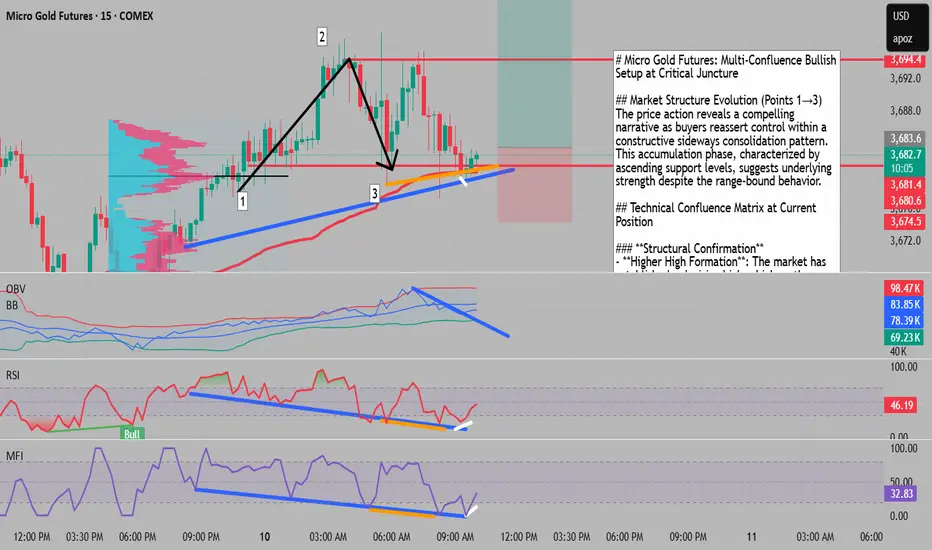

# Micro Gold Futures: Multi-Confluence Bullish Setup at Critical Juncture

## Market Structure Evolution (Points 1→3)

The price action reveals a compelling narrative as buyers reassert control within a constructive sideways consolidation pattern. This accumulation phase, characterized by ascending support levels, suggests underlying strength despite the range-bound behavior.

## Technical Confluence Matrix at Current Position

### **Structural Confirmation**

- **Higher High Formation**: The market has established a decisive higher high on the bar-level structure at this precise technical junction, confirming the shift in short-term momentum dynamics.

### **Volume-Weighted Analysis**

- **VWAP Touch Point**: Price has precisely tested the Volume Weighted Average Price anchored from the local market low, providing institutional-level support validation at this critical level.

### **Divergence Trinity Setup**

A rare triple-layered divergence configuration has emerged:

- **Hidden Bullish Divergence**: Suggesting continuation of the underlying uptrend

- **Classical Bullish Divergence**: Indicating potential reversal from oversold conditions

- Both divergences align on the bar-level timeframe, amplifying the signal strength

### **Volume Profile Dynamics**

- **OBV Breakout**: The On-Balance Volume indicator has decisively broken above its downtrend line, signaling a shift in accumulation patterns and renewed buying interest from smart money participants.

- **Low Volume Node Rejection**: Point 3 marks a textbook rejection from a low volume area (LVN), a high-probability reversal zone where price typically finds little acceptance, creating a spring-loaded setup for directional movement.

## Trading Implications

This confluence of technical factors creates a high-probability setup where multiple timeframes and indicators align. The rejection from the low volume node, combined with the structural higher high and triple divergence setup, presents an asymmetric risk-reward opportunity for positioned traders.

## Risk Considerations

While the technical picture appears constructive, traders should monitor the sustainability of the OBV breakout and watch for volume confirmation on any upside continuation. The sideways market structure suggests patience may be required as the accumulation phase completes.

## Market Structure Evolution (Points 1→3)

The price action reveals a compelling narrative as buyers reassert control within a constructive sideways consolidation pattern. This accumulation phase, characterized by ascending support levels, suggests underlying strength despite the range-bound behavior.

## Technical Confluence Matrix at Current Position

### **Structural Confirmation**

- **Higher High Formation**: The market has established a decisive higher high on the bar-level structure at this precise technical junction, confirming the shift in short-term momentum dynamics.

### **Volume-Weighted Analysis**

- **VWAP Touch Point**: Price has precisely tested the Volume Weighted Average Price anchored from the local market low, providing institutional-level support validation at this critical level.

### **Divergence Trinity Setup**

A rare triple-layered divergence configuration has emerged:

- **Hidden Bullish Divergence**: Suggesting continuation of the underlying uptrend

- **Classical Bullish Divergence**: Indicating potential reversal from oversold conditions

- Both divergences align on the bar-level timeframe, amplifying the signal strength

### **Volume Profile Dynamics**

- **OBV Breakout**: The On-Balance Volume indicator has decisively broken above its downtrend line, signaling a shift in accumulation patterns and renewed buying interest from smart money participants.

- **Low Volume Node Rejection**: Point 3 marks a textbook rejection from a low volume area (LVN), a high-probability reversal zone where price typically finds little acceptance, creating a spring-loaded setup for directional movement.

## Trading Implications

This confluence of technical factors creates a high-probability setup where multiple timeframes and indicators align. The rejection from the low volume node, combined with the structural higher high and triple divergence setup, presents an asymmetric risk-reward opportunity for positioned traders.

## Risk Considerations

While the technical picture appears constructive, traders should monitor the sustainability of the OBV breakout and watch for volume confirmation on any upside continuation. The sideways market structure suggests patience may be required as the accumulation phase completes.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.