic of DSRTL‑ML, this green support zone marks a historical high‑volume demand node where passive buy liquidity has previously absorbed aggressive selling. It behaves as a structural floor rather than a neutral price area.

D5 – Overshoot Below the Dynamic Channel

At the same time, price is positioned below the 5‑Point Dynamic Channel:

Dynamic Band: 96.41K – 132.03K

State D5 describes a downside extension beneath the lower boundary of the dynamic channel. Within this framework, that move is read as an oversold displacement away from the equilibrium path of the trend geometry, not as a fully confirmed new downtrend on its own.

Combined Reading – WEAK DIP with Neutral/Bearish Bias

The overlap of:

price sitting inside Static Support S4, and

price being oversold relative to the Dynamic Channel (D5)

produces the WEAK DIP classification. The Neutral/Bearish bias tells us that the dominant leg into this area is still downward, but the current candle represents a weaker phase of that dip occurring directly into a pre‑defined demand floor.

2. Key DSRTL Levels on This Chart

From the Levels and System panels on the chart:

Static Resistance (Supply Block): 111K – 117.17K

Upper structural ceiling derived from the DSRTL matrix of historical volume and price interaction.

Static Support (Demand Block): 84.47K – 96.14K

The active S4 floor where the current weekly bar is developing.

Dynamic Channel (Trend Geometry): 96.41K – 132.03K

The 5‑Point trend channel that defines the dynamic path of price; its lower edge around 96.41K is the first mean‑reversion checkpoint above the market.

Volume Metrics on This Bar:

Buying volume (▲): 290.18K

Selling volume (▼): 258.91K

Total volume (Σ): 549.09K

Delta volume (Δ): +31.27K

The positive delta together with the WEAK DIP label supports the idea that, inside S4, aggressive selling is meeting responsive buying rather than progressing as a fresh impulsive breakdown.

3. My Structural View Based on DSRTL‑ML

From a structural perspective, I read this configuration as follows:

Context of the Trend

The Neutral/Bearish bias confirms that the larger move into this zone is still a downward leg. The market is not flagged by DSRTL‑ML as a confirmed bullish reversal; instead, we are in a weak phase of the decline, pressing into defined support while the geometry is stretched.

Support Floor and Invalidation

As long as weekly closes remain above roughly 84.5K – the lower boundary of the S4 block – I consider this area a working demand floor for the current sequence. A decisive weekly close below that level would invalidate the weak‑dip narrative and shift the focus to a more developed breakdown of support.

Primary Path While S4 Holds

If S4 continues to hold, my expectation is that the oversold S4–D5 state will tend to resolve through mean reversion back toward the lower edge of the Dynamic Channel around 96.41K. In DSRTL terms, that is the first structural magnet above price once an overshoot has occurred.

Next Reference Above the Channel

Should price manage to re‑enter and hold inside the Dynamic Channel, the next major reference becomes the Static Resistance block at 111K – 117.17K. In my view, that zone represents the upper boundary of the current weekly structure and the area where I would expect supply and volatility to increase again.

In short, DSRTL‑ML currently maps MBT1! as a weak dip into S4 support with a still‑bearish background trend. My directional view is that, while this support holds, the structure favors a corrective mean‑reversion phase toward the dynamic band rather than an immediate continuation breakdown, with any weekly close below the S4 floor acting as a clear structural invalidation.

Indicator used for this analysis: DSRTL‑ML (Dynamic Support & Resistance Trend Logic).

Disclaimer: This publication expresses my personal opinion on the MBT1! chart based solely on the DSRTL‑ML indicator and standard price/volume analysis. It is not financial or investment advice and does not constitute a recommendation to buy or sell any instrument.

Trade active

After the MBT1! session opened, price has continued to trade inside the Static S4 demand block (84.5K–96.1K). The market printed another weak flush toward the lower edge of S4, but selling was absorbed and the current weekly candle is reacting higher from support, in line with the original “weak dip at support” scenario. Structurally, this keeps the setup in an S4–D5 state: oversold versus the dynamic channel, but not yet a confirmed new downside leg. As long as we don’t get a decisive weekly close below S4, the base case remains a mean-reversion path toward the lower band of the dynamic channel, while a break and weekly close below S4 would invalidate this view.Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.