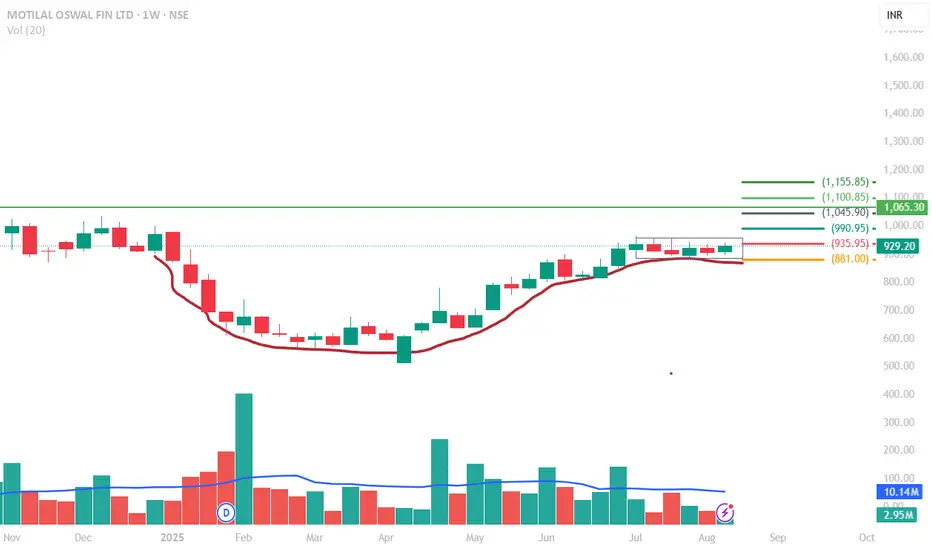

Motilal Oswal Financial Services– Weekly, NSE - Cup & handle

Trend: Stock is in a steady uptrend since March 2025 but currently consolidating in a sideways range.

Support Levels: Strong support at ₹936 and deeper support near ₹881.

Resistance Levels: Immediate resistance at ₹991, followed by ₹1,046. Major breakout zone is at ₹1,065.

Targets if Breakout Holds: ₹1,101 and ₹1,156.

📌 Conclusion: The stock is in a bullish consolidation. A weekly close above ₹1,065 with volume can trigger the next rally toward ₹1,100–1,155. Downside is protected as long as it stays above ₹881.

⚠️ Disclaimer: This chart is for educational purposes only.

Regulatory Note: We are an independent development team. Our services are not registered or licensed by any regulatory body in India, the U.S., the U.K., or any global financial authority. Please consult a licensed advisor before making trading decisions

Support Levels: Strong support at ₹936 and deeper support near ₹881.

Resistance Levels: Immediate resistance at ₹991, followed by ₹1,046. Major breakout zone is at ₹1,065.

Targets if Breakout Holds: ₹1,101 and ₹1,156.

📌 Conclusion: The stock is in a bullish consolidation. A weekly close above ₹1,065 with volume can trigger the next rally toward ₹1,100–1,155. Downside is protected as long as it stays above ₹881.

⚠️ Disclaimer: This chart is for educational purposes only.

Regulatory Note: We are an independent development team. Our services are not registered or licensed by any regulatory body in India, the U.S., the U.K., or any global financial authority. Please consult a licensed advisor before making trading decisions

Creator of “VaultSignal Weekly, SignalSurge Daily, ProChart Future Hourly, – Invite-only scripts. Access available via profile. t.me/+Mdc4fo9qxn8zNzI1

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Creator of “VaultSignal Weekly, SignalSurge Daily, ProChart Future Hourly, – Invite-only scripts. Access available via profile. t.me/+Mdc4fo9qxn8zNzI1

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.