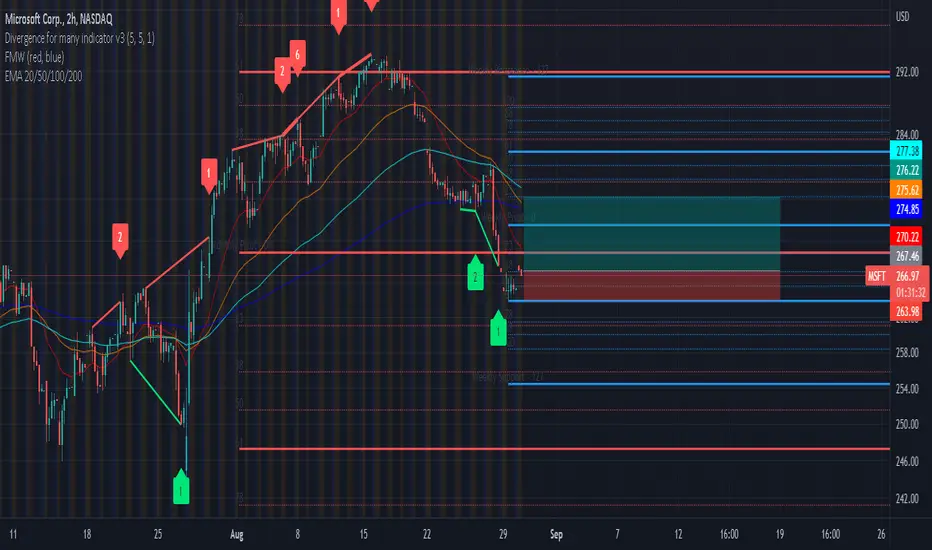

Divergence indication signals suggest bullish change in momentum.

Candlestick momentum shows a potential bullish hammer. The underlying stock price presented in the form of candlesticks seems to be reversing in line with its moderate 0.38 weekly support level. A bullish hammer can be identified within the down trend, a bullish hammer suggests that there will be a change in momentum.

When applying a weekly and monthly ranged Fibonacci, investors can see that this potential bullish hammer is occurring in line with its moderate 0.38 support level. However, when looking at the 1-month ranged Fibonacci investors are wary given that the stock is trading close to its central 0.00 pivot level.

EMA indicators suggest the stock is undervalued given that the underlying stock value is currently trading below all 20-, 50-, 100- and 200-day EMA averages. Furthermore, the crossover of 20- and 50-day EMA lines is a buy signal.

Based on these undervalued signals, we anticipate the stock to correct towards a stronger resistance.

Candlestick momentum shows a potential bullish hammer. The underlying stock price presented in the form of candlesticks seems to be reversing in line with its moderate 0.38 weekly support level. A bullish hammer can be identified within the down trend, a bullish hammer suggests that there will be a change in momentum.

When applying a weekly and monthly ranged Fibonacci, investors can see that this potential bullish hammer is occurring in line with its moderate 0.38 support level. However, when looking at the 1-month ranged Fibonacci investors are wary given that the stock is trading close to its central 0.00 pivot level.

EMA indicators suggest the stock is undervalued given that the underlying stock value is currently trading below all 20-, 50-, 100- and 200-day EMA averages. Furthermore, the crossover of 20- and 50-day EMA lines is a buy signal.

Based on these undervalued signals, we anticipate the stock to correct towards a stronger resistance.

💥 Free signals and ideas ➡ t.me/vfinvestment

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

💥 Free signals and ideas ➡ t.me/vfinvestment

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.