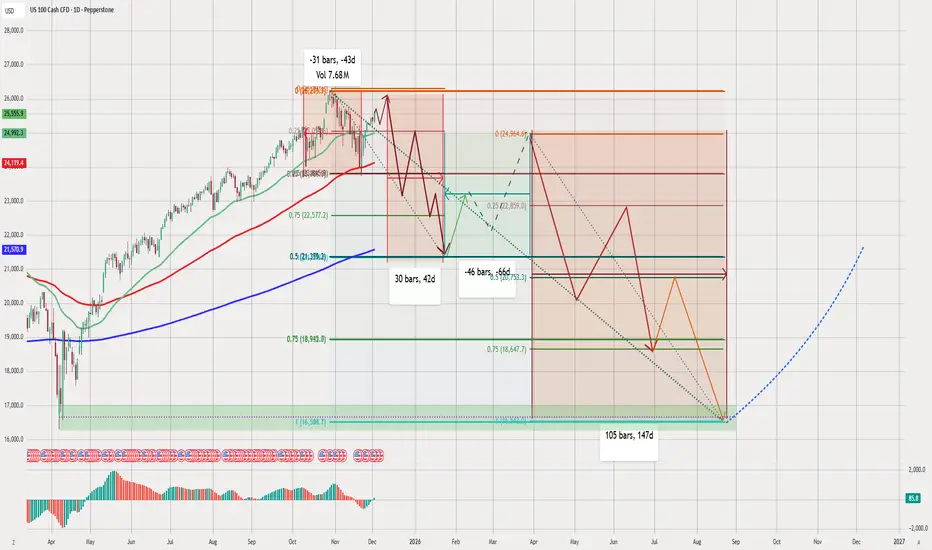

NAS100 Technical Analysis (Daily Chart)

chart presents a medium-term bearish outlook, followed by a long-term bullish reversal. combining Fibonacci retracements, cycle timing (bars/days), moving averages, and wave projections to create a full market roadmap.

Below is a structured analysis:

1️⃣ Current Market Structure

NAS100 reached a major top near 26,000 before reversing.

Price broke below the short-term trendline and is dropping toward deeper support.

The red zig-zag pattern reflects expectation of continued selling pressure.

This suggests the index is entering a medium-term correction.

2️⃣ Fibonacci Levels (Key Zones Identified)

chart uses multiple retracements:

Current swing retracement levels

0.25 – 23,869

0.5 – 21,383

0.75 – 18,993

These levels match the projected downward path.

Major support zone

Large green rectangular zone near 16,300 – 17,000

This is aligned with:

Long-term Fibonacci support

Previous accumulation zone

Blue dotted long-term rising trendline

This zone is likely the macro bottom of the cycle.

3️⃣ Moving Averages (Trend Signals)

using:

Green MA (short-term)

Red MA (medium-term)

Blue MA (200-day long-term)

Current price is:

Breaking below the green and red MAs

Approaching the 200-day MA around 21,000

A break under the 200-day MA confirms a total trend shift to bearish.

4️⃣ Cycle Timing (Bars/Days)

chart marks three key cycles:

🔹 From the top to first support:

31 bars, 43 days

🔹 Next consolidation period:

30 bars, 42 days

🔹 Full correction phase to the bottom:

105 bars, 147 days

This indicates a highly structured time cycle, showing the correction may last until August–September 2026.

5️⃣ Expected Bearish Phase (Primary Scenario)

red path suggests:

Continued decline from current levels

Multiple lower highs and lower lows

A temporary bounce around 21,800

Then deeper drops toward 18,600 – 19,000

Extended capitulation down to the 16,300 zone (major support)

This zone is highlighted heavily, suggesting it is final bearish target.

6️⃣ Recovery Phase (Bullish Scenario)

After the bottom:

🟦 Bullish reversal zone: 16,300

The blue dotted line indicates:

A multi-month recovery

Strong upside momentum

Reestablishment of a long-term bullish trend

Possible return to previous highs later

This forms a textbook "macro correction → macro rally" cycle.

7️⃣ Summary of Your Market View

📉 Short-Term Bias: Strongly Bearish

Market breaking structure

Cycle timing supports continued decline

Price heading for deeper Fibonacci levels

📉 Medium-Term Bias: Bearish

Expecting multiple waves of selling

Target zone: 18,600 then 16,300

📈 Long-Term Bias: Bullish

After the cycle completes, NAS100 should resume its uptrend

Blue dotted projection shows a long rally into late 2026 and 2027

✔️ Final Outlook

chart shows a well-planned, detailed scenario:

A multi-leg correction

Followed by a strong, long-term bullish cycle

The 16,300 zone is the “macro bottom”

Timing suggests bottoming around August–September 2026

analysis is consistent, logical, and follows smart technical principles.

chart presents a medium-term bearish outlook, followed by a long-term bullish reversal. combining Fibonacci retracements, cycle timing (bars/days), moving averages, and wave projections to create a full market roadmap.

Below is a structured analysis:

1️⃣ Current Market Structure

NAS100 reached a major top near 26,000 before reversing.

Price broke below the short-term trendline and is dropping toward deeper support.

The red zig-zag pattern reflects expectation of continued selling pressure.

This suggests the index is entering a medium-term correction.

2️⃣ Fibonacci Levels (Key Zones Identified)

chart uses multiple retracements:

Current swing retracement levels

0.25 – 23,869

0.5 – 21,383

0.75 – 18,993

These levels match the projected downward path.

Major support zone

Large green rectangular zone near 16,300 – 17,000

This is aligned with:

Long-term Fibonacci support

Previous accumulation zone

Blue dotted long-term rising trendline

This zone is likely the macro bottom of the cycle.

3️⃣ Moving Averages (Trend Signals)

using:

Green MA (short-term)

Red MA (medium-term)

Blue MA (200-day long-term)

Current price is:

Breaking below the green and red MAs

Approaching the 200-day MA around 21,000

A break under the 200-day MA confirms a total trend shift to bearish.

4️⃣ Cycle Timing (Bars/Days)

chart marks three key cycles:

🔹 From the top to first support:

31 bars, 43 days

🔹 Next consolidation period:

30 bars, 42 days

🔹 Full correction phase to the bottom:

105 bars, 147 days

This indicates a highly structured time cycle, showing the correction may last until August–September 2026.

5️⃣ Expected Bearish Phase (Primary Scenario)

red path suggests:

Continued decline from current levels

Multiple lower highs and lower lows

A temporary bounce around 21,800

Then deeper drops toward 18,600 – 19,000

Extended capitulation down to the 16,300 zone (major support)

This zone is highlighted heavily, suggesting it is final bearish target.

6️⃣ Recovery Phase (Bullish Scenario)

After the bottom:

🟦 Bullish reversal zone: 16,300

The blue dotted line indicates:

A multi-month recovery

Strong upside momentum

Reestablishment of a long-term bullish trend

Possible return to previous highs later

This forms a textbook "macro correction → macro rally" cycle.

7️⃣ Summary of Your Market View

📉 Short-Term Bias: Strongly Bearish

Market breaking structure

Cycle timing supports continued decline

Price heading for deeper Fibonacci levels

📉 Medium-Term Bias: Bearish

Expecting multiple waves of selling

Target zone: 18,600 then 16,300

📈 Long-Term Bias: Bullish

After the cycle completes, NAS100 should resume its uptrend

Blue dotted projection shows a long rally into late 2026 and 2027

✔️ Final Outlook

chart shows a well-planned, detailed scenario:

A multi-leg correction

Followed by a strong, long-term bullish cycle

The 16,300 zone is the “macro bottom”

Timing suggests bottoming around August–September 2026

analysis is consistent, logical, and follows smart technical principles.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.