Results of Day One of our Radical Departure from YouTube Wisdom

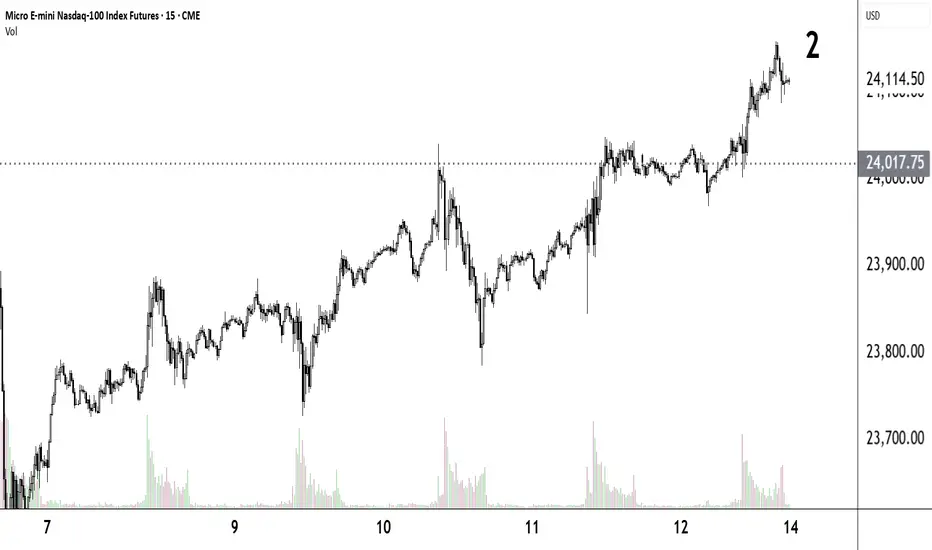

Following our Breakout Plan from Chart 1 we banked $4,546.68.

Account Value: $54,546.68

At day's end we are 2L NQ and 8L MNQ.

Intraday Margin Required:

1.NQ: 2 x $1000.00 = $2000.00

2.MNQ: 8 x $100.00 = $800.00

Initial Margin Required: $68,376.00

Problem: At day's end we cannot cover Initial Margin.

Solution: At 4:30 PM New York time sell 6 MNQs. When the market opens 9/7/25 at 6:00 PM New York time buy them back at a lower Px if possible.

Math:

You are 2.8L NQ

68,376/2.8 = 24,420 for each NQ contract

24,420/10 = 2,442 for each MNQ contract

68,376 - 54,546.68 = 13,829.32

13,829.32/2,442 = 5.6631122

Account Value: $54,546.68

At day's end we are 2L NQ and 8L MNQ.

Intraday Margin Required:

1.NQ: 2 x $1000.00 = $2000.00

2.MNQ: 8 x $100.00 = $800.00

Initial Margin Required: $68,376.00

Problem: At day's end we cannot cover Initial Margin.

Solution: At 4:30 PM New York time sell 6 MNQs. When the market opens 9/7/25 at 6:00 PM New York time buy them back at a lower Px if possible.

Math:

You are 2.8L NQ

68,376/2.8 = 24,420 for each NQ contract

24,420/10 = 2,442 for each MNQ contract

68,376 - 54,546.68 = 13,829.32

13,829.32/2,442 = 5.6631122

Trade active

Important Note:Check the Initial Margin Rules of your broker. Since this is an hypothetical Trading Plan with an hypothetical account we shall use a standard rule of thumb - Initial Margin must be met 15 minutes before the session closes. This means 4:45 PM New York time. However, I will be using real numbers on a real account for all examples.

Initial Margin is very important. Make sure you understand it. Brokers do change both Intraday and Initial Margin requirements at will, usually preceding important news releases. Stay on top of it.

For our hypothetical account let's use the close of the 4:25 PM NY time candle as our exit point to cover Initial Margin. Therefore, we sold 6 MNQ contracts at 4:30 PM NY time at 24,113.50. Remember we will buy them back, hopefully at a lower Px when the markets reopen 9/7 at 6:00 PM NY time.

Note

Sunday BOT back 6 MNQ @ 24,110.50 = Profit 25.80Sell To Close 1 NQ @ 24,159 = Profit = 351.80

Sell To Close 1 NQ @ 24,169 = Profit 361.80

Sunday @ 18:12:01 I began buying one MNQ contract at 24,120. I bought one MNQ contract every 5 points. Each entry had a 19 point target.

ACCOUNT VALUE Monday @ 5:00PM : 56,671.30

AROI : 6,671.30 Profit / 50,000 account x 100 x 365 days/5 days (9/12 - 9/15) = 974.0098 %

Goals of this example

1.To challenge the idea that you must place a stop at such and such a place and have a target of at least 1.1 reward to risk. Climb the Ladder works very well. Once you reach the fifth rung you bank profit every 5 points.

2. To emphasize the importance of Context is King when it comes to interpreting a chart. Today's context is that of an historical bull market marking the early days of the fourth Industrial Revolution, that of A.I. and Robotics. Also, the markets are expecting a 25-point cut by the Federal Reserve Wednesday, 9/17.

I have just showed that Climb the Ladder works very well

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.