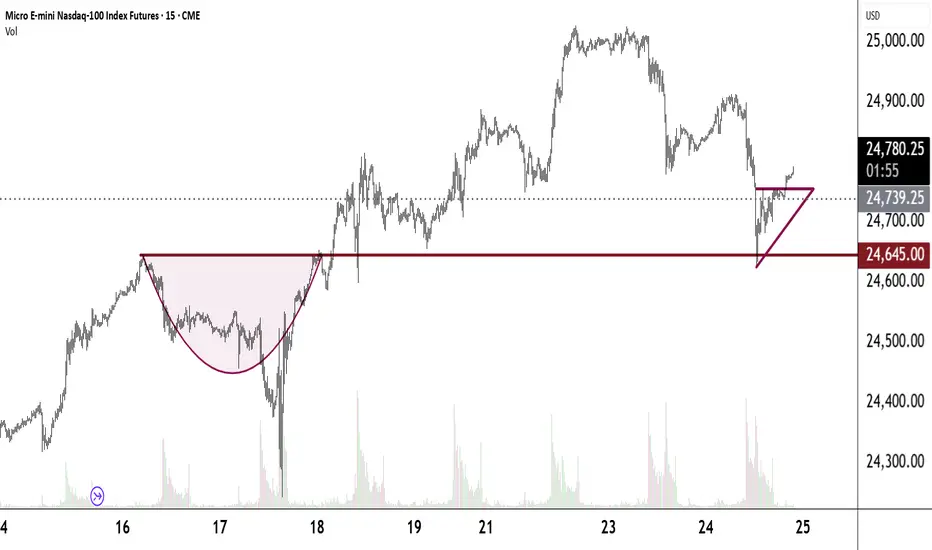

Beautiful chart. How to interpret it? How to trade it? How to manage risk?

One must have a precise plan, contextually interpret the charts and manage risk.

Precise Plan

1.Buy the Breakouts

2.Buy the Dips

3.Buy the Pivots

Buy the Breakouts

1.Wait for a bounce

2.Set a buy to open (bto) stop market order above the bounce

3.Enter a sell to close (stc) limit order

Buy the Dips

1.Wait for a bounce

2.Set a bto limit order less than the close of the bounce

3.When it fills set a stc limit order

Buy the Pivots

1.Find a strong Support

2.Set a bto limit order

3.When it fxs set a stc limit order

More Details

My Breakouts

1.I always stack them to the ceiling.

2.Most of the time I place a bto stop mkt order every 5 points.

3.For each entry I set a 19-point target.

NOTE: You must tailor this to your risk tolerance and to your account size.

NOTE: I do not place a stop loss. I manage risk by always keeping a close eye on Intraday Margin and Initial Margin. These are all-important. This cannot be over emphasized.

NOTE: Another way I manage risk is by not overlapping my trades. For example, if my margin requirements need some breathing room, I will not enter another trade until the prior trade has fxed its target.

My Buy the Dips

1.I usually wait for a bounce.

2.I buy them in descending 5-point intervals

3.19-point target for each trade

NOTE: Often, even a good bounce fails and the px goes lower. Always plan for this. Always.

NOTE: I always have accumulation/distribution areas clearly visible on my charts. This is where buyers and sellers have met in the past. Maybe they will meet here again.

NOTE: My goal is to have 5 a day. Here is the math with my broker: 5 trades x 5 days x 36.18 P x 50 weeks = $45,225.00. I am way ahead of that goal.

NOTE: Past performance is not indicative of future performance.

My Pivots

1.Look for a strong pivot.

2.I always aim to get a 101-point target.

Context is extremely important.

1.Learn how to interpret a chart. I assume most of you have learned the basics. If you haven't Jerremy Alexander Newsome has many great videos on YouTube. He also has much info on his website, reallifetrading.com. Investopedia is another great resource.

2.News is vital. News moves markets. Look at Liberation Day, 4/2/25. Look at June 13th, the day Israel bombed Iran. The jobs report comes out every first Friday of the month. Earnings reports matter. FOMC day, PCE, inflation data etc. etc. etc... I always look at MarketWatch's U.S. economic calendar. It's free and an invaluable resource. Find a reliable economic news source. I always have Fox Business on. They have great hosts and great guests. You will get a great economics education. Maria Bartiromo comes on at 06:00:00 NY time and she sets the day for any important events you should know.

3.We are in an historical bull market marking the early days of The Fourth Industrial Revolution - that of AI & Robotics.

I'm probably forgetting somethings right now. I will add them as I think of them. Here is one now - most of the time I am looking at a 5-minute chart. Here's another - I use Session Volume Profile charts daily. Each session (trading day) will have a point of control (poc). Buyers and sellers meet here. Sometimes a poc will not be touched by the next session's candles. It then becomes a virgin point of control (vpoc) and its significance becomes greater.

Until now, I have included many entries, many results and much math. I wanted you to get a feel for these things. They are the essence of trading. Perhaps going forward I won't post these, at least not so often.

I fear that I have been ham-handed in my posts - like a machine gun laying down rapid, unaimed firepower. I think this post best describes my trading plan and my thoughts on how important context is to trading. Context is far more comprehensive than just a chart, not to minimize the importance of charts. A chart, I suppose, could be pictured as a ship and context is the sea upon which that ship sails.

I hope this helps you have a Precise Trading Plan suitable to your singular needs, and that you see how vital and comprehensive Context is.

One must have a precise plan, contextually interpret the charts and manage risk.

Precise Plan

1.Buy the Breakouts

2.Buy the Dips

3.Buy the Pivots

Buy the Breakouts

1.Wait for a bounce

2.Set a buy to open (bto) stop market order above the bounce

3.Enter a sell to close (stc) limit order

Buy the Dips

1.Wait for a bounce

2.Set a bto limit order less than the close of the bounce

3.When it fills set a stc limit order

Buy the Pivots

1.Find a strong Support

2.Set a bto limit order

3.When it fxs set a stc limit order

More Details

My Breakouts

1.I always stack them to the ceiling.

2.Most of the time I place a bto stop mkt order every 5 points.

3.For each entry I set a 19-point target.

NOTE: You must tailor this to your risk tolerance and to your account size.

NOTE: I do not place a stop loss. I manage risk by always keeping a close eye on Intraday Margin and Initial Margin. These are all-important. This cannot be over emphasized.

NOTE: Another way I manage risk is by not overlapping my trades. For example, if my margin requirements need some breathing room, I will not enter another trade until the prior trade has fxed its target.

My Buy the Dips

1.I usually wait for a bounce.

2.I buy them in descending 5-point intervals

3.19-point target for each trade

NOTE: Often, even a good bounce fails and the px goes lower. Always plan for this. Always.

NOTE: I always have accumulation/distribution areas clearly visible on my charts. This is where buyers and sellers have met in the past. Maybe they will meet here again.

NOTE: My goal is to have 5 a day. Here is the math with my broker: 5 trades x 5 days x 36.18 P x 50 weeks = $45,225.00. I am way ahead of that goal.

NOTE: Past performance is not indicative of future performance.

My Pivots

1.Look for a strong pivot.

2.I always aim to get a 101-point target.

Context is extremely important.

1.Learn how to interpret a chart. I assume most of you have learned the basics. If you haven't Jerremy Alexander Newsome has many great videos on YouTube. He also has much info on his website, reallifetrading.com. Investopedia is another great resource.

2.News is vital. News moves markets. Look at Liberation Day, 4/2/25. Look at June 13th, the day Israel bombed Iran. The jobs report comes out every first Friday of the month. Earnings reports matter. FOMC day, PCE, inflation data etc. etc. etc... I always look at MarketWatch's U.S. economic calendar. It's free and an invaluable resource. Find a reliable economic news source. I always have Fox Business on. They have great hosts and great guests. You will get a great economics education. Maria Bartiromo comes on at 06:00:00 NY time and she sets the day for any important events you should know.

3.We are in an historical bull market marking the early days of The Fourth Industrial Revolution - that of AI & Robotics.

I'm probably forgetting somethings right now. I will add them as I think of them. Here is one now - most of the time I am looking at a 5-minute chart. Here's another - I use Session Volume Profile charts daily. Each session (trading day) will have a point of control (poc). Buyers and sellers meet here. Sometimes a poc will not be touched by the next session's candles. It then becomes a virgin point of control (vpoc) and its significance becomes greater.

Until now, I have included many entries, many results and much math. I wanted you to get a feel for these things. They are the essence of trading. Perhaps going forward I won't post these, at least not so often.

I fear that I have been ham-handed in my posts - like a machine gun laying down rapid, unaimed firepower. I think this post best describes my trading plan and my thoughts on how important context is to trading. Context is far more comprehensive than just a chart, not to minimize the importance of charts. A chart, I suppose, could be pictured as a ship and context is the sea upon which that ship sails.

I hope this helps you have a Precise Trading Plan suitable to your singular needs, and that you see how vital and comprehensive Context is.

Note

Don't lose sight of your job description. A trader's job is to take and manage risk.Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.